Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Treasury Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

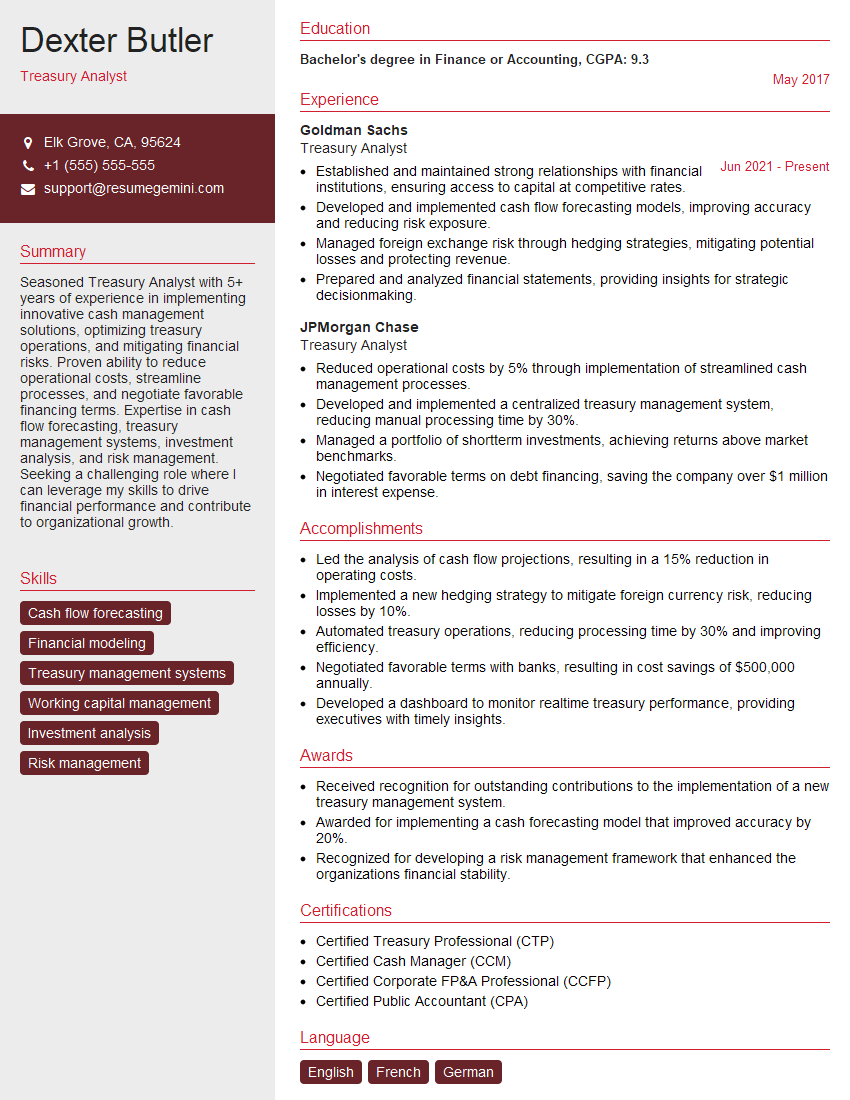

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Treasury Analyst

1. Can you explain the process of developing and managing a cash flow forecast?

In developing and managing a cash flow forecast, I follow several key steps:

- Data gathering and analysis: I gather historical financial data, analyze trends, and project future cash flows based on assumptions and estimates.

- Scenario planning: I create multiple cash flow scenarios under different assumptions, such as different revenue growth rates or expense levels, to assess potential financial outcomes.

- Cash flow modeling: I build detailed cash flow models using spreadsheets or specialized software to simulate cash inflows and outflows, considering factors like operating activities, investing activities, and financing activities.

- Regular monitoring and updates: I monitor actual cash flows against the forecast on a regular basis and make adjustments as needed based on changes in assumptions or business conditions.

- Variance analysis and reporting: I analyze variances between actual and forecasted cash flows to identify areas of concern or opportunities for improvement, and report key findings to management.

2. How do you evaluate the liquidity and solvency of a company using financial ratios?

Liquidity Ratios

- Current ratio: Assesses a company’s ability to meet short-term obligations by comparing current assets to current liabilities.

- Quick ratio (acid-test ratio): Evaluates a company’s ability to meet short-term obligations using only highly liquid assets, excluding inventory.

- Cash ratio: Measures a company’s ability to meet short-term obligations using only cash and cash equivalents.

Solvency Ratios

- Debt-to-equity ratio: Compares a company’s debt obligations to its equity, indicating the level of financial leverage.

- Times interest earned ratio: Assesses a company’s ability to cover interest payments on its debt with earnings before interest and taxes (EBIT).

- Debt-to-asset ratio: Measures the proportion of a company’s assets that are financed through debt.

3. Describe the different methods of managing foreign exchange risk and how you would choose the most appropriate method for a specific situation.

Methods of managing foreign exchange risk:

- Hedging: Using financial instruments such as forwards, futures, or options to lock in exchange rates and mitigate risk.

- Natural hedging: Using operational strategies such as matching foreign currency receivables with foreign currency payables to offset risk.

- Diversification: Investing in assets denominated in different currencies to reduce overall foreign exchange exposure.

- Currency invoicing: Invoicing customers or paying suppliers in their local currency to eliminate foreign exchange risk.

Choosing the most appropriate method depends on factors such as the level of risk, the time horizon, the availability of hedging instruments, and the company’s risk tolerance.

4. How do you stay up-to-date on the latest developments in treasury management and financial markets?

- Attend industry conferences and webinars: Attend events organized by professional associations and financial institutions to learn about new trends and best practices.

- Read industry publications and news sources: Stay informed through subscriptions to industry magazines, newsletters, and financial news websites.

- Network with other treasury professionals: Engage with peers through professional organizations, LinkedIn groups, and networking events to exchange knowledge and insights.

- Pursue continuing education: Enroll in online courses, certifications, or specialized programs to enhance knowledge and skills.

- Monitor regulatory updates: Stay abreast of changes in financial regulations and their impact on treasury operations.

5. Explain the role of a treasury analyst in supporting the overall financial strategy of a company.

The treasury analyst supports the overall financial strategy of a company by:

- Managing cash flow and liquidity: Forecasting cash flows, optimizing cash balances, and implementing strategies to mitigate liquidity risks.

- Managing financial risk: Analyzing and mitigating financial risks, including foreign exchange risk, interest rate risk, and credit risk.

- Capital structure analysis: Evaluating different financing options, including debt and equity, to optimize the company’s capital structure.

- Investment management: Managing surplus cash and investing in short-term and long-term investment vehicles to generate returns and meet financial objectives.

- Financial planning and analysis: Providing financial analysis, forecasts, and recommendations to support strategic decision-making and business planning.

6. What are the ethical considerations that you adhere to as a treasury analyst?

- Confidentiality: Maintaining the confidentiality of sensitive financial information and transactions.

- Objectivity: Providing unbiased and independent financial analysis and recommendations, free from conflicts of interest.

- Integrity: Acting with honesty and transparency in all dealings, avoiding any form of fraud or misrepresentation.

- Compliance: Adhering to all applicable laws, regulations, and ethical standards governing treasury operations.

- Professionalism: Maintaining a high level of professionalism in interactions with colleagues, clients, and external stakeholders.

7. Describe a challenging situation you encountered as a treasury analyst and how you resolved it.

In a previous role, I faced a challenge when managing a large foreign currency exposure. The company had significant operations in multiple countries, and fluctuations in exchange rates were impacting the company’s profitability. To resolve the issue, I implemented a hedging strategy using a combination of forward contracts and options. This strategy effectively mitigated the foreign exchange risk and stabilized the company’s financial performance.

8. How do you prioritize multiple tasks and manage your workload effectively?

- Time management techniques: Using tools like to-do lists, calendars, and task management software to organize and prioritize tasks.

- Delegation: Assigning tasks to colleagues or team members when appropriate to manage workload and ensure timely completion.

- Communication: Proactively communicating with stakeholders to set clear expectations, timelines, and priorities.

- Flexibility: Adapting to changing priorities and adjusting workload as needed to meet deadlines and deliverables.

- Self-awareness: Recognizing personal strengths and limitations and seeking support or resources when necessary.

9. What are your thoughts on the current economic outlook and its potential impact on treasury operations?

The current economic outlook is characterized by factors such as rising inflation, geopolitical tensions, and supply chain disruptions. These factors could impact treasury operations by increasing the cost of borrowing, affecting cash flow stability, and creating challenges in managing foreign exchange risk. I closely monitor economic indicators, market trends, and geopolitical events to assess their potential impact on treasury operations and develop strategies to mitigate any negative consequences.

10. Why are you interested in this Treasury Analyst position specifically, and how do you believe your skills and experience align with the requirements of the role?

I am eager to join your company as a Treasury Analyst because of your reputation for excellence in treasury management and your commitment to innovation. My skills and experience in financial analysis, risk management, and investment management align well with the requirements of this role. I am confident that I can leverage my expertise to contribute to the success of your organization and its financial strategy.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Treasury Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Treasury Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Treasury Analyst is responsible for a wide range of tasks that support the financial operations of a company. Key job responsibilities include:1. Cash Management

Treasury Analysts are responsible for managing the company’s cash flow, which includes forecasting cash needs, investing excess cash, and managing relationships with banks and other financial institutions.

- Forecasting cash flow and developing strategies to meet short-term and long-term cash needs.

- Investing excess cash in a variety of financial instruments, such as money market accounts, certificates of deposit, and treasury bills.

- Managing relationships with banks and other financial institutions, including negotiating loan terms and lines of credit.

2. Debt Management

Treasury Analysts are also responsible for managing the company’s debt, which includes issuing new debt, refinancing existing debt, and managing relationships with debt holders.

- Issuing new debt in the form of bonds or other debt instruments.

- Refinancing existing debt to reduce interest costs or extend maturities.

- Managing relationships with debt holders, including providing information and answering questions.

3. Risk Management

Treasury Analysts are also responsible for managing the company’s financial risks, which includes identifying, assessing, and mitigating financial risks.

- Identifying and assessing financial risks, such as interest rate risk, currency risk, and credit risk.

- Developing and implementing strategies to mitigate financial risks.

- Monitoring financial risks and reporting to senior management.

4. Financial Modeling and Analysis

Treasury Analysts also use financial modeling and analysis to support the company’s financial decision-making.

- Developing and using financial models to forecast financial performance and evaluate investment opportunities.

- Analyzing financial data to identify trends and develop insights.

- Presenting financial information to senior management and other stakeholders.

Interview Tips

1. Research the Company and the Position

Before you go to the interview, it is important to research the company and the position. This will allow you to answer questions about the company and the position in a knowledgeable and informed way. You can research the company on its website, in the news, and on social media. You can also research the position by reading the job description and by looking at other similar positions on the company’s website or on job boards.

2. Practice Answering Common Interview Questions

There are a number of common interview questions that you can expect to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is helpful to practice answering these questions beforehand so that you can deliver your answers confidently and concisely.

3. Be Prepared to Talk About Your Experience and Skills

The interviewer will want to know about your experience and skills, so be prepared to talk about your accomplishments in your previous roles. Be sure to highlight your skills that are relevant to the position you are interviewing for.

4. Ask Questions

Asking questions at the end of the interview shows that you are interested in the position and the company. It is also a good way to learn more about the company and the position. Some good questions to ask include:

- What are the biggest challenges facing the company right now?

- What are the company’s goals for the next year?

- What is the company’s culture like?

5. Follow Up

After the interview, it is important to follow up with the interviewer. This shows that you are still interested in the position and that you appreciate their time. You can follow up by sending a thank-you note or by emailing the interviewer to check on the status of your application.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Treasury Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!