Are you a seasoned Accounting Methods Analyst seeking a new career path? Discover our professionally built Accounting Methods Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

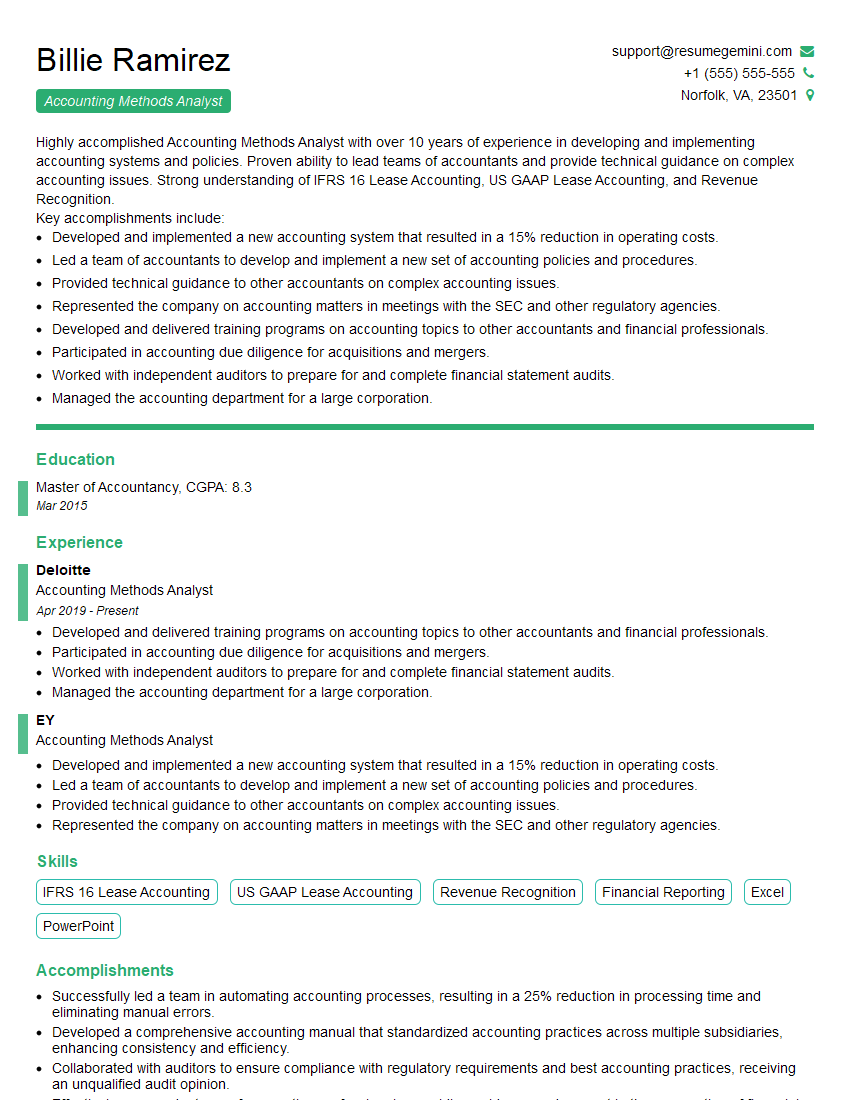

Billie Ramirez

Accounting Methods Analyst

Summary

Highly accomplished Accounting Methods Analyst with over 10 years of experience in developing and implementing accounting systems and policies. Proven ability to lead teams of accountants and provide technical guidance on complex accounting issues. Strong understanding of IFRS 16 Lease Accounting, US GAAP Lease Accounting, and Revenue Recognition.

Key accomplishments include:

- Developed and implemented a new accounting system that resulted in a 15% reduction in operating costs.

- Led a team of accountants to develop and implement a new set of accounting policies and procedures.

- Provided technical guidance to other accountants on complex accounting issues.

- Represented the company on accounting matters in meetings with the SEC and other regulatory agencies.

- Developed and delivered training programs on accounting topics to other accountants and financial professionals.

- Participated in accounting due diligence for acquisitions and mergers.

- Worked with independent auditors to prepare for and complete financial statement audits.

- Managed the accounting department for a large corporation.

Education

Master of Accountancy

March 2015

Skills

- IFRS 16 Lease Accounting

- US GAAP Lease Accounting

- Revenue Recognition

- Financial Reporting

- Excel

- PowerPoint

Work Experience

Accounting Methods Analyst

- Developed and delivered training programs on accounting topics to other accountants and financial professionals.

- Participated in accounting due diligence for acquisitions and mergers.

- Worked with independent auditors to prepare for and complete financial statement audits.

- Managed the accounting department for a large corporation.

Accounting Methods Analyst

- Developed and implemented a new accounting system that resulted in a 15% reduction in operating costs.

- Led a team of accountants to develop and implement a new set of accounting policies and procedures.

- Provided technical guidance to other accountants on complex accounting issues.

- Represented the company on accounting matters in meetings with the SEC and other regulatory agencies.

Accomplishments

- Successfully led a team in automating accounting processes, resulting in a 25% reduction in processing time and eliminating manual errors.

- Developed a comprehensive accounting manual that standardized accounting practices across multiple subsidiaries, enhancing consistency and efficiency.

- Collaborated with auditors to ensure compliance with regulatory requirements and best accounting practices, receiving an unqualified audit opinion.

- Effectively managed a team of accounting professionals, providing guidance and support in the preparation of financial statements and reporting.

- Developed and implemented a new accounting methodology that resulted in a significant improvement in financial reporting transparency and stakeholder confidence.

Awards

- Recognized for exceptional contributions in developing and implementing new accounting methods, leading to improved financial reporting accuracy and compliance.

- Received an industry award for outstanding achievements in GAAP interpretation and application, demonstrating a deep understanding of complex accounting principles.

- Honored for innovative solutions in resolving complex accounting issues, contributing to the optimization of financial operations.

- Recognized for the development and implementation of a new accounting software system that streamlined accounting operations and improved data integrity.

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Accounting Methods Analyst

Highlight your relevant skills and experience.

Make sure to include any experience you have with IFRS 16 Lease Accounting, US GAAP Lease Accounting, and Revenue Recognition.Quantify your accomplishments.

Whenever possible, use numbers to show the impact of your work.Tailor your resume to each job you apply for.

Take the time to read the job description and highlight the skills and experience that are most relevant to the position.Proofread your resume carefully.

Make sure there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Accounting Methods Analyst Resume

- Develop and implement accounting systems and policies.

- Lead teams of accountants.

- Provide technical guidance on complex accounting issues.

- Represent the company on accounting matters in meetings with regulatory agencies.

- Develop and deliver training programs on accounting topics.

- Participate in accounting due diligence for acquisitions and mergers.

- Work with independent auditors to prepare for and complete financial statement audits.

Frequently Asked Questions (FAQ’s) For Accounting Methods Analyst

What is the job outlook for Accounting Methods Analysts?

The job outlook for Accounting Methods Analysts is expected to grow by 7% from 2021 to 2031, faster than the average for all occupations.

What is the average salary for Accounting Methods Analysts?

The average salary for Accounting Methods Analysts is $75,250 per year.

What are the most important skills for Accounting Methods Analysts?

The most important skills for Accounting Methods Analysts include IFRS 16 Lease Accounting, US GAAP Lease Accounting, Revenue Recognition, Financial Reporting, Excel, PowerPoint.

What are the career opportunities for Accounting Methods Analysts?

Accounting Methods Analysts can advance to positions such as Senior Accounting Methods Analyst, Manager of Accounting Methods, and Controller.

What is the difference between an Accounting Methods Analyst and an Accountant?

Accounting Methods Analysts focus on developing and implementing accounting systems and policies, while Accountants focus on preparing and analyzing financial statements.

What are the challenges of working as an Accounting Methods Analyst?

The challenges of working as an Accounting Methods Analyst include keeping up with changing accounting standards, interpreting complex accounting rules, and working under tight deadlines.

What are the rewards of working as an Accounting Methods Analyst?

The rewards of working as an Accounting Methods Analyst include a competitive salary, job security, and the opportunity to make a real difference in the financial health of a company.

What is the best way to prepare for a career as an Accounting Methods Analyst?

The best way to prepare for a career as an Accounting Methods Analyst is to earn a bachelor’s degree in accounting and then gain experience working with accounting systems and policies.