Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Medical Accountant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Medical Accountant so you can tailor your answers to impress potential employers.

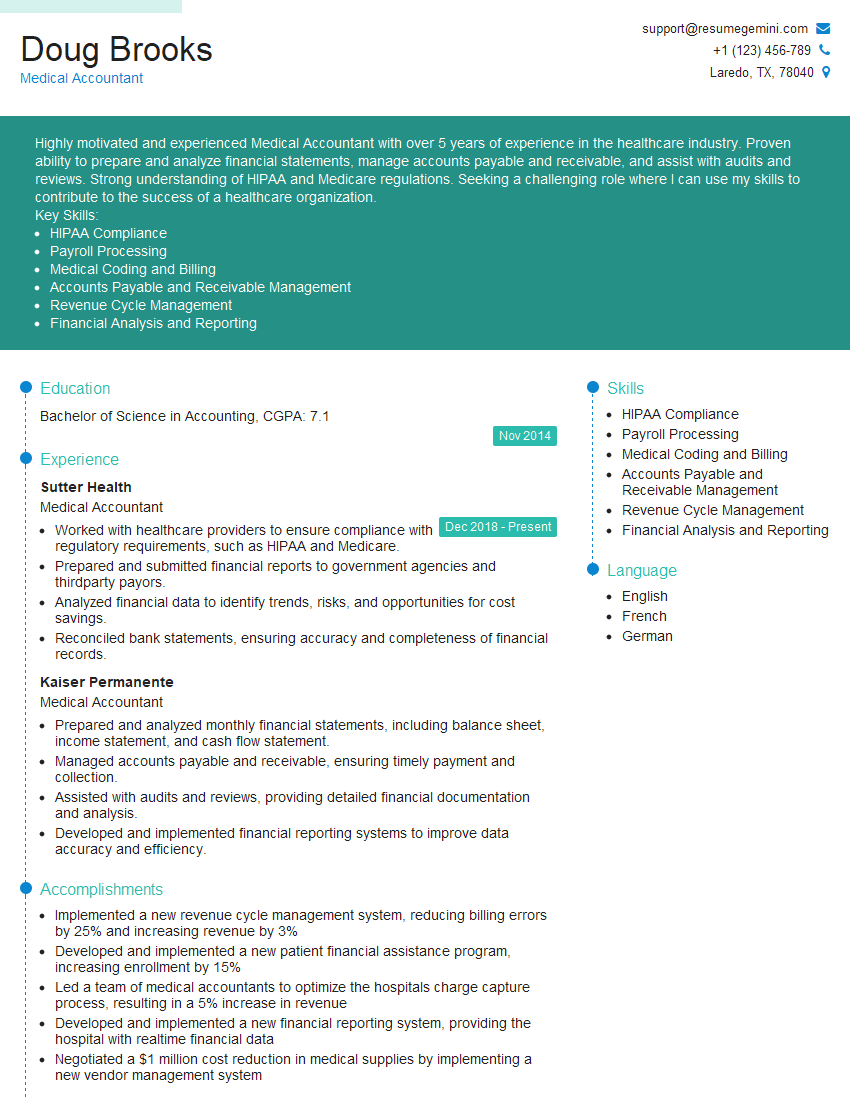

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Medical Accountant

1. Can you elaborate on the key responsibilities of a Medical Accountant?

As a Medical Accountant, I would be responsible for a wide range of tasks, including:

- Managing the day-to-day accounting operations, including accounts payable, accounts receivable, and payroll.

- Preparing financial statements and reports for internal and external use.

- Developing and implementing accounting policies and procedures.

- Overseeing the auditing process and ensuring compliance with all applicable laws and regulations.

- Collaborating with other departments, such as billing, purchasing, and human resources, to ensure the accuracy and integrity of financial data.

2. How would you approach the task of reconciling patient accounts?

1: Data Gathering and Analysis

- Gather all relevant patient account information, including invoices, payments, and insurance claims.

- Analyze the data to identify any discrepancies or errors.

- Research and investigate the cause of any discrepancies.

Subheading 2: Communication and Resolution

- Communicate with patients and insurance providers to resolve any outstanding issues.

- Make necessary adjustments to patient accounts to ensure accuracy.

- Document all reconciliation activities and findings for future reference.

3. Describe your experience with medical coding and billing.

In my previous role as a Medical Accountant, I was responsible for the entire medical coding and billing process. This included:

- Assigning medical codes to patient encounters.

- Preparing and submitting medical claims to insurance companies.

- Following up on claims and resolving any denials or rejections.

- Maintaining accurate patient billing records.

- Ensuring compliance with all applicable coding and billing regulations.

4. How do you stay up-to-date with the latest changes in healthcare regulations?

I stay up-to-date with the latest changes in healthcare regulations by:

- Attending industry conferences and webinars.

- Reading healthcare publications and journals.

- Participating in online discussion forums and groups.

- Consulting with experts in the field.

- Reviewing and analyzing government and regulatory updates.

5. What are the key elements of a successful healthcare revenue cycle management system?

- Patient registration and scheduling.

- Medical coding and billing.

- Claims submission and follow-up.

- Payment processing.

- Collections.

- Reporting and analysis.

6. Can you describe your experience with using healthcare accounting software?

I have extensive experience using a variety of healthcare accounting software, including:

- Epic

- Cerner

- Meditech

- NextGen

- Sage Intacct

I am proficient in using these software programs to perform all aspects of medical accounting, including:

- General ledger accounting.

- Accounts payable and receivable.

- Payroll.

- Financial reporting.

- Budgeting and forecasting.

7. What are the most common challenges faced by Medical Accountants?

- The ever-changing healthcare landscape, which requires accountants to stay up-to-date on the latest regulations and best practices.

- The need to balance the financial needs of the organization with the ethical obligation to provide quality patient care.

- The importance of maintaining accurate and timely financial records for both internal and external stakeholders.

- The need to collaborate effectively with other departments, such as billing, purchasing, and human resources.

- The potential for fraud and abuse in the healthcare industry.

8. How would you handle a situation where you discovered a discrepancy in the financial records?

If I discovered a discrepancy in the financial records, I would take the following steps:

- Investigate the discrepancy to determine the cause.

- Document the discrepancy and my findings.

- Consult with my supervisor or other appropriate personnel.

- Take corrective action to resolve the discrepancy.

- Follow up to ensure that the discrepancy has been resolved.

9. What is your understanding of generally accepted accounting principles (GAAP) as they apply to healthcare organizations?

GAAP is a common set of accounting rules, standards, and procedures issued by the Financial Accounting Standards Board (FASB). GAAP is used to ensure that financial statements are consistent, transparent, and comparable. In the healthcare industry, GAAP is used to:

- Prepare financial statements that fairly present the financial position and results of operations of a healthcare organization.

- Ensure that healthcare organizations are using the same accounting principles so that their financial statements can be compared to each other.

- Provide investors and other stakeholders with the information they need to make informed decisions about healthcare organizations.

10. How do you stay motivated and continue to develop your skills as a Medical Accountant?

I stay motivated and continue to develop my skills as a Medical Accountant by:

- Attending industry conferences and webinars.

- Reading healthcare publications and journals.

- Participating in online discussion forums and groups.

- Consulting with experts in the field.

- Taking continuing education courses.

- Mentoring other accountants.

- Volunteering my time to healthcare organizations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Medical Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Medical Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Medical Accountant holds a crucial role within the financial operations of a healthcare organization. They are responsible for managing and interpreting financial data specific to the healthcare industry, ensuring compliance with regulations and standards. Their core responsibilities include:

1. Financial Reporting and Analysis

Preparing and analyzing financial statements, such as balance sheets, income statements, and cash flow statements

- Monitoring financial performance and identifying areas for improvement

- Providing financial insights to management for decision-making

2. Billing and Collections

Managing the billing process, including coding and submitting claims to insurance companies

- Tracking and resolving billing discrepancies

- Analyzing revenue and collections data to identify trends and potential issues

3. Cost Accounting

Allocating and analyzing costs associated with healthcare services

- Developing and implementing cost-saving measures

- Providing cost data for budgeting and planning purposes

4. Compliance and Auditing

Ensuring compliance with healthcare regulations and standards

- Conducting internal audits and risk assessments

- Preparing for external audits and inspections

Interview Tips

To ace the interview for a Medical Accountant position, it’s essential to prepare thoroughly. Here are some key tips:

1. Research the Healthcare Industry

Familiarize yourself with the unique aspects of healthcare finance, including the regulatory environment and reimbursement models.

- Read industry publications and articles

- Attend webinars or industry conferences

2. Highlight Your Relevant Skills

Emphasize your accounting expertise, particularly in areas such as cost accounting, revenue recognition, and financial reporting.

- Quantify your accomplishments using specific metrics

- Use the STAR method (Situation, Task, Action, Result) to describe your experience

3. Demonstrate Understanding of Regulations

Show that you are knowledgeable about healthcare regulations, such as HIPAA, Medicare, and Medicaid. Explain how you have ensured compliance in previous roles.

- Provide examples of how you have implemented or revised policies and procedures

- Discuss your experience with internal and external audits

4. Prepare for Industry-Specific Questions

Be ready to answer questions about specific healthcare accounting practices. For example:

- How would you account for uncompensated care?

- Explain the difference between Medicare Part A and Part B

- What are the key components of a revenue cycle management system?

5. Practice Your Communication Skills

Medical Accountants need to be able to communicate effectively with both financial and non-financial stakeholders. Practice presenting your findings clearly and concisely.

- Rehearse your answers to common interview questions

- Seek feedback from a friend or mentor on your presentation skills

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Medical Accountant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.