Are you a seasoned Accounting Auditor seeking a new career path? Discover our professionally built Accounting Auditor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

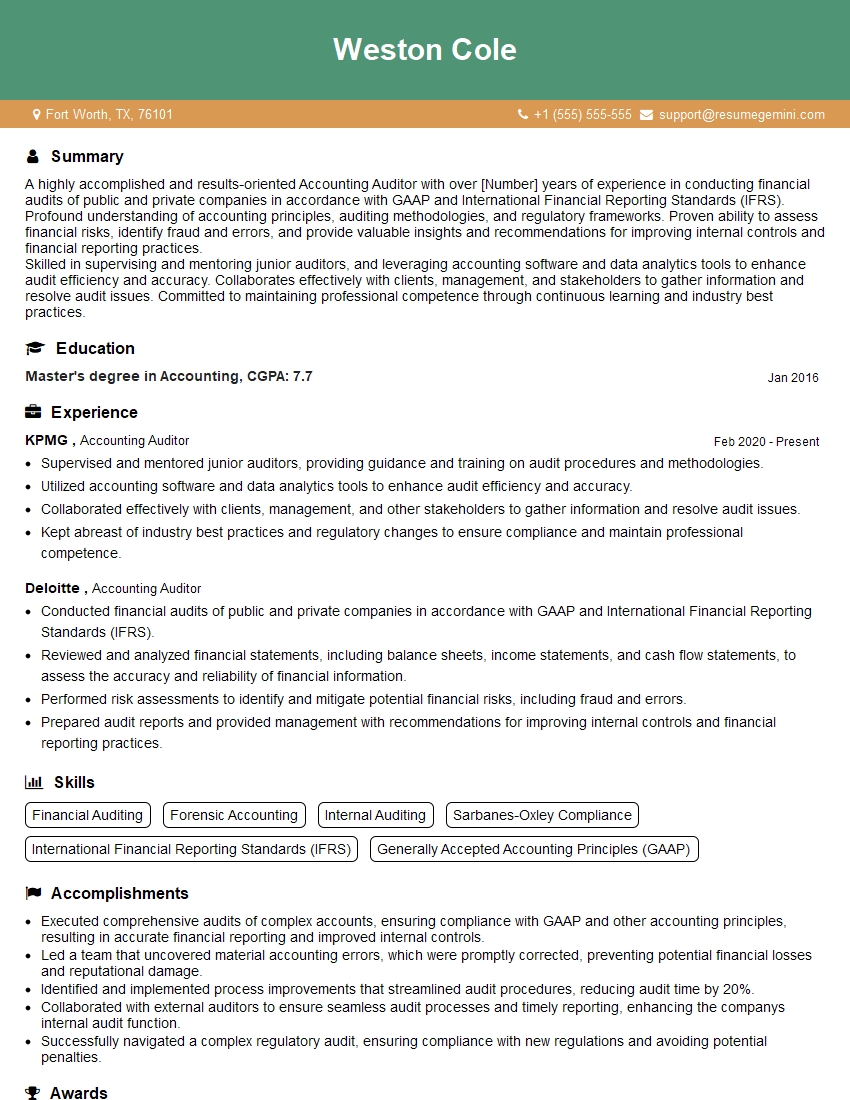

Weston Cole

Accounting Auditor

Summary

A highly accomplished and results-oriented Accounting Auditor with over [Number] years of experience in conducting financial audits of public and private companies in accordance with GAAP and International Financial Reporting Standards (IFRS). Profound understanding of accounting principles, auditing methodologies, and regulatory frameworks. Proven ability to assess financial risks, identify fraud and errors, and provide valuable insights and recommendations for improving internal controls and financial reporting practices.

Skilled in supervising and mentoring junior auditors, and leveraging accounting software and data analytics tools to enhance audit efficiency and accuracy. Collaborates effectively with clients, management, and stakeholders to gather information and resolve audit issues. Committed to maintaining professional competence through continuous learning and industry best practices.

Education

Master’s degree in Accounting

January 2016

Skills

- Financial Auditing

- Forensic Accounting

- Internal Auditing

- Sarbanes-Oxley Compliance

- International Financial Reporting Standards (IFRS)

- Generally Accepted Accounting Principles (GAAP)

Work Experience

Accounting Auditor

- Supervised and mentored junior auditors, providing guidance and training on audit procedures and methodologies.

- Utilized accounting software and data analytics tools to enhance audit efficiency and accuracy.

- Collaborated effectively with clients, management, and other stakeholders to gather information and resolve audit issues.

- Kept abreast of industry best practices and regulatory changes to ensure compliance and maintain professional competence.

Accounting Auditor

- Conducted financial audits of public and private companies in accordance with GAAP and International Financial Reporting Standards (IFRS).

- Reviewed and analyzed financial statements, including balance sheets, income statements, and cash flow statements, to assess the accuracy and reliability of financial information.

- Performed risk assessments to identify and mitigate potential financial risks, including fraud and errors.

- Prepared audit reports and provided management with recommendations for improving internal controls and financial reporting practices.

Accomplishments

- Executed comprehensive audits of complex accounts, ensuring compliance with GAAP and other accounting principles, resulting in accurate financial reporting and improved internal controls.

- Led a team that uncovered material accounting errors, which were promptly corrected, preventing potential financial losses and reputational damage.

- Identified and implemented process improvements that streamlined audit procedures, reducing audit time by 20%.

- Collaborated with external auditors to ensure seamless audit processes and timely reporting, enhancing the companys internal audit function.

- Successfully navigated a complex regulatory audit, ensuring compliance with new regulations and avoiding potential penalties.

Awards

- Received the AICPA Outstanding Auditor Award for contributions to the accounting profession.

- Recognized by the company for exceptional audit quality and leadership, receiving the Auditor of the Year Award.

- Honored with the Presidents Award for outstanding performance and contributions to the companys accounting practices.

- Received the CPA of the Year Award from the state CPA society for contributions to the profession.

Certificates

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

- Certified Information Systems Auditor (CISA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Accounting Auditor

- Highlight your educational qualifications and any specialized certifications, such as the Certified Public Accountant (CPA) or Certified Internal Auditor (CIA) designation.

- Showcase your experience in conducting financial audits, including the size and complexity of the organizations you have audited.

- Emphasize your proficiency in accounting principles, auditing methodologies, and regulatory frameworks.

- Provide specific examples of how you have identified and resolved audit issues, and how your recommendations have improved internal controls and financial reporting practices.

- Demonstrate your ability to work independently and as part of a team, and your commitment to professional development and maintaining industry best practices.

Essential Experience Highlights for a Strong Accounting Auditor Resume

- Conducted financial audits of public and private companies in accordance with GAAP and International Financial Reporting Standards (IFRS).

- Reviewed and analyzed financial statements, including balance sheets, income statements, and cash flow statements, to assess the accuracy and reliability of financial information.

- Performed risk assessments to identify and mitigate potential financial risks, including fraud and errors.

- Prepared audit reports and provided management with recommendations for improving internal controls and financial reporting practices.

- Supervised and mentored junior auditors, providing guidance and training on audit procedures and methodologies.

- Utilized accounting software and data analytics tools to enhance audit efficiency and accuracy.

Frequently Asked Questions (FAQ’s) For Accounting Auditor

What are the key responsibilities of an Accounting Auditor?

The key responsibilities of an Accounting Auditor include conducting financial audits, reviewing and analyzing financial statements, performing risk assessments, preparing audit reports, and supervising junior auditors.

What are the educational requirements for becoming an Accounting Auditor?

Most Accounting Auditors hold a Master’s degree in Accounting or a related field.

What are the career prospects for Accounting Auditors?

Accounting Auditors can advance to senior positions within their firms, such as Audit Manager or Audit Partner. They may also move into other roles in the accounting and finance field, such as Financial Analyst or Controller.

What are the key skills required for success as an Accounting Auditor?

Key skills for success as an Accounting Auditor include strong analytical and problem-solving abilities, attention to detail, and excellent communication and interpersonal skills.

What are the challenges faced by Accounting Auditors?

Accounting Auditors face challenges such as the increasing complexity of financial reporting regulations, the need to keep up with new technologies, and the pressure to meet deadlines.