Are you gearing up for an interview for a Risk Analyst position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Risk Analyst and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

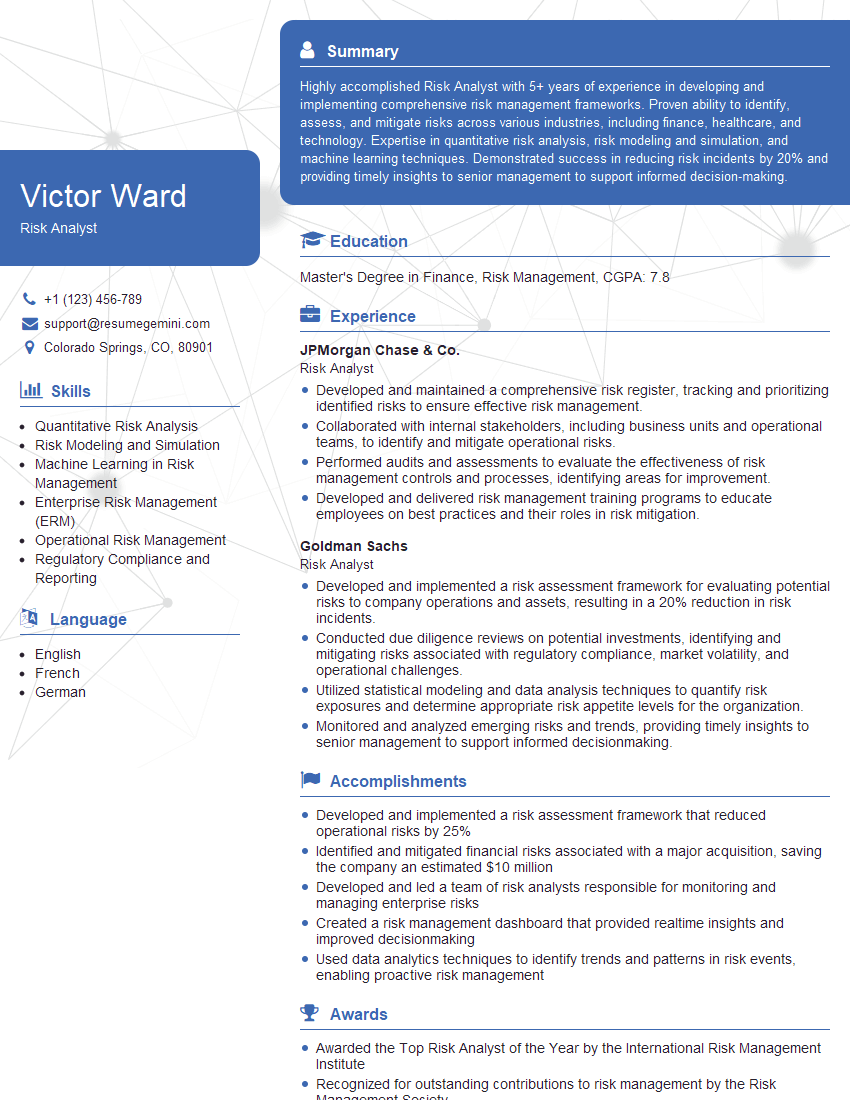

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Risk Analyst

1. How do you quantify and analyze risk?

- Identifying the potential risks and their likelihood and impact.

- Using statistical techniques, such as Monte Carlo simulations, to assess the probability and financial impact of risks.

- Developing risk models to calculate the overall risk exposure of an organization or project.

2. What are the key components of a risk management framework?

Risk identification

- Identifying potential risks to the organization and understanding their sources, causes, and consequences.

Risk assessment

- Evaluating the likelihood and potential impact of identified risks on the organization’s objectives.

Risk mitigation

- Developing and implementing strategies to reduce or eliminate the likelihood or impact of risks.

Risk monitoring and review

- Continuously monitoring and reviewing risks to ensure their ongoing relevance and adequacy of risk mitigation strategies.

3. How do you prioritize risks?

- Assessing the probability and potential impact of risks.

- Considering the organization’s risk appetite and tolerance levels.

- Using risk matrices or other prioritization techniques.

4. What are the different methods of risk mitigation?

- Risk avoidance: Eliminating the risk entirely.

- Risk reduction: Reducing the likelihood or impact of the risk.

- Risk transfer: Transferring the risk to another party, such as through insurance.

- Risk acceptance: Accepting the risk and taking no action.

5. How do you communicate risk to stakeholders?

- Tailoring the communication to the specific audience and their needs.

- Using clear and concise language, avoiding technical jargon.

- Providing sufficient context and background information.

- Using visual aids, such as charts and graphs, to illustrate complex concepts.

6. What are the challenges of risk management in the financial industry?

- The complexity and interconnectedness of financial markets.

- The rapidly evolving regulatory landscape.

- The need to balance risk and return in investment decisions.

7. What are the emerging trends in risk management?

- The use of big data and artificial intelligence for risk assessment and monitoring.

- The increasing focus on climate-related risks.

- The development of new risk management tools and techniques.

8. How do you stay up-to-date on the latest risk management best practices?

- Reading industry publications and attending conferences.

- Participating in professional development courses and workshops.

- Networking with other risk professionals.

9. What are the ethical considerations in risk management?

- Ensuring that risk management decisions are fair and equitable.

- Protecting the privacy and confidentiality of sensitive information.

- Avoiding conflicts of interest.

10. What is your experience with using risk management software?

- Proficient in using risk management software, such as [insert software name].

- Experience in using the software to perform risk assessments, develop risk mitigation plans, and monitor risks.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Risk Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Risk Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Risk analysts are responsible for identifying, assessing, and mitigating risks that could impact an organization. They play a critical role in helping organizations make informed decisions and protect their assets.

1. Risk Identification

Risk analysts are responsible for identifying potential risks that could impact an organization. This involves gathering information from a variety of sources, including internal and external stakeholders, and analyzing data to identify potential threats.

- Interview stakeholders to gather information about potential risks

- Review financial statements, contracts, and other documents to identify potential risks

- Conduct site visits to assess potential risks

2. Risk Assessment

Once risks have been identified, risk analysts are responsible for assessing their potential impact and likelihood of occurrence. This involves using a variety of risk assessment tools and techniques to determine the severity of each risk.

- Use risk assessment tools to quantify the potential impact and likelihood of each risk

- Develop risk scenarios to assess the potential impact of each risk

- Prioritize risks based on their severity

3. Risk Mitigation

Once risks have been assessed, risk analysts are responsible for developing and implementing strategies to mitigate those risks. This involves working with other stakeholders to identify and implement controls to reduce the likelihood and impact of each risk.

- Develop risk mitigation plans to reduce the likelihood and impact of each risk

- Implement controls to reduce the likelihood and impact of each risk

- Monitor the effectiveness of risk mitigation strategies

4. Risk Reporting

Risk analysts are responsible for communicating the results of their risk assessments and mitigation plans to senior management and other stakeholders. This involves preparing risk reports and presentations, and discussing risk issues with stakeholders.

- Prepare risk reports and presentations

- Discuss risk issues with stakeholders

- Provide training on risk management to stakeholders

Interview Tips

Preparing for a risk analyst interview can be daunting, but there are a few things you can do to increase your chances of success.

1. Research the company and the position

Before you go to your interview, take some time to research the company and the position you’re applying for. This will help you understand the company’s culture, values, and risk appetite. It will also help you tailor your answers to the specific questions that you’re likely to be asked.

- Visit the company’s website to learn about their business, products, and services.

- Read the job description carefully and make a list of the qualifications and skills that the employer is looking for.

2. Practice answering common interview questions

There are a number of common interview questions that you’re likely to be asked, such as “Tell me about yourself,” “Why are you interested in this position,” and “What are your strengths and weaknesses?” Practice answering these questions out loud so that you can feel confident and prepared when you’re in the interview.

- Use the STAR method to answer interview questions. STAR stands for Situation, Task, Action, Result.

- For example, when answering the question “Tell me about a time when you had to deal with a difficult client,” you could use the STAR method to describe the situation, the task that you were given, the actions that you took, and the result of your actions.

3. Be prepared to talk about your experience

The interviewer will want to know about your experience in risk management. Be prepared to talk about your skills and experience in identifying, assessing, and mitigating risks.

- Highlight your experience in using risk assessment tools and techniques.

- Provide examples of risk mitigation strategies that you have developed and implemented.

4. Be confident and enthusiastic

Confidence and enthusiasm are key in any interview, but they are especially important in a risk analyst interview. Risk analysts are responsible for identifying and mitigating risks, and employers want to know that you are confident in your abilities and enthusiastic about the role.

- Make eye contact with the interviewer and speak clearly and confidently.

- Show your interest in the position by asking questions about the company, the position, and the interviewer’s experience.

Next Step:

Now that you’re armed with the knowledge of Risk Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Risk Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini