Are you gearing up for a career in Loan Review Analyst? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Loan Review Analyst and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

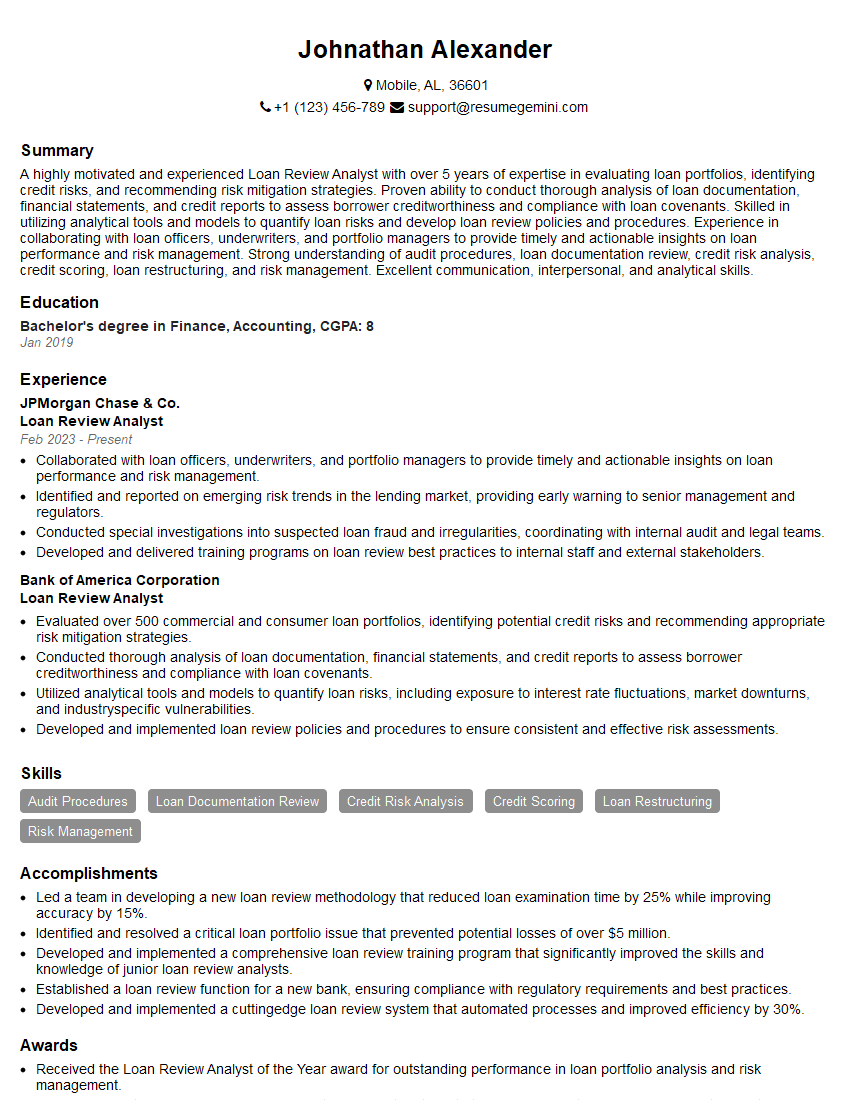

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Review Analyst

1. Describe the key steps involved in the loan review process?

The loan review process typically involves the following key steps:

- Planning and preparation

- Loan file selection

- Data gathering and analysis

- Risk assessment

- Report writing and communication

- Follow-up and monitoring

2. What are the common red flags that you look for when reviewing a loan application?

Financial and Credit Red Flags

- Unusually high debt-to-income ratio

- Recent bankruptcies or foreclosures

- Collections or judgments

- Delinquent or missed payments

- Insufficient cash reserves

Property-Related Red Flags

- Property condition issues

- Over-appraisal or over-leveraging

- Environmental concerns

- Title defects

3. How do you evaluate a borrower’s creditworthiness?

I evaluate a borrower’s creditworthiness by assessing their credit history, debt-to-income ratio, income stability, and employment history. I also consider factors such as the borrower’s savings, investments, and any recent financial setbacks.

4. What are the different types of loan covenants, and how do you assess their compliance?

The different types of loan covenants include financial covenants, restrictive covenants, and affirmative covenants. I assess their compliance by reviewing the loan agreement and relevant financial statements, and by interviewing the borrower’s management.

5. How do you document your findings and recommendations in a loan review report?

I document my findings and recommendations in a loan review report that typically includes the following sections:

- Executive summary

- Loan summary

- Financial analysis

- Compliance review

- Risk assessment

- Conclusions and recommendations

6. What are the ethical considerations that you must adhere to as a loan review analyst?

As a loan review analyst, I must adhere to the following ethical considerations:

- Confidentiality

- Objectivity

- Competence and Due Care

- Integrity

- Professionalism

7. How do you stay up-to-date on changes in the regulatory environment that impact loan review?

I stay up-to-date on changes in the regulatory environment that impact loan review by reading industry publications, attending conferences and webinars, and taking continuing education courses.

8. What do you anticipate as some of the key challenges facing loan review analysts in the future?

some of the key challenges facing loan review analysts in the future include:

- Increased complexity and volume of financial data

- Greater regulatory scrutiny

- Increased use of technology and automation

9. How do you manage your workload and prioritize tasks effectively?

I manage my workload and prioritize tasks effectively by using a variety of techniques, including:

- Setting clear priorities

- Creating a to-do list and breaking down tasks into smaller steps

- Managing my time effectively

- Asking for help when needed

10. Please share a situation where you identified a critical issue during a loan review that led to significant changes within the organization?

In a recent loan review, I identified a critical issue related to the bank’s lending policies. The bank had been making loans to borrowers with high debt-to-income ratios and insufficient cash reserves. This issue had the potential to lead to significant loan losses. I presented my findings to the bank’s management team, and they made changes to their lending policies as a result. These changes have helped to reduce the bank’s risk of loan losses.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Review Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Review Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Review Analysts are responsible for assessing the risk associated with a financial institution’s loan portfolio. They conduct thorough examinations of loan applications, financial statements, and other relevant documents to ensure that the loans meet the institution’s lending standards and regulatory requirements.

1. Loan File Review

Scrutinize loan applications, financial statements, and supporting documentation to assess the completeness, accuracy, and compliance of the loan with established underwriting guidelines.

- Verify the borrower’s financial condition, including income, assets, liabilities, and credit history.

- Validate the collateral securing the loan, including appraisals, title reports, and environmental assessments.

2. Loan Monitoring

Monitor the performance of existing loans to identify potential risks and ensure compliance with loan terms and covenants.

- Review loan payment histories, financial reports, and other relevant information.

- Identify loans that deviate from expected performance or show signs of financial stress.

3. Loan Documentation

Maintain accurate and comprehensive loan files by updating loan documentation, tracking loan status, and recording all relevant activities.

- Document loan reviews, risk assessments, and any changes made to loan terms.

- Collaborate with other departments to ensure the timely execution of loan agreements.

4. Reporting and Recommendations

Summarize loan review findings, identify potential risks, and make recommendations to senior management and loan officers.

- Present loan review reports to management, outlining any concerns or areas for improvement.

- Suggest adjustments to lending policies and procedures to mitigate identified risks.

Interview Tips

To ace an interview for a Loan Review Analyst position, it is crucial to demonstrate your technical expertise, analytical skills, and understanding of the industry. Here are some key tips to help you prepare:

1. Research the Industry

Familiarize yourself with the latest trends and regulations in the banking industry, particularly those related to lending and loan review.

- Read industry publications, attend webinars, and stay informed about relevant laws and regulations.

- Research the specific financial institution you are applying to and its lending practices.

2. Practice Your Technical Skills

Review the fundamentals of loan underwriting, financial analysis, and risk assessment. Be prepared to discuss your experience with loan documentation and loan performance monitoring.

- Use practice tests or online resources to refresh your knowledge of financial ratios, credit analysis, and loan documentation.

- Prepare examples of loan reviews you have conducted, highlighting your analytical approach and risk identification skills.

3. Highlight Your Communication and Interpersonal Skills

Loan Review Analysts often collaborate with other departments within the institution, including lending, risk management, and compliance. Demonstrate your ability to communicate complex concepts clearly and effectively.

- Prepare examples of successful interactions with senior management, loan officers, and borrowers.

- Emphasize your ability to present your findings and recommendations persuasively.

4. Prepare for Behavioral Questions

Be ready to answer common behavioral interview questions that assess your problem-solving abilities, teamwork skills, and attention to detail.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples.

- Focus on highlighting your analytical mindset, ethical behavior, and commitment to accuracy.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Loan Review Analyst, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Loan Review Analyst positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.