Are you gearing up for a career in Payroll Accountant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Payroll Accountant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

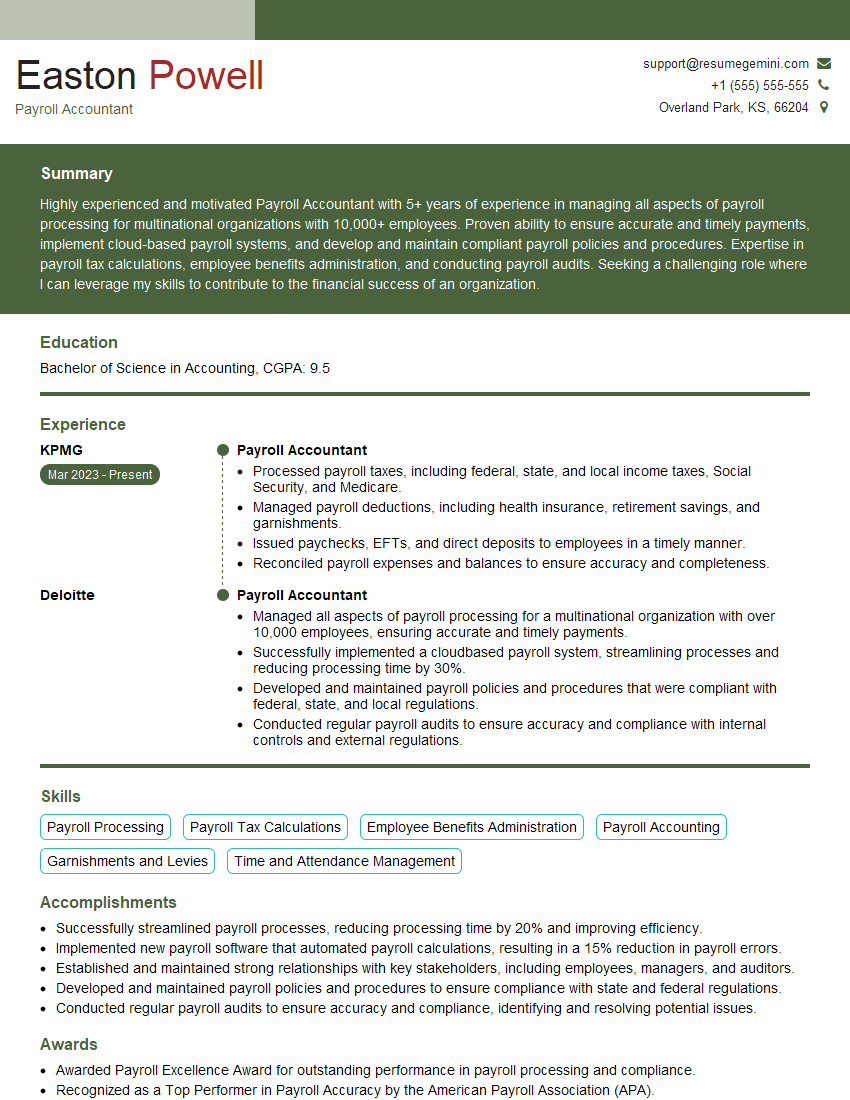

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Accountant

1. What are the different types of payroll reports that you are familiar with?

There are various types of payroll reports that I am familiar with, including:

- Payroll registers

- Payroll summaries

- Withholding statements

- Earning statements

- Deduction statements

2. What are the key laws and regulations that Payroll Accountants must comply with?

Federal Laws

- Fair Labor Standards Act (FLSA)

- Social Security Act (SSA)

- Medicare Act

- Unemployment Insurance (UI)

- Family and Medical Leave Act (FMLA)

State Laws

- State income tax withholding

- State unemployment insurance

- State disability insurance

- State wage and hour laws

3. What is the process for calculating payroll taxes?

The process for calculating payroll taxes involves the following steps:

- Determining the employee’s gross pay

- Calculating the employee’s federal income tax withholding

- Calculating the employee’s FICA taxes (Social Security and Medicare)

- Calculating the employee’s state income tax withholding (if applicable)

- Calculating the employee’s local income tax withholding (if applicable)

4. What are the different types of payroll deductions?

The different types of payroll deductions include:

- Federal income tax

- FICA taxes (Social Security and Medicare)

- State income tax

- Local income tax

- Health insurance

- Dental insurance

- Vision insurance

- Retirement savings

- Child support

- Union dues

5. What is the difference between a gross and net pay?

Gross pay is the total amount of money that an employee earns before any deductions are taken out. Net pay is the amount of money that an employee receives after all deductions have been taken out.

6. What are the most common payroll errors?

The most common payroll errors include:

- Incorrectly calculating gross pay

- Incorrectly calculating payroll taxes

- Incorrectly calculating deductions

- Incorrectly issuing paychecks

- Incorrectly reporting payroll information to the government

7. What are the best practices for payroll processing?

The best practices for payroll processing include:

- Using a payroll software

- Automating as much of the payroll process as possible

- Reviewing payroll reports before issuing paychecks

- Filing payroll taxes on time

- Keeping accurate payroll records

8. What are the challenges of payroll accounting?

The challenges of payroll accounting include:

- Keeping up with changing laws and regulations

- Ensuring the accuracy of payroll information

- Processing payroll on time

- Dealing with payroll errors

- Maintaining confidentiality of payroll information

9. What are the qualities of a successful Payroll Accountant?

The qualities of a successful Payroll Accountant include:

- Strong attention to detail

- Excellent math skills

- Knowledge of payroll laws and regulations

- Ability to work independently and as part of a team

- Strong communication skills

10. What is your experience with payroll software?

I have experience with a variety of payroll software, including ADP, Paychex, and QuickBooks. I am proficient in using these software to process payroll, calculate payroll taxes, and generate payroll reports.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payroll Accountants are responsible for ensuring that employees are paid accurately and on time. They also play a key role in ensuring that the company complies with all applicable payroll laws and regulations.

1. Prepare and process payroll

This includes calculating wages, withholding taxes, and making deductions for benefits.

- Calculate gross and net pay for employees

- Withhold taxes, including federal, state, and local income taxes, Social Security, and Medicare

- Deduct for benefits, such as health insurance, retirement plans, and paid time off

2. File payroll taxes

Payroll Accountants must file payroll taxes with the appropriate government agencies.

- File federal payroll tax returns (Form 941)

- File state payroll tax returns

- File local payroll tax returns

3. Prepare payroll reports

Payroll Accountants must prepare payroll reports for management and employees.

- Prepare payroll summaries

- Prepare employee pay stubs

- Prepare reports for management, such as payroll expense reports and employee earnings reports

4. Maintain payroll records

Payroll Accountants must maintain payroll records for the company.

- Maintain employee payroll files

- Maintain payroll journals and ledgers

- Maintain payroll tax records

Interview Tips

Interviewing for a Payroll Accountant position can be a daunting task, but by following these tips, you can increase your chances of success.

1. Research the company

Take some time to learn about the company’s culture, values, and products or services.

- Visit the company’s website

- Read articles about the company in the news

- Talk to people who work or have worked for the company

2. Practice your answers to common interview questions

Think about questions that you might be asked in an interview, such as “Why are you interested in this position?” or “What are your strengths and weaknesses?”

- Prepare your answers ahead of time

- Practice your answers out loud

- Get feedback from a friend or family member

3. Dress professionally

First impressions matter, so make sure to dress professionally for your interview.

- Wear a suit or business casual attire

- Make sure your clothes are clean and pressed

- Accessorize with a briefcase or portfolio

4. Be on time

Punctuality is important, so make sure to arrive for your interview on time.

- Plan your route ahead of time

- Leave yourself plenty of time to travel

- If you’re running late, call the interviewer and let them know

Next Step:

Now that you’re armed with the knowledge of Payroll Accountant interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Payroll Accountant positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini