Are you gearing up for a career in Wire Transfer Clerk? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Wire Transfer Clerk and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

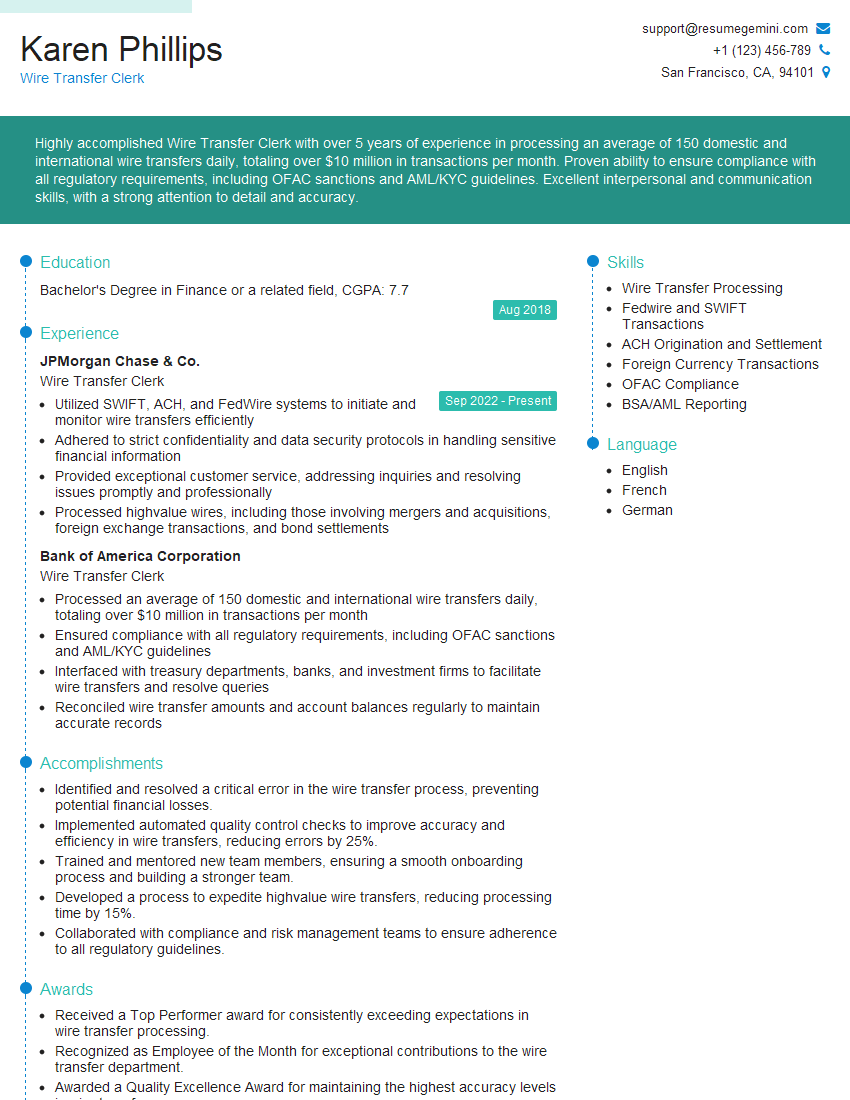

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Wire Transfer Clerk

1. Describe the process of initiating a domestic wire transfer.

- Verify the sender’s and recipient’s information.

- Authenticate the sender’s identity.

- Confirm the amount and currency to be transferred.

- Initiate the transfer through the bank’s wire transfer system.

2. What are the key differences between ACH and wire transfers?

ACH Transfers:

- Lower fees

- Slower processing time (1-3 business days)

- Ideal for small, non-urgent transfers

Wire Transfers:

- Higher fees

- Faster processing time (same day or next day)

- Suitable for large, urgent transfers

3. How do you handle high-volume wire transfer requests?

- Use specialized software to automate the process.

- Prioritize transfers based on urgency and risk.

- Work in collaboration with colleagues to ensure timely processing.

4. What security measures do you implement to prevent fraud?

- Validate sender and recipient information.

- Use multi-factor authentication for sensitive transactions.

- Monitor for suspicious activity and report any potential fraud.

5. How do you ensure the accuracy and completeness of wire transfer transactions?

- Reconcile transfers against bank statements.

- Review transactions regularly for errors or omissions.

- Implement quality control measures to minimize mistakes.

6. What are some common errors that can occur during wire transfers?

- Incorrect account numbers

- Typos in sender or recipient names

- Unclear or incomplete instructions

7. How do you handle international wire transfers?

- Confirm the recipient’s bank account information.

- Verify compliance with international banking regulations.

- Monitor transfers carefully to ensure timely delivery.

8. What are the different types of wire transfer fees?

- Transaction fees

- Bank fees

- Exchange rate fees

- Intermediary bank fees

9. How do you handle customer inquiries related to wire transfers?

- Listen attentively to the customer’s concerns.

- Gather relevant information about the transfer.

- Provide updates and resolve any issues promptly.

10. What professional development opportunities do you seek to enhance your wire transfer processing skills?

- Attend industry conferences and webinars.

- Read trade publications and stay updated on best practices.

- Participate in training programs offered by professional organizations.

11. Tell me about a time when you successfully resolved a complex wire transfer issue.

Describe the situation, actions taken, and the outcome.

12. Describe your experience with using wire transfer software or systems.

Highlight the specific software or systems, your proficiency, and how they have aided your efficiency.

13. Explain the process of reconciling wire transfer transactions.

- Matching transfers with bank statements

- Checking for discrepancies or errors

- Adjusting or correcting transactions as necessary

14. What are the key factors to consider when determining the appropriate method of funds transfer?

- Transfer amount

- Urgency

- Costs and fees

- Security and risk

15. How do you stay updated with changes in wire transfer regulations and industry best practices?

- Reading industry publications

- Attending conferences and webinars

- Networking with colleagues and experts

- Participating in professional development programs

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Wire Transfer Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Wire Transfer Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Wire Transfer Clerks are responsible for processing and managing electronic funds transfers, ensuring they are executed accurately, securely, and in compliance with company policies and regulations.

1. Wire Transfer Processing

Execute wire transfers via various channels, including online banking, phone, and in-person requests.

- Verify and validate wire transfer details, including account numbers, amounts, and beneficiary information.

- Review and process incoming wire transfer requests, ensuring completeness and accuracy.

2. Wire Transfer Communication

Communicate with customers and internal departments to resolve any wire transfer inquiries or issues.

- Provide updates on wire transfer status, including estimated delivery time and confirmation.

- Handle customer queries or complaints related to wire transfers, ensuring prompt and satisfactory resolution.

3. Reconciliation and Reporting

Maintain records and reconcile wire transfer transactions, ensuring accuracy and completeness.

- Reconcile wire transfer activity against bank statements and internal records.

- Generate reports on wire transfer activity for internal review and regulatory compliance.

4. Compliance and Security

Adhere to regulatory requirements and internal policies related to wire transfer processing and security.

- Prevent and detect fraudulent activities through thorough verification of transfer details.

- Maintain confidentiality of customer information and comply with data security protocols.

Interview Tips

Preparing for a Wire Transfer Clerk interview can enhance your chances of success. Here are some tips to help you ace the interview:

1. Research the Role and Company

Thoroughly review the job description and research the company’s industry and values. This demonstrates your interest and understanding of the role.

- Identify key responsibilities and skills required for the position.

- Visit the company’s website to learn about their culture, mission, and recent accomplishments.

2. Practice Your Answers

Prepare answers to common interview questions related to wire transfer processing, customer service, and compliance. This helps you present yourself confidently and professionally.

- Review potential questions and prepare concise, well-structured responses that highlight your skills.

- Use the STAR method (Situation, Task, Action, Result) to provide specific examples.

3. Emphasize Accuracy and Attention to Detail

Accuracy and attention to detail are crucial for Wire Transfer Clerks. Showcase your abilities in these areas.

- Highlight your experience in handling large volumes of transactions and ensuring their precision.

- Provide examples of how you have detected and corrected errors in wire transfer processes.

4. Showcase Customer Service Skills

Wire Transfer Clerks often interact with customers. Demonstrate your customer service orientation and communication abilities.

- Emphasize your ability to communicate clearly, handle queries professionally, and resolve issues efficiently.

- Provide examples of how you have exceeded customer expectations in previous roles.

5. Dress Professionally and Arrive Punctually

Make a positive first impression by dressing appropriately and arriving on time for the interview.

- Choose attire that conveys professionalism and confidence.

- Plan your route and allow ample time to avoid any delays.

6. Additional Tips

- Bring a resume and references to the interview.

- Be prepared to discuss your salary expectations.

- Ask questions about the company, role, and career opportunities.

- Follow up with the interviewer after the interview to express your interest and thank them for their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Wire Transfer Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.