Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Tax Commissioner interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Tax Commissioner so you can tailor your answers to impress potential employers.

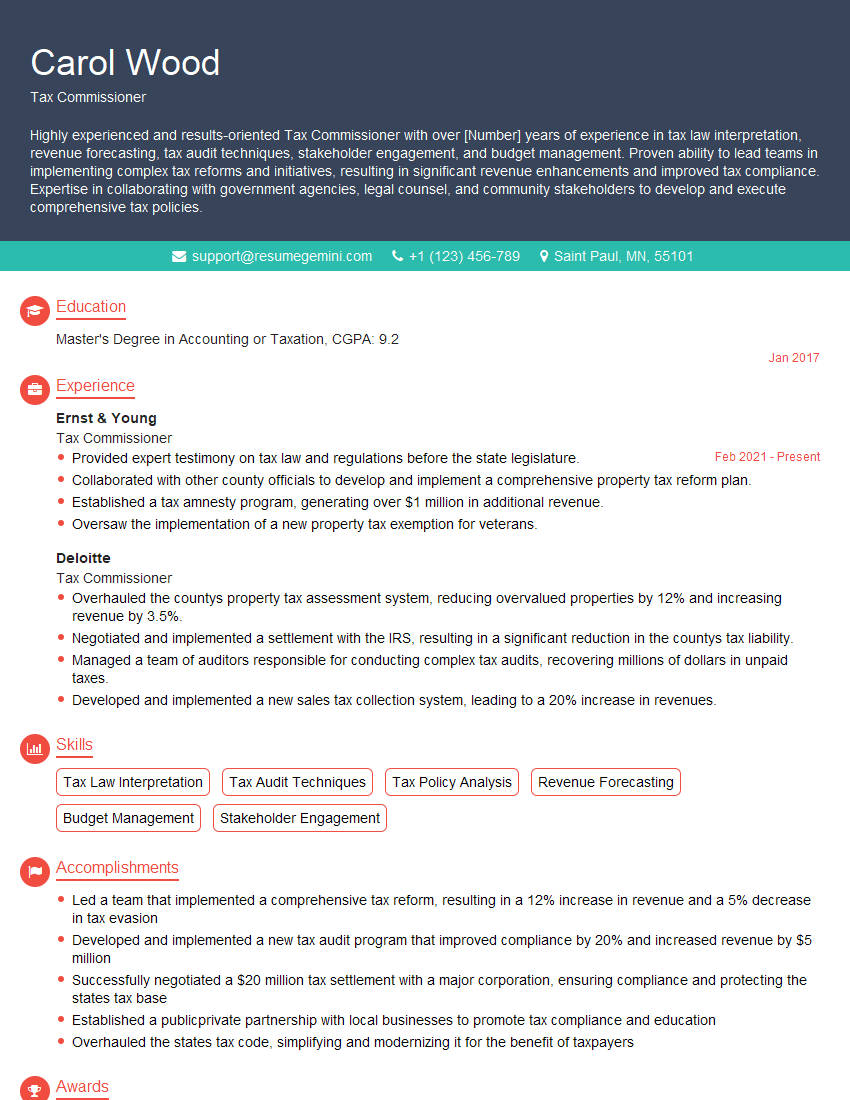

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Commissioner

1. What are the key responsibilities of a Tax Commissioner?

- Overseeing the administration and enforcement of tax laws and regulations

- Managing the tax agency’s budget and resources

- Developing and implementing tax policies

- Resolving tax disputes and appeals

- Providing guidance and support to taxpayers

2. What are the qualities and skills required to be an effective Tax Commissioner?

Leadership and Management

- Strong leadership and management skills

- Ability to motivate and inspire a team

- Excellent communication and interpersonal skills

Technical Expertise

- In-depth knowledge of tax laws and regulations

- Ability to interpret and apply complex tax laws

- Experience in tax administration and enforcement

3. What are the challenges and opportunities facing tax administration in the current environment?

- The increasing complexity of tax laws and regulations

- The rise of global taxation

- The impact of technology on tax administration

- The need to improve taxpayer services

4. How do you plan to address the challenges and opportunities facing tax administration?

- By investing in technology to improve taxpayer services

- By working with other tax agencies to improve global cooperation

- By developing and implementing new tax policies to address the challenges of the current environment

5. What is your vision for the future of tax administration?

- A tax administration that is efficient, effective, and responsive to the needs of taxpayers

- A tax administration that is fair and impartial

- A tax administration that is transparent and accountable

6. How do you plan to improve taxpayer services?

- By making it easier for taxpayers to file their taxes

- By providing more information and support to taxpayers

- By improving the way the tax agency communicates with taxpayers

7. What is your experience in managing large and complex organizations?

I have over 20 years of experience in managing large and complex organizations. In my previous role as the head of a major tax agency, I was responsible for overseeing a budget of over $1 billion and a staff of over 1,000 employees. I also have experience in leading large-scale change initiatives and developing and implementing new policies and procedures.

8. What is your experience in dealing with the media and public stakeholders?

I have extensive experience in dealing with the media and public stakeholders. In my previous role, I was responsible for representing the tax agency to the media and the public. I also have experience in developing and implementing public relations campaigns and in responding to media inquiries.

9. What are your thoughts on the future of taxation?

I believe that the future of taxation will be characterized by increasing complexity and globalization. I also believe that technology will play an increasingly important role in tax administration. I am committed to staying abreast of these trends and to ensuring that the tax agency is prepared for the future.

10. Why are you interested in this position?

I am interested in this position because I believe that I have the skills and experience necessary to be an effective Tax Commissioner. I am also passionate about public service and I am committed to making a difference in the lives of taxpayers.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Commissioner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Commissioner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Tax Commissioner is responsible for the administration, management, and oversight of the tax system within a specified jurisdiction. Key job responsibilities include:

1. Tax Policy and Administration

Develops and implements tax policies and procedures to ensure compliance with applicable laws and regulations.

- Interprets tax laws and regulations, issues rulings, and provides guidance to taxpayers.

- Oversees the collection, assessment, and enforcement of taxes owed to the jurisdiction.

2. Budget and Financial Management

Manages the agency’s budget and ensures efficient use of financial resources.

- Prepares and submits budget proposals to the governing body for approval.

- Monitors financial performance and implements cost-saving measures as needed.

3. Customer Service and Outreach

Provides excellent customer service to taxpayers and other stakeholders.

- Responds to inquiries, resolves tax issues, and provides information to the public.

- Conducts outreach programs to educate taxpayers about their tax obligations.

4. Human Resources Management

Manages the agency’s workforce and ensures compliance with employment laws.

- Recruits, hires, trains, and evaluates staff.

- Promotes a positive and productive work environment.

Interview Tips

To ace an interview for a Tax Commissioner position, it is important to:

1. Research the Jurisdiction and Agency

Familiarize yourself with the specific tax laws, regulations, and policies of the jurisdiction you are applying to.

- Visit the agency’s website and review its mission, vision, and strategic goals.

- Read recent news articles and tax-related publications to stay informed about current issues.

2. Highlight Relevant Experience and Skills

Emphasize your expertise in tax law, administration, and financial management.

- Discuss your experience in developing and implementing tax policies, conducting audits, and resolving tax disputes.

- Quantify your accomplishments and provide specific examples of how you have contributed to the success of previous organizations.

3. Demonstrate Leadership and Communication Skills

Show that you have the leadership skills and communication abilities necessary to effectively lead a team and engage with the public.

- Describe examples of how you have motivated and inspired others to achieve goals.

- Explain how you effectively communicate complex tax concepts to diverse audiences.

4. Be Enthusiastic and Professional

Present yourself as enthusiastic about the position and the opportunity to contribute to the jurisdiction’s tax system.

- Dress professionally and arrive on time for the interview.

- Be prepared to discuss your career goals and how they align with the agency’s mission.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tax Commissioner interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!