Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Loan Processor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

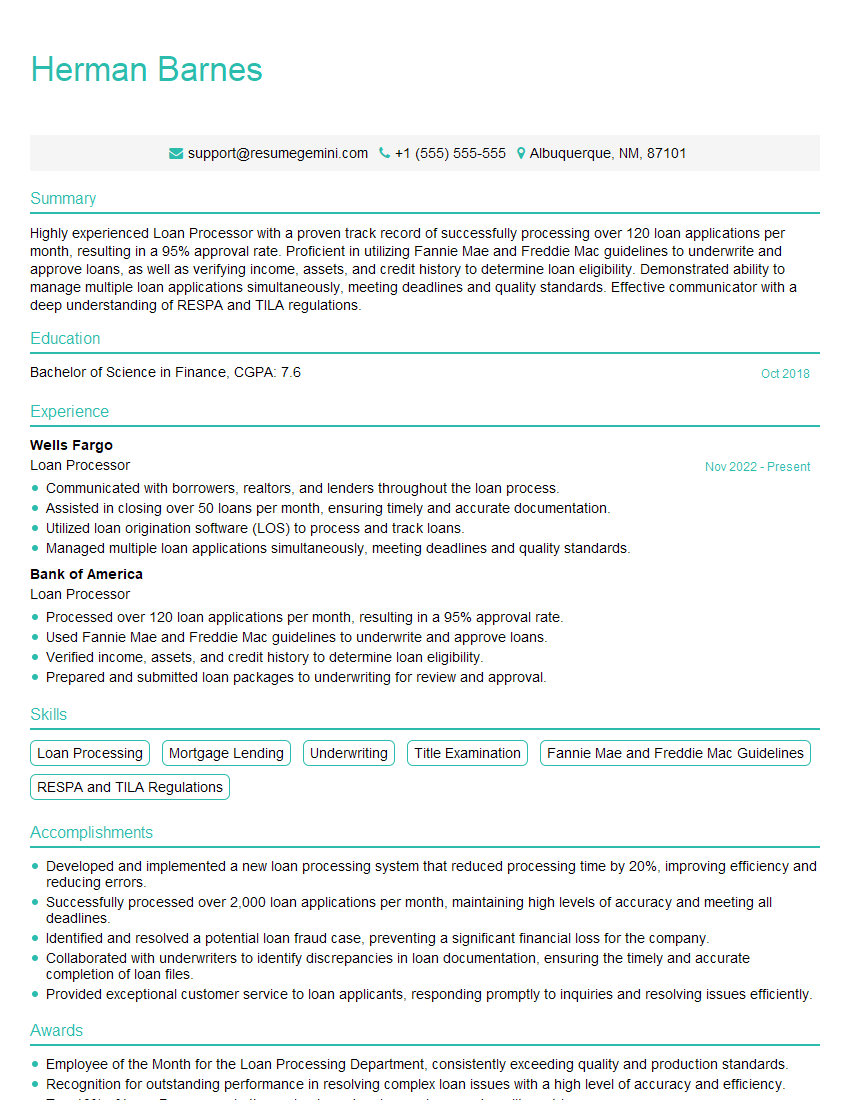

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Processor

1. Explain the loan processing workflow that you are familiar with.

- Receive and review loan application documents.

- Verify borrower’s identity, income, and assets.

- Order and review credit reports and appraisals.

- Prepare loan documents for underwriting review.

- Disclose loan terms to the borrower and obtain signatures.

- Close the loan and fund the disbursement.

2. What are the different types of loans you have processed?

Mortgages

- Conventional loans

- FHA loans

- VA loans

- USDA loans

Consumer loans

- Personal loans

- Auto loans

- Student loans

- Credit card loans

3. What are the key steps involved in underwriting a loan?

- Verifying the borrower’s identity, income, and assets.

- Reviewing the borrower’s credit history.

- Evaluating the property securing the loan.

- Determining the borrower’s debt-to-income ratio.

- Making a decision on whether or not to approve the loan.

4. What are the most common reasons for a loan to be denied?

- Insufficient income

- Poor credit history

- Insufficient collateral

- Unverifiable information

- Fraud

5. What are the most important qualities of a successful loan processor?

- Accuracy

- Attention to detail

- Organization

- Communication skills

- Customer service skills

6. What are the latest trends in loan processing?

- Increased use of technology

- Automated underwriting

- Electronic document signing

- Remote loan closings

- Focus on compliance

7. How do you stay up-to-date on the latest changes in the loan processing industry?

- Attend industry conferences and workshops.

- Read industry publications.

- Network with other loan processors.

- Obtain industry certifications.

- Take online courses.

8. What are your strengths as a loan processor?

- I am very organized and detail-oriented.

- I have a strong understanding of loan processing procedures.

- I am able to work independently and as part of a team.

- I have excellent communication and customer service skills.

- I am eager to learn new things and stay up-to-date on the latest trends in the industry.

9. What are your weaknesses as a loan processor?

- I sometimes have difficulty managing multiple tasks at once.

- I can be a bit perfectionistic at times.

- I am still learning about some of the more complex aspects of loan processing.

10. Why are you interested in working as a loan processor for our company?

- I am very impressed with your company’s reputation in the industry.

- I am eager to work for a company that is committed to providing excellent customer service.

- I believe that my skills and experience would be a valuable asset to your team.

- I am confident that I can make a significant contribution to your company’s success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Processors play a crucial role in the mortgage industry, ensuring smooth and efficient loan applications.

1. Processing Loan Applications

Reviewing and analyzing loan applications to verify their accuracy and completeness.

- Collecting and organizing all necessary documentation from applicants, such as income statements, tax returns, and credit reports.

- Verifying the applicant’s income, assets, and liabilities to determine their creditworthiness.

2. Coordinating with Underwriters and Appraisers

Working closely with Underwriters and Appraisers to obtain loan approvals.

- Preparing loan packages for review by Underwriters, including all relevant documentation.

- Communicating with Appraisers to schedule property inspections and review appraisal reports.

3. Managing Loan Approvals and Denials

Processing and issuing loan approvals, as well as communicating loan denials to applicants.

- Preparing loan closing documents for signing by the borrower and lender.

- Disbursing loan funds to borrowers.

4. Maintaining Compliance and Regulations

Ensuring that all loan processing activities comply with industry regulations and ethical standards.

- Adhering to Fair Lending Laws and Equal Credit Opportunity Act guidelines.

- Maintaining up-to-date knowledge of industry rules and regulations.

Interview Tips

Preparation is key to acing a Loan Processor interview. Here are some tips to help candidates succeed:

1. Research the Company and Position

Thoroughly research the company’s website, news articles, and LinkedIn profiles to gain insights into their culture, values, and specific loan processing needs.

- Familiarize with the company’s loan products and services to showcase your understanding of the industry.

- Review the job description carefully to identify the key skills and experience required.

2. Prepare Specific Questions

Asking thoughtful questions at the end of the interview demonstrates your engagement and interest in the role.

- Inquire about the company’s current and future loan processing initiatives.

- Ask about the challenges and opportunities within the team.

3. Highlight Relevant Skills and Experience

Tailor your answers to the specific job responsibilities and requirements outlined in the interview.

- Use the STAR method (Situation, Task, Action, Result) to provide concrete examples of your success in loan processing.

- Quantify your accomplishments whenever possible to demonstrate your impact.

4. Practice Your Answers

Rehearsing your answers will boost your confidence and deliver polished responses during the interview.

- Practice answering common interview questions, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”

- Consider having a mock interview with a friend or family member to receive feedback.

Next Step:

Now that you’re armed with the knowledge of Loan Processor interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Loan Processor positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini