Are you gearing up for an interview for a Mortgage Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Mortgage Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

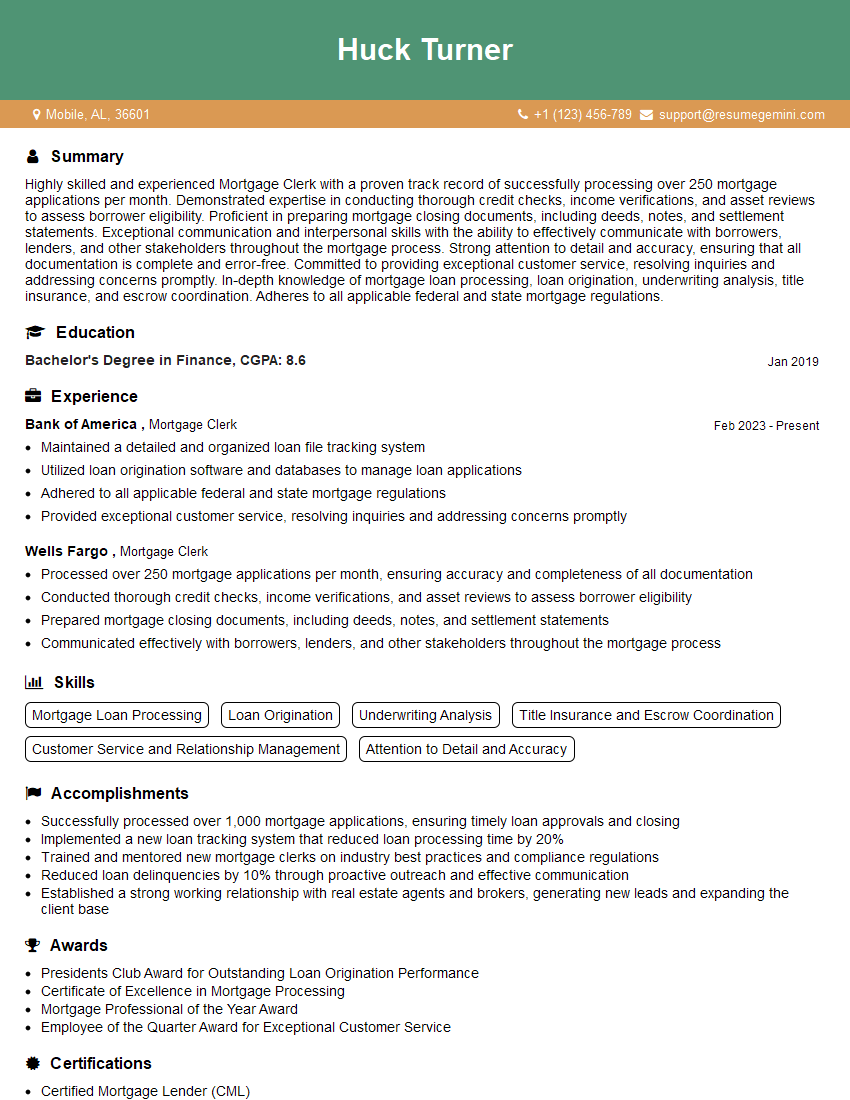

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Clerk

1. What are the key responsibilities of a Mortgage Clerk?

- Processing and verifying loan applications

- Calculating and collecting monthly mortgage payments

- Maintaining accurate loan records

- Providing customer service to borrowers

- Following all federal and state regulations

2. What software programs are you proficient in that are relevant to this role?

Loan Origination Systems (LOS)

- Encompass

- Calyx Point

Loan Servicing Systems

- Black Knight Servicing System (BKSS)

- Fiserv Loan Servicing Platform (LSP)

3. What is your experience with underwriting mortgage loans?

- Reviewed and analyzed loan applications for completeness and accuracy

- Assessed borrower’s creditworthiness and ability to repay

- Determined loan amount and interest rate

- Recommended loan approval or denial

4. What are the different types of mortgage loans you have experience with?

- Conventional loans

- FHA loans

- VA loans

- USDA loans

- Jumbo loans

5. What is your understanding of the Truth in Lending Act (TILA)?

- Requires lenders to disclose the terms and costs of a mortgage loan to borrowers

- Protects borrowers from unfair or deceptive lending practices

- Ensures that borrowers can make informed decisions about their mortgage

6. What is the difference between a fixed-rate mortgage and an adjustable-rate mortgage?

- Fixed-rate mortgage: The interest rate remains the same for the life of the loan.

- Adjustable-rate mortgage: The interest rate can change periodically, based on market conditions.

7. What are some of the common challenges you have faced as a Mortgage Clerk?

- Dealing with incomplete or inaccurate loan applications

- Helping borrowers who are struggling to make their mortgage payments

- Staying up-to-date on changing regulations

- Managing a high volume of work

- Providing excellent customer service

8. What is your favorite thing about working as a Mortgage Clerk?

- Helping people achieve their dream of homeownership

- Learning about the different aspects of the mortgage industry

- Working with a team of dedicated professionals

- Making a difference in the lives of others

9. What are your career goals?

- To become a Mortgage Underwriter

- To manage a team of Mortgage Clerks

- To open my own mortgage brokerage

10. Why should we hire you for this position?

- I have the necessary skills and experience to be successful in this role.

- I am a hard worker and I am always willing to go the extra mile.

- I am a team player and I am always willing to help out my colleagues.

- I am passionate about helping people achieve their dream of homeownership.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mortgage Clerks play a crucial role in the mortgage industry by assisting borrowers throughout the mortgage process. Their key responsibilities include:1. Loan Processing:

- Collecting and verifying borrower’s financial documents, including income verification, debt analysis, and asset calculation.

- Reviewing and analyzing loan applications to ensure completeness and accuracy.

- Preparing loan documentation, including mortgage notes, deeds of trust, and other closing documents.

2. Customer Service:

- Providing excellent customer service to borrowers, answering their questions and addressing their concerns.

- Keeping borrowers informed on the status of their loan application.

- Coordinating with lenders, title companies, and other parties involved in the transaction.

3. Loan Closing:

- Scheduling and coordinating loan closings.

- Preparing closing documents for borrowers to sign.

- Disbursing loan proceeds and ensuring proper disbursement.

4. Post-Closing Activities:

- Recording mortgages and other loan documents with the appropriate authorities.

- Monitoring loan status and providing updates to borrowers and lenders.

- Assisting with loan modifications and other post-closing services.

5. Regulatory Compliance:

- Ensuring compliance with all federal, state, and local mortgage regulations.

- Participating in ongoing training and education to stay abreast of industry changes.

- Maintaining accurate records and documentation to meet compliance requirements.

Interview Tips

Preparing well for a Mortgage Clerk interview is crucial. Here are some tips to help you ace it:1. Research the Company and Position:

- Thoroughly research the mortgage company you’re applying to, including their products, services, and culture.

- Carefully review the job description and highlight the skills and experience that make you the ideal candidate.

2. Highlight Your Skills and Experience:

- Focus on showcasing your proficiency in loan processing, customer service, and regulatory compliance.

- Quantify your accomplishments whenever possible, using metrics and specific examples to demonstrate your impact.

3. Prepare for Common Interview Questions:

- Practice answering questions about your experience, qualifications, and why you’re interested in the role.

- Be ready to discuss your knowledge of mortgage products, regulations, and industry trends.

4. Ask Thoughtful Questions:

- Prepare thoughtful questions to ask the interviewer, demonstrating your interest and engagement.

- Inquire about the company’s training and development opportunities, the work environment, and their expectations for the role.

5. Dress Professionally and Arrive on Time:

- First impressions matter, so dress professionally and arrive for your interview on time.

- Be polite and respectful to everyone you meet, including the receptionist and other employees.

Example Questions and Answers:

- Q: Tell me about your experience in loan processing.

- A: In my previous role, I handled a high volume of loan applications, ensuring completeness, accuracy, and compliance with all underwriting guidelines. I also conducted thorough financial analysis, income verification, and asset calculations to assess borrowers’ eligibility for various mortgage programs.

- Q: How do you handle challenging customers?

- A: I believe in providing exceptional customer service, even in challenging situations. I actively listen to customers’ concerns, empathize with their perspectives, and work collaboratively to find solutions. I have successfully resolved complex issues by utilizing my communication and problem-solving skills, building strong relationships with borrowers.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Mortgage Clerk role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.