Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Savings Counselor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

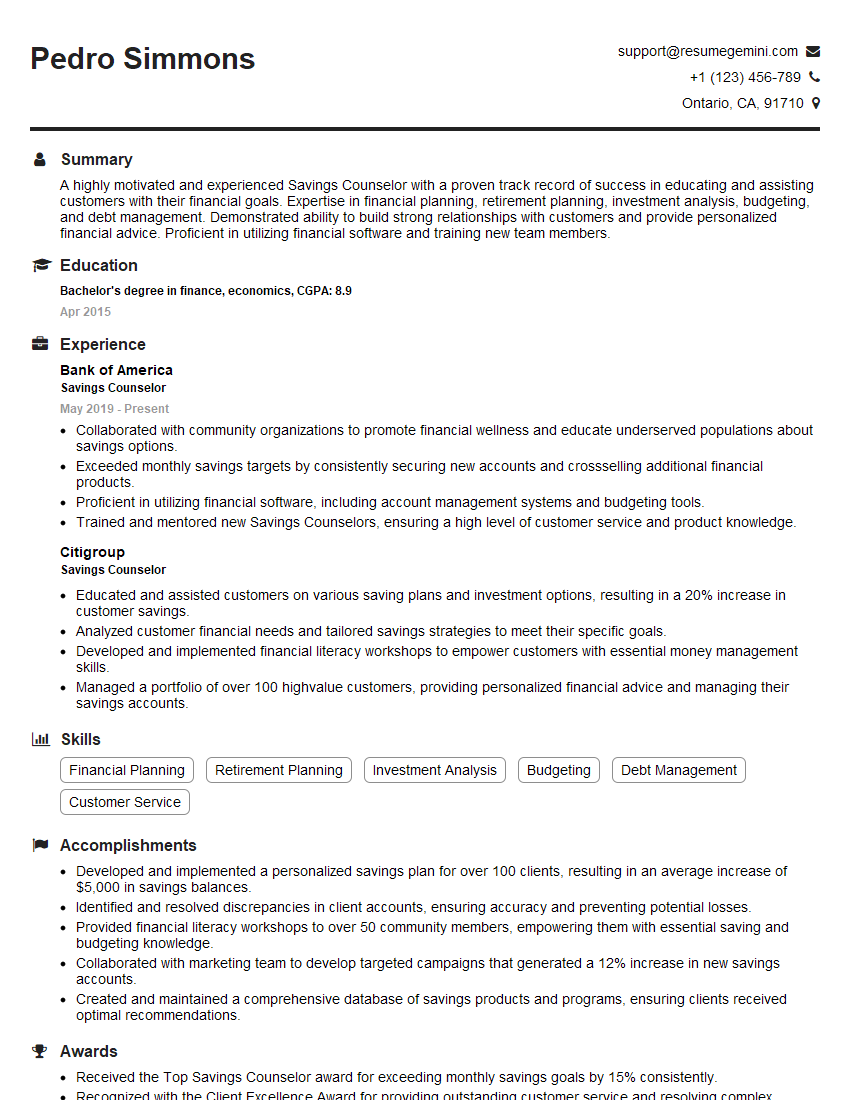

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Savings Counselor

1. What are the key responsibilities of a Savings Counselor?

- Providing financial counseling and guidance to clients on various savings and investment options.

- Analyzing clients’ financial situations, identifying their savings goals, and developing personalized savings plans.

- Educating clients on financial literacy, budgeting, and debt management.

- Developing and implementing financial literacy programs and workshops for community outreach.

- Collaborating with other financial professionals, such as loan officers and investment advisors, to provide comprehensive financial advice.

2. What are the most common savings goals that clients seek guidance on?

- Saving for retirement

- Purchasing a home

- Funding education

- Building an emergency fund

- Saving for specific life events, such as a wedding or a vacation

3. How do you assess a client’s risk tolerance and investment horizon when developing a savings plan?

- By asking questions about their financial goals, investment experience, and time horizon.

- By using risk assessment questionnaires to gauge their comfort level with different levels of risk.

- By reviewing their investment portfolio and analyzing their past investment behavior.

- By considering their age, income, and overall financial situation.

4. What are some of the challenges you have faced as a Savings Counselor and how did you overcome them?

- Helping clients overcome emotional barriers to saving, such as fear or procrastination.

- Advising clients on how to save when they have limited income or financial constraints.

- Educating clients on complex financial concepts in a way that is easy to understand.

- Staying up-to-date on the latest financial products and regulations.

5. What are the most important qualities and skills for a successful Savings Counselor?

- Strong financial knowledge and expertise

- Excellent communication and interpersonal skills

- Ability to build rapport and trust with clients

- Patience and empathy

- Problem-solving and analytical skills

6. How do you stay up-to-date on the latest trends in savings and investment?

- Attending industry conferences and workshops

- Reading financial publications and research reports

- Networking with other financial professionals

- Taking continuing education courses

7. What sets you apart from other candidates for this role?

- My strong academic background in finance and economics.

- My previous experience as a financial advisor, where I provided comprehensive financial planning and investment advice to clients.

- My passion for helping others improve their financial well-being.

- My excellent communication and interpersonal skills, which enable me to connect with clients and build strong relationships.

- My commitment to staying up-to-date on the latest financial trends and products.

8. What are your salary expectations for this role?

- My salary expectations are in line with the industry standard for Savings Counselors with my experience and qualifications.

- I am open to negotiating a salary package that is fair and commensurate with my contributions to the organization.

- I am primarily focused on finding a role where I can make a meaningful impact on clients’ financial lives.

9. Are you familiar with any specific savings or investment strategies that you are particularly interested in?

- I am particularly interested in strategies that help clients save for retirement, such as 401(k) plans and IRAs.

- I am also knowledgeable about various investment strategies, including stock and bond investing, mutual funds, and ETFs.

- I am always eager to learn about new and innovative savings and investment strategies that can benefit clients.

10. How do you handle clients who are hesitant to invest or save their money?

- I start by listening to their concerns and understanding their reasons for being hesitant.

- I then educate them about the benefits of saving and investing, using examples that are relevant to their individual circumstances.

- I help them set realistic savings goals and develop a personalized savings plan that fits their budget and risk tolerance.

- I also emphasize the importance of seeking professional advice from a financial advisor who can provide them with personalized guidance.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Savings Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Savings Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Savings Counselors play a vital role in assisting customers with managing their finances and achieving their financial goals.

1. Customer Service

Provide exceptional customer service by understanding and fulfilling the customer’s needs and requirements.

- Establish and maintain positive relationships with customers.

- Resolve customer queries and complaints effectively.

2. Sales and Marketing

Promote and sell the bank’s savings products and services to increase customer acquisition and revenue generation.

- Identify and target potential customers.

- Develop and implement marketing campaigns.

3. Financial Guidance

Provide financial guidance and advice to customers based on their individual circumstances and goals.

- Assess customer’s financial situation and identify areas for improvement.

- Develop personalized savings plans and strategies.

4. Product Knowledge

Maintain a comprehensive understanding of the bank’s savings products and services, as well as industry trends and best practices.

- Stay up-to-date on new products and services.

- Provide accurate and informative product information to customers.

Interview Tips

Preparing for a savings counselor interview requires a combination of industry knowledge, customer service skills, and effective communication.

1. Research the Bank and Industry

Familiarize yourself with the bank’s products, services, and company culture. Research industry trends and best practices.

- Visit the bank’s website and social media pages.

- Read industry publications and articles.

2. Highlight Your Customer Service Skills

Emphasize your ability to build rapport, communicate effectively, and resolve customer concerns. Provide specific examples of situations where you have exceeded customer expectations.

- Use the STAR method (Situation, Task, Action, Result) to describe your experiences.

- Quantify your accomplishments whenever possible.

3. Demonstrate Your Sales and Marketing Abilities

Showcase your sales techniques and marketing knowledge. Explain how you have successfully promoted and sold products or services in previous roles.

- Be prepared to discuss your understanding of lead generation and customer acquisition strategies.

- Share examples of successful sales campaigns you have been involved in.

4. Emphasize Your Financial Knowledge

Highlight your understanding of basic financial concepts, savings products, and investment strategies. Demonstrate your ability to provide sound financial advice to customers.

- Explain your knowledge of different types of savings accounts and investment vehicles.

- Discuss your understanding of risk tolerance and investment diversification.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Savings Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!