Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Personal Financial Advisor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Personal Financial Advisor so you can tailor your answers to impress potential employers.

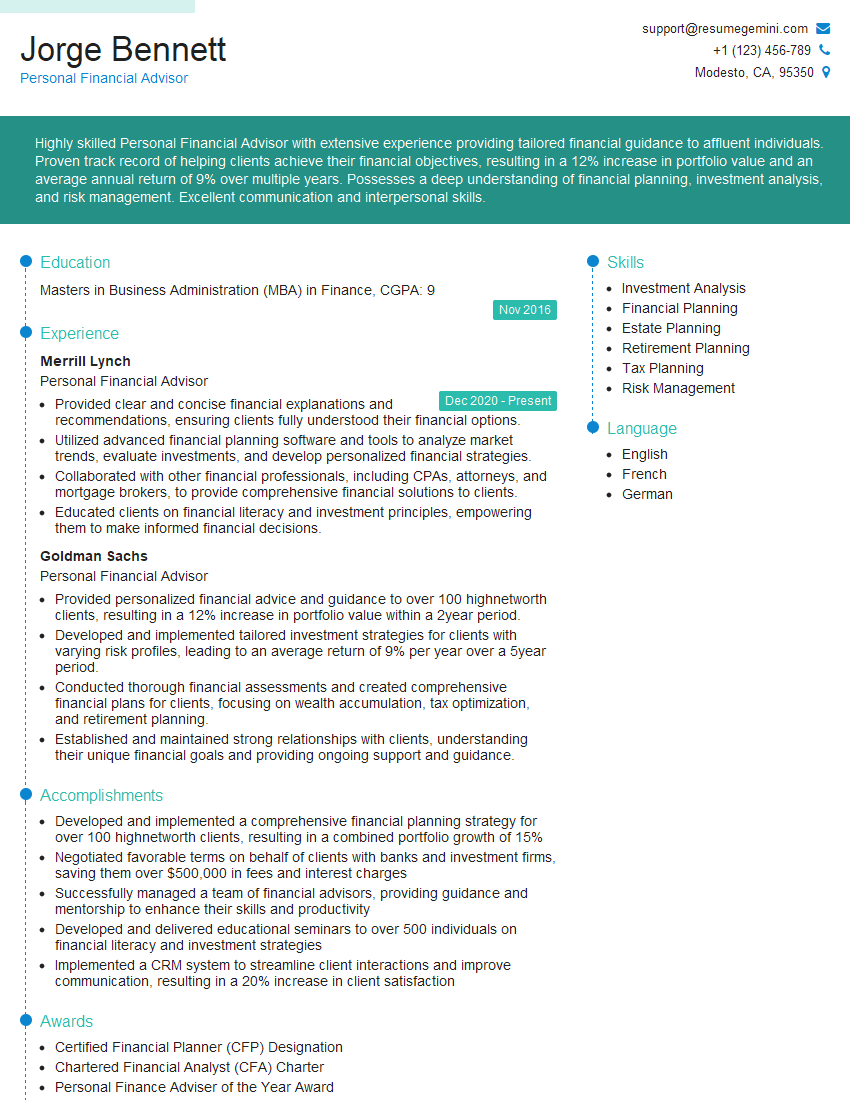

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Financial Advisor

1. How do you determine an appropriate asset allocation strategy for a client?

I consider several factors, including:

- Risk tolerance: I assess the client’s comfort level with potential losses and volatility.

- Time horizon: I consider the client’s investment goals and how long they have until they need the funds.

- Income needs: I evaluate the client’s current and future income needs to ensure the strategy generates sufficient returns.

- Tax implications: I consider the impact of taxes on the client’s investments to minimize tax liabilities.

- Market conditions: I analyze current market conditions and forecasts to make informed decisions about asset allocation.

2. What are the key principles of retirement planning and how do you apply them?

Maximize tax-advantaged accounts:

- I recommend utilizing tax-advantaged accounts, such as IRAs and 401(k)s, to minimize taxes on investment earnings.

- I help clients maximize contributions to these accounts within the limits set by the IRS.

Create a diversified portfolio:

- I create diversified portfolios with a mix of investments, including stocks, bonds, and real estate, to reduce risk.

- I consider the client’s risk tolerance and time horizon when selecting investments.

Regularly review and adjust:

- I monitor clients’ investments and make adjustments as needed to ensure they remain on track to meet their retirement goals.

- I meet with clients regularly to discuss their progress and any changes in their circumstances.

3. How do you approach financial planning for high-net-worth individuals?

- I develop comprehensive wealth management plans that cover all aspects of their financial lives, including investments, estate planning, and tax strategies.

- I work closely with tax professionals and estate attorneys to ensure my plans are legally sound and tax-efficient.

- I provide ongoing support and guidance to help high-net-worth individuals manage their complex financial affairs.

4. How do you stay up-to-date on the latest financial products and investment strategies?

- I attend industry conferences and webinars to learn about new products and strategies.

- I read financial publications and research reports to stay abreast of market trends and economic developments.

- I participate in continuing education programs to earn professional designations, such as the CFP and ChFC.

5. How do you handle clients who are emotionally attached to their investments?

- I approach these clients with empathy and understanding.

- I educate them about the risks and potential consequences of making investment decisions based solely on emotions.

- I help them develop a structured investment plan that aligns with their financial goals and risk tolerance.

6. What is your approach to building relationships with clients?

- I focus on building strong, long-term relationships based on trust and transparency.

- I actively listen to my clients to understand their financial needs and concerns.

- I communicate regularly and provide clear explanations of my recommendations.

7. How do you measure your success as a Personal Financial Advisor?

- Client satisfaction: I track client feedback and strive to exceed their expectations.

- Financial performance: I monitor the performance of my clients’ investments and compare it to relevant benchmarks.

- Professional development: I pursue ongoing education and industry certifications to enhance my knowledge and skills.

8. What is your ethical framework for providing financial advice?

- I adhere to the fiduciary standard, which requires me to act in the best interests of my clients.

- I avoid conflicts of interest and disclose any potential conflicts to my clients.

- I provide objective and unbiased advice based on my professional judgment.

9. How do you handle clients who are not willing to take risks?

- I help these clients understand the potential consequences of being too conservative.

- I discuss the trade-offs between risk and return and help them determine an appropriate level of risk.

- I develop investment strategies that prioritize capital preservation while still providing potential for growth.

10. How do you stay motivated and engaged in your role as a Personal Financial Advisor?

- I am passionate about helping my clients achieve their financial goals.

- I find it rewarding to make a positive impact on people’s lives.

- I am constantly learning and growing in my field, which keeps me motivated and engaged.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Financial Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Financial Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Personal Financial Advisors are responsible for providing financial advice and guidance to individuals and families. They work closely with clients to understand their financial goals, risk tolerance, and investment objectives. Based on this information, they develop and implement personalized financial plans that help clients achieve their financial objectives.

1. Client Relationship Management

Establishing and maintaining strong relationships with clients is crucial. This involves building rapport, understanding their needs, and providing tailored advice that meets their specific requirements.

- Develop and implement financial plans tailored to clients’ unique financial circumstances and goals.

- Review clients’ financial situations regularly and make recommendations for adjustments as needed.

2. Financial Planning

Creating comprehensive financial plans requires a thorough understanding of clients’ financial goals, risk tolerance, and time horizon. These plans consider various aspects such as investments, insurance, retirement planning, and estate planning.

- Analyze clients’ financial situations to identify potential risks and opportunities.

- Develop and present financial plans that align with clients’ investment objectives.

3. Investment Management

Personal Financial Advisors handle clients’ investment portfolios, ensuring they align with their risk tolerance and financial goals. This involves making investment recommendations, monitoring performance, and rebalancing portfolios as required.

- Conduct research and make recommendations on suitable investment options.

- Monitor investment performance and make adjustments to optimize returns.

4. Retirement Planning

Retirement planning is a vital aspect of financial planning, helping clients navigate the complexities of saving for retirement and managing their income during their golden years.

- Develop retirement income plans that meet clients’ lifestyle needs and goals.

- Recommend and manage retirement accounts, including IRAs and 401(k) plans.

5. Tax Planning

Understanding tax implications is essential for maximizing clients’ financial outcomes. Personal Financial Advisors consider tax laws and regulations when making financial recommendations.

- Provide tax planning advice to minimize clients’ tax liability.

- Coordinate with tax professionals to ensure compliance and optimize tax benefits.

6. Estate Planning

Personal Financial Advisors assist clients with estate planning to ensure their assets are distributed according to their wishes. They work closely with estate attorneys to draft wills, trusts, and other estate planning documents.

- Collaborate with estate attorneys to create comprehensive estate plans.

- Provide guidance on estate tax minimization strategies.

Interview Tips

Preparing thoroughly for a Personal Financial Advisor interview is crucial to showcase your qualifications and make a lasting impression. Here are some tips to help you ace the interview:

1. Research the Company and Position

Research the company’s values, services, and financial performance to demonstrate your genuine interest and understanding of the organization. Additionally, learn about the specific role and its responsibilities to highlight your relevant skills and experience.

- Review the company’s website, financial statements, and news articles.

- Identify the key responsibilities and qualifications for the position.

2. Practice Your Responses to Common Interview Questions

Prepare thoughtful responses to common interview questions related to your skills, experience, and knowledge of the financial industry. Consider using the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples.

- Prepare answers to questions about your financial planning experience, investment strategies, and client relationship management skills.

- Use the STAR method to provide concrete examples of your accomplishments and results.

3. Highlight Your Certifications and Credentials

Certifications such as CFP (Certified Financial Planner) and ChFC (Chartered Financial Consultant) demonstrate your commitment to professional development and enhance your credibility. Mention these certifications in your resume and interview responses.

- Discuss how your certifications have contributed to your financial planning knowledge and skills.

- Emphasize your commitment to ongoing professional development.

4. Dress Professionally and Arrive on Time

First impressions matter, so dress professionally and arrive punctually for your interview. This shows respect for the interviewer and the organization, and it creates a positive impression.

- Choose attire that is appropriate for a business setting.

- Plan your route and allow ample time to arrive on time.

5. Ask Thoughtful Questions

Towards the end of the interview, asking thoughtful questions demonstrates your interest in the position and the company. Prepare questions related to the company’s culture, growth opportunities, or their approach to financial planning. Avoid asking questions that are easily answered by researching the company’s website or social media.

- Prepare specific questions about the company’s financial planning philosophy.

- Inquire about the company’s commitment to client satisfaction and professional development.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Personal Financial Advisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!