Are you a seasoned Account Adjuster seeking a new career path? Discover our professionally built Account Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

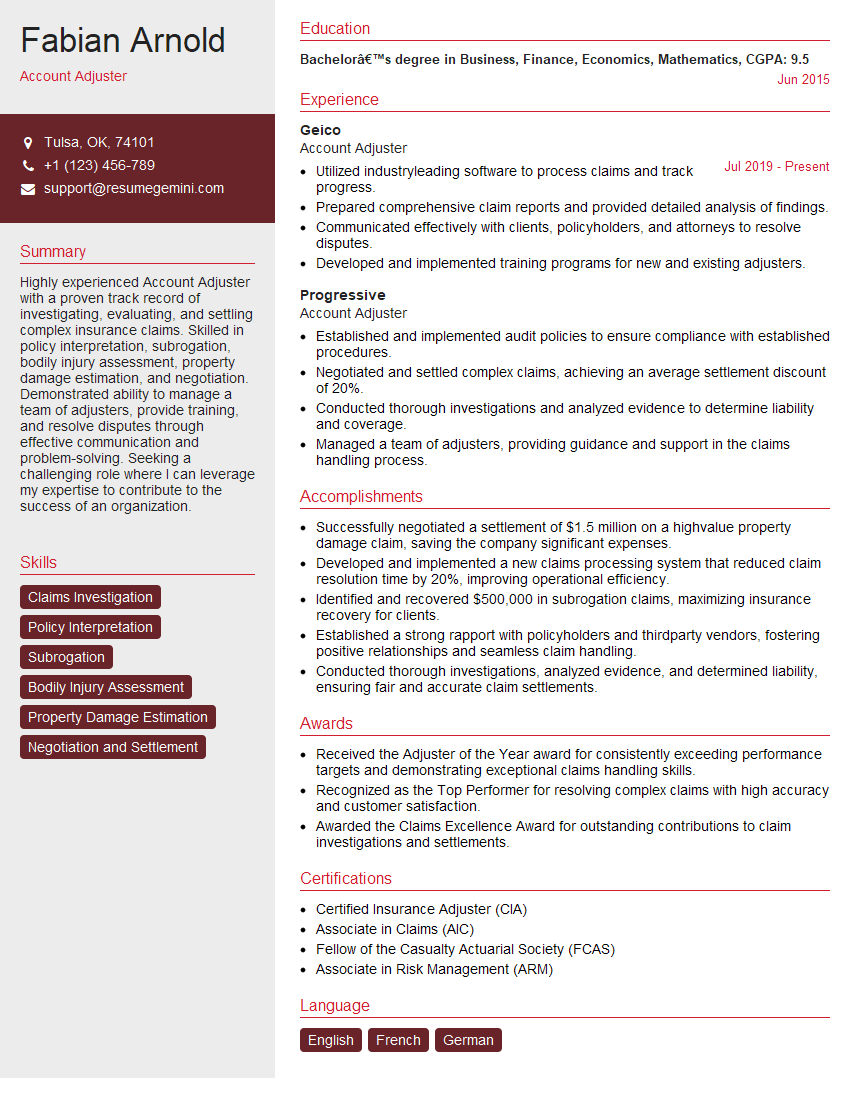

Fabian Arnold

Account Adjuster

Summary

Highly experienced Account Adjuster with a proven track record of investigating, evaluating, and settling complex insurance claims. Skilled in policy interpretation, subrogation, bodily injury assessment, property damage estimation, and negotiation. Demonstrated ability to manage a team of adjusters, provide training, and resolve disputes through effective communication and problem-solving. Seeking a challenging role where I can leverage my expertise to contribute to the success of an organization.

Education

Bachelor’s degree in Business, Finance, Economics, Mathematics

June 2015

Skills

- Claims Investigation

- Policy Interpretation

- Subrogation

- Bodily Injury Assessment

- Property Damage Estimation

- Negotiation and Settlement

Work Experience

Account Adjuster

- Utilized industryleading software to process claims and track progress.

- Prepared comprehensive claim reports and provided detailed analysis of findings.

- Communicated effectively with clients, policyholders, and attorneys to resolve disputes.

- Developed and implemented training programs for new and existing adjusters.

Account Adjuster

- Established and implemented audit policies to ensure compliance with established procedures.

- Negotiated and settled complex claims, achieving an average settlement discount of 20%.

- Conducted thorough investigations and analyzed evidence to determine liability and coverage.

- Managed a team of adjusters, providing guidance and support in the claims handling process.

Accomplishments

- Successfully negotiated a settlement of $1.5 million on a highvalue property damage claim, saving the company significant expenses.

- Developed and implemented a new claims processing system that reduced claim resolution time by 20%, improving operational efficiency.

- Identified and recovered $500,000 in subrogation claims, maximizing insurance recovery for clients.

- Established a strong rapport with policyholders and thirdparty vendors, fostering positive relationships and seamless claim handling.

- Conducted thorough investigations, analyzed evidence, and determined liability, ensuring fair and accurate claim settlements.

Awards

- Received the Adjuster of the Year award for consistently exceeding performance targets and demonstrating exceptional claims handling skills.

- Recognized as the Top Performer for resolving complex claims with high accuracy and customer satisfaction.

- Awarded the Claims Excellence Award for outstanding contributions to claim investigations and settlements.

Certificates

- Certified Insurance Adjuster (CIA)

- Associate in Claims (AIC)

- Fellow of the Casualty Actuarial Society (FCAS)

- Associate in Risk Management (ARM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Account Adjuster

- Highlight your experience investigating and settling complex insurance claims.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Showcase your expertise in policy interpretation, subrogation, bodily injury assessment, property damage estimation, and negotiation.

- Emphasize your ability to manage a team of adjusters and provide training.

- Demonstrate your commitment to ongoing professional development and continuing education.

Essential Experience Highlights for a Strong Account Adjuster Resume

- Investigate and evaluate insurance claims to determine liability and coverage.

- Negotiate and settle claims, achieving optimal outcomes for the company.

- Analyze evidence, including medical records, property damage reports, and witness statements.

- Interpret insurance policies and apply them to specific claim scenarios.

- Manage a team of adjusters, providing guidance and support in the claims handling process.

- Prepare comprehensive claim reports and provide detailed analysis of findings.

- Communicate effectively with clients, policyholders, and attorneys to resolve disputes.

Frequently Asked Questions (FAQ’s) For Account Adjuster

What are the key skills required for an Account Adjuster?

Key skills for an Account Adjuster include: claims investigation, policy interpretation, subrogation, bodily injury assessment, property damage estimation, negotiation and settlement, and communication.

What is the career path for an Account Adjuster?

The career path for an Account Adjuster typically involves starting as an entry-level adjuster, then progressing to a senior adjuster, and eventually to a claims manager or executive role.

What is the salary range for an Account Adjuster?

The salary range for an Account Adjuster varies depending on experience, location, and company size. According to Salary.com, the average salary for an Account Adjuster in the United States is $65,000.

What are the job prospects for an Account Adjuster?

The job prospects for an Account Adjuster are expected to be good in the coming years. The insurance industry is growing, and there is a increasing demand for qualified adjusters.

What are the educational requirements for an Account Adjuster?

Most Account Adjusters have a bachelor’s degree in business, finance, economics, mathematics, or a related field.

What are the certification requirements for an Account Adjuster?

Some states require Account Adjusters to be licensed. There are also a number of professional certifications available for Account Adjusters, such as the Associate in Claims (AIC) designation from the Insurance Institute of America (IIA).