Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Manager, Asset Management interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Manager, Asset Management so you can tailor your answers to impress potential employers.

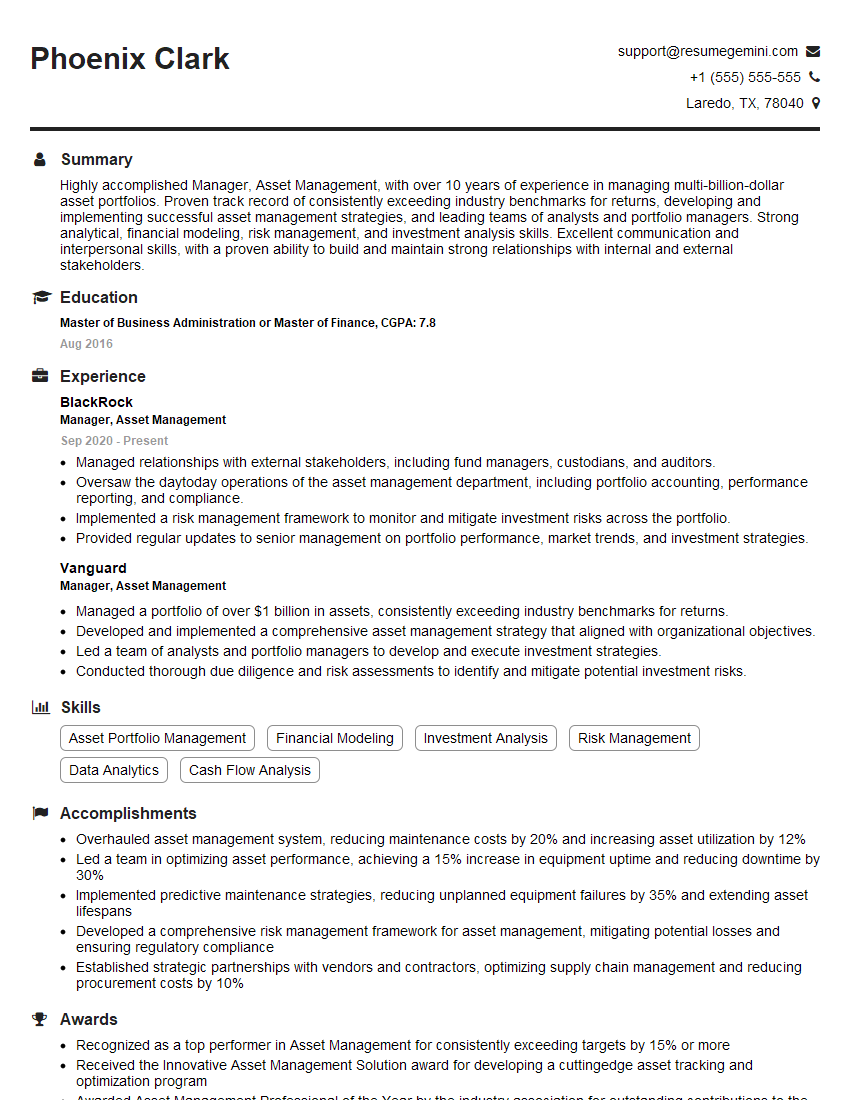

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Manager, Asset Management

1. What is your understanding of the role and responsibilities of a Manager in Asset Management?

In my understanding, the Manager in Asset Management is responsible for planning, organizing, directing, and controlling the activities of an asset management organization. This includes developing and implementing investment strategies, managing risk, and overseeing the performance of investment portfolios. The manager also ensures that the organization complies with all applicable laws and regulations.

2. What are the key skills and experience required for this role?

Technical Skills

- Strong knowledge of investment principles and practices

- Experience in portfolio management and risk management

- Excellent analytical and problem-solving skills

- Strong communication and interpersonal skills

- Experience in team leadership and management

Experience

- 5+ years of experience in asset management or a related field

- Proven track record of success in managing investment portfolios

- Experience in developing and implementing investment strategies

- Experience in risk management and compliance

3. What is your approach to developing and implementing investment strategies?

My approach to developing and implementing investment strategies involves the following steps:

- Identifying the investment objectives and constraints of the client

- Conducting a thorough analysis of the market and economic conditions

- Developing a range of investment options that meet the client’s objectives and constraints

- Presenting the investment options to the client and discussing the pros and cons of each option

- Implementing the investment strategy and monitoring its performance

- Making adjustments to the investment strategy as needed

4. How do you manage risk in your investment portfolios?

I manage risk in my investment portfolios through a variety of methods, including:

- Diversification

- Asset allocation

- Hedging

- Risk monitoring and analysis

5. How do you measure and evaluate the performance of your investment portfolios?

I measure and evaluate the performance of my investment portfolios using a variety of metrics, including:

- Return on investment (ROI)

- Sharpe ratio

- Sortino ratio

- Jensen’s alpha

- Treynor ratio

6. What are the key challenges facing the asset management industry today?

The asset management industry is facing a number of key challenges today including:

- Low interest rates

- Increased market volatility

- Competition from passive investment strategies

- Regulatory changes

- Technological advancements

7. How do you stay up-to-date on the latest trends and developments in the asset management industry?

I stay up-to-date on the latest trends and developments in the asset management industry through a variety of methods, including:

- Reading industry publications

- Attending industry conferences and events

- Networking with other professionals in the industry

- Taking online courses and webinars

8. What are your career goals for the next 5 years?

My career goals for the next 5 years are to:

- Continue to develop my skills and knowledge in asset management

- Become a Chartered Financial Analyst (CFA)

- Take on a leadership role in asset management

- Start my own asset management firm

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your company’s commitment to providing innovative and ethical investment solutions to clients. I believe that my skills and experience would be a valuable asset to your team. I am also eager to learn and grow as a professional in the asset management industry.

10. What are your salary expectations for this role?

My salary expectations for this role are in line with the market rate for similar positions. I am confident that I can bring value to your company that is commensurate with my salary expectations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Manager, Asset Management.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Manager, Asset Management‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Manager, Asset Management plays a crucial role in an organization’s financial health and operational efficiency. Their primary responsibilities include:

1. Strategic Asset Planning

Develop and implement a comprehensive asset management strategy that aligns with the organization’s overall business objectives.

- Assess current asset portfolio and identify opportunities for improvement.

- Conduct financial modeling and analysis to estimate future asset requirements.

2. Asset Acquisition and Development

Manage the process of acquiring, developing, and disposing of assets to optimize portfolio performance.

- Negotiate and execute contracts for asset purchases and leases.

- Supervise project management for asset development initiatives.

3. Asset Maintenance and Operations

Oversee the maintenance and operation of assets to ensure their continued functionality and minimize downtime.

- Develop and implement maintenance schedules and protocols.

- Manage contracts with vendors and service providers for asset upkeep.

4. Risk Management and Insurance

Assess and mitigate risks associated with the asset portfolio and ensure adequate insurance coverage.

- Conduct regular risk assessments and develop mitigation strategies.

- Negotiate and secure insurance policies to protect assets against potential losses.

5. Performance Monitoring and Reporting

Monitor and evaluate the performance of assets and communicate results to stakeholders.

- Collect and analyze data on asset performance and ROI.

- Prepare and present reports to senior management and external auditors.

Interview Tips

Preparing for an interview for the Manager, Asset Management role requires a comprehensive approach and an understanding of the key responsibilities outlined above. Here are some tips to help you ace the interview:

1. Research the Company and the Role

Thoroughly research the company’s business, its asset management practices, and the specific responsibilities of the role. This will demonstrate your interest and understanding of the organization.

- Visit the company website and social media pages.

- Reach out to your professional network for insights.

2. Highlight your Experience and Skills

Emphasize your experience in asset management, strategic planning, and financial analysis. Quantify your accomplishments and provide specific examples of your success in managing an asset portfolio.

- Example Outline:

- – “In my previous role, I developed a comprehensive asset management strategy that reduced operating costs by 15%.”

3. Demonstrate your Business Acumen

Show that you understand the broader business context and can make informed decisions that align with the organization’s objectives. Demonstrate your ability to analyze financial data, assess risks, and evaluate investment opportunities.

- Example Outline:

- – “I have a strong understanding of financial modeling and have used it to forecast future asset requirements and evaluate potential investments.”

4. Prepare for Technical Questions

Expect to be asked technical questions about asset management principles, risk assessment techniques, and financial analysis methods. Review your knowledge and practice answering these questions clearly and confidently.

- Example Outline:

- – “Explain the different methods for valuing assets on a balance sheet.”

5. Emphasize your Communication and Interpersonal Skills

As a Manager, Asset Management, you will need to effectively communicate with various stakeholders, including senior management, investors, and external auditors. Show that you have strong written and verbal communication skills and the ability to build relationships.

- Example Outline:

- – “I am highly proficient in presenting complex financial information to non-technical audiences.”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Manager, Asset Management interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!