Feeling lost in a sea of interview questions? Landed that dream interview for Teller but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Teller interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

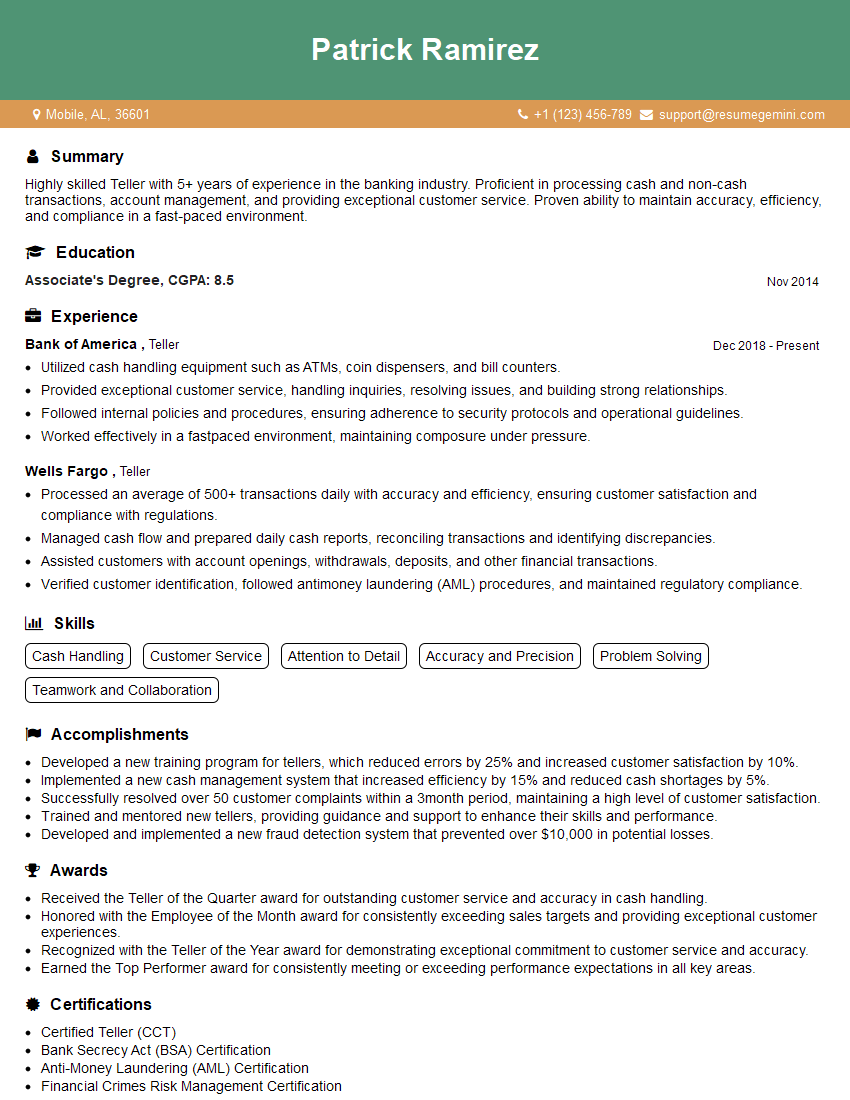

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Teller

1. Describe the process you follow when cashing a check for a customer

- Verify the customer’s identity using a valid form of ID such as a driver’s license or passport.

- Check the check for any signs of alteration or forgery.

- Confirm the account number and routing number on the check.

- Verify that the customer has sufficient funds in their account to cover the check amount.

- Dispense the cash to the customer and provide a receipt.

2. How do you handle a situation where a customer’s check bounces?

- Contact the customer and inform them of the bounced check.

- Request payment from the customer within a specified timeframe.

- If the customer fails to pay, pursue legal action if necessary.

3. Describe the security measures you take when handling cash

- Count cash carefully before and after each shift.

- Secure cash in a locked drawer or safe when not in use.

- Use a currency counter to ensure accuracy.

- Report any discrepancies or suspicious activity immediately.

4. How do you deal with a customer who is angry or upset?

- Remain calm and professional.

- Listen to the customer’s concerns without interrupting.

- Provide clear and accurate information.

- Offer solutions to resolve the issue.

- If necessary, escalate the issue to a supervisor or manager.

5. What do you consider to be the most important qualities of a successful teller?

- Accuracy and attention to detail.

- Excellent customer service skills.

- Ability to work under pressure.

- Trustworthiness and integrity.

- Strong math skills.

6. Describe a challenging situation you encountered as a teller and how you overcame it.

- Handled a large volume of transactions during a busy period with accuracy and efficiency.

- Resolved a customer dispute by providing clear and concise information.

- Prevented a potential fraud by identifying suspicious activity.

7. What are your career goals and how do you see this position contributing to achieving them?

- Advance within the banking industry.

- Develop leadership and management skills.

- Gain experience in customer service and financial transactions.

8. Why are you interested in this teller position?

- Passion for providing excellent customer service.

- Strong math skills and attention to detail.

- Interest in learning about the banking industry.

9. What is your availability to work?

Indicate your flexibility and availability to meet the required hours of the position.

10. Do you have any questions for me?

Ask thoughtful questions about the position, the company, or the industry to show your interest and engagement.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tellers are responsible for providing efficient and friendly customer service while performing banking transactions accurately and securely.

1. Customer Service

Greet customers, answer questions, and provide information about bank products and services.

- Process transactions such as deposits, withdrawals, transfers, and check cashing.

- Verify customer identification and ensure compliance with bank regulations.

2. Accuracy and Security

Count cash and verify transactions for accuracy, ensuring the confidentiality of customer information.

- Detect and report suspicious activity to prevent fraud and protect bank assets.

- Maintain a clean and organized work area, adhering to bank’s security protocols.

3. Sales and Marketing

Promote bank products and services to customers, identifying opportunities for cross-selling.

- Build and maintain positive relationships with customers, fostering loyalty and referrals.

- Provide excellent customer service to enhance the bank’s reputation and drive customer satisfaction.

4. Other Duties

Perform other tasks as assigned, such as balancing cash drawers, reconciling accounts, and assisting with teller training.

- Collaborate with other departments to ensure seamless customer experiences.

- Stay up-to-date on bank policies, procedures, and products to provide accurate information to customers.

Interview Tips

Preparing for a teller interview is crucial for success. Here are some tips to help you ace it:

1. Research the Bank and Position

Familiarize yourself with the bank’s history, culture, and the specific teller role you’re applying for.

- Visit the bank’s website, read news articles, and check social media pages to gather information.

- Practice answering questions about your interest in the bank and why you’re suitable for the position.

2. Emphasize Customer Service Skills

Tellers play a vital role in customer interactions. Highlight your ability to provide exceptional service.

- Share examples of situations where you exceeded customer expectations in a previous role.

- Demonstrate your empathy, patience, and ability to handle challenging customers professionally.

3. Showcase Accuracy and Attention to Detail

Accuracy is paramount for a teller. Emphasize your strong math skills, attention to detail, and ability to work under pressure.

- Provide examples of how you ensured accuracy in previous roles, such as balancing cash or verifying transactions.

- Explain how you handle errors and maintain a high level of focus even during busy periods.

4. Highlight Security Awareness

Tellers are responsible for protecting the bank’s assets and customer information. Demonstrate your understanding of security protocols.

- Explain how you would identify and report suspicious activity, such as forged checks or unusual transactions.

- Emphasize your commitment to maintaining confidentiality and adhering to bank regulations.

5. Practice and Prepare Common Questions

Anticipate common interview questions and practice your answers. This will boost your confidence and make you appear more prepared.

- Questions like “Tell me about yourself” or “Why are you interested in this role?” should be answered concisely and professionally.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples.

6. Be Professional and Enthusiastic

First impressions matter. Dress professionally, arrive on time, and maintain a positive attitude throughout the interview.

- Show enthusiasm for the position and demonstrate your eagerness to contribute to the team.

- Ask thoughtful questions at the end of the interview to show your engagement and interest.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Teller interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.