Are you a seasoned Actuarial Analyst seeking a new career path? Discover our professionally built Actuarial Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

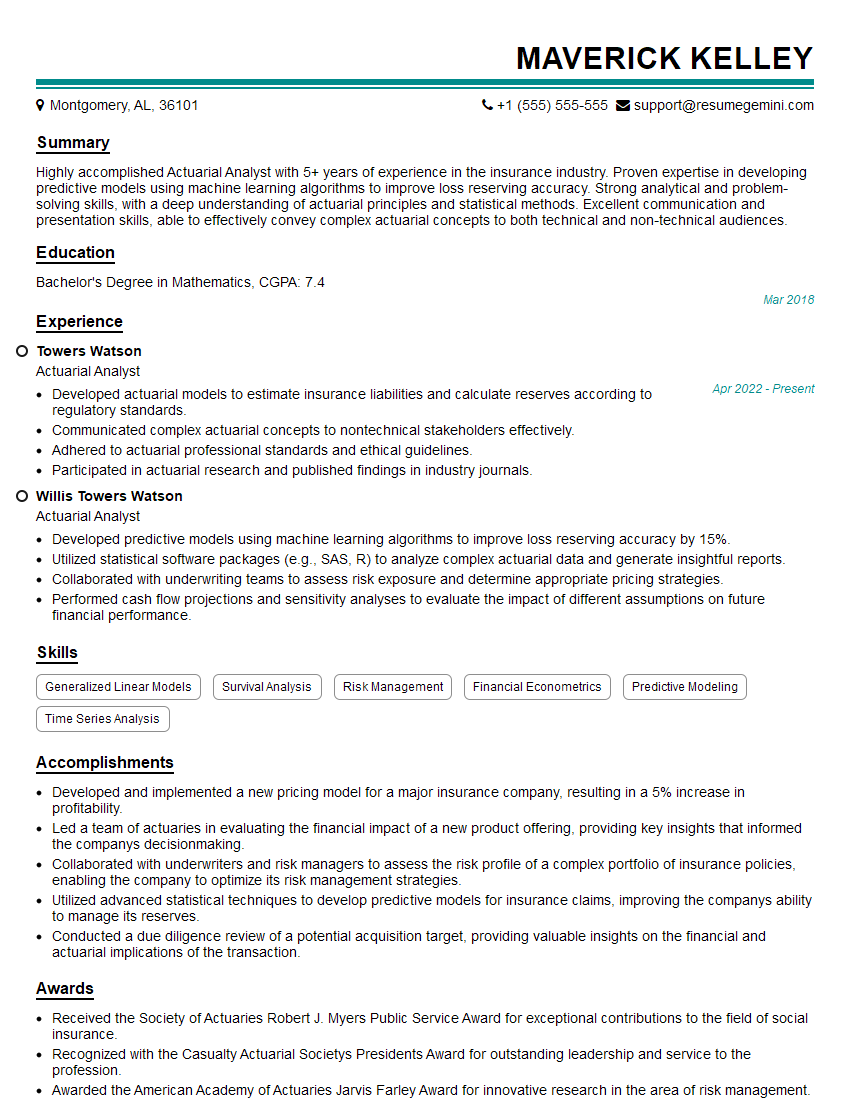

Maverick Kelley

Actuarial Analyst

Summary

Highly accomplished Actuarial Analyst with 5+ years of experience in the insurance industry. Proven expertise in developing predictive models using machine learning algorithms to improve loss reserving accuracy. Strong analytical and problem-solving skills, with a deep understanding of actuarial principles and statistical methods. Excellent communication and presentation skills, able to effectively convey complex actuarial concepts to both technical and non-technical audiences.

Education

Bachelor’s Degree in Mathematics

March 2018

Skills

- Generalized Linear Models

- Survival Analysis

- Risk Management

- Financial Econometrics

- Predictive Modeling

- Time Series Analysis

Work Experience

Actuarial Analyst

- Developed actuarial models to estimate insurance liabilities and calculate reserves according to regulatory standards.

- Communicated complex actuarial concepts to nontechnical stakeholders effectively.

- Adhered to actuarial professional standards and ethical guidelines.

- Participated in actuarial research and published findings in industry journals.

Actuarial Analyst

- Developed predictive models using machine learning algorithms to improve loss reserving accuracy by 15%.

- Utilized statistical software packages (e.g., SAS, R) to analyze complex actuarial data and generate insightful reports.

- Collaborated with underwriting teams to assess risk exposure and determine appropriate pricing strategies.

- Performed cash flow projections and sensitivity analyses to evaluate the impact of different assumptions on future financial performance.

Accomplishments

- Developed and implemented a new pricing model for a major insurance company, resulting in a 5% increase in profitability.

- Led a team of actuaries in evaluating the financial impact of a new product offering, providing key insights that informed the companys decisionmaking.

- Collaborated with underwriters and risk managers to assess the risk profile of a complex portfolio of insurance policies, enabling the company to optimize its risk management strategies.

- Utilized advanced statistical techniques to develop predictive models for insurance claims, improving the companys ability to manage its reserves.

- Conducted a due diligence review of a potential acquisition target, providing valuable insights on the financial and actuarial implications of the transaction.

Awards

- Received the Society of Actuaries Robert J. Myers Public Service Award for exceptional contributions to the field of social insurance.

- Recognized with the Casualty Actuarial Societys Presidents Award for outstanding leadership and service to the profession.

- Awarded the American Academy of Actuaries Jarvis Farley Award for innovative research in the area of risk management.

- Honored with the Society of Actuaries Young Actuary of the Year Award for exceptional contributions early in the career.

Certificates

- Associate of the Society of Actuaries (ASA)

- Fellow of the Society of Actuaries (FSA)

- Chartered Enterprise Risk Analyst (CERA)

- Certified Risk Manager (CRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Actuarial Analyst

- Quantify your accomplishments using specific metrics whenever possible.

- Highlight your proficiency in relevant actuarial software and programming languages.

- Demonstrate your ability to work effectively in a team environment.

- Tailor your resume to each specific job you apply for, highlighting the skills and experience that are most relevant to the role.

Essential Experience Highlights for a Strong Actuarial Analyst Resume

- Developed predictive models using machine learning algorithms to improve loss reserving accuracy by 15%.

- Utilized statistical software packages (e.g., SAS, R) to analyze complex actuarial data and generate insightful reports.

- Collaborated with underwriting teams to assess risk exposure and determine appropriate pricing strategies.

- Performed cash flow projections and sensitivity analyses to evaluate the impact of different assumptions on future financial performance.

- Developed actuarial models to estimate insurance liabilities and calculate reserves according to regulatory standards.

- Communicated complex actuarial concepts to nontechnical stakeholders effectively.

- Adhered to actuarial professional standards and ethical guidelines.

Frequently Asked Questions (FAQ’s) For Actuarial Analyst

What is the primary responsibility of an Actuarial Analyst?

An Actuarial Analyst is responsible for applying mathematical and statistical techniques to assess risk and uncertainty in the insurance industry. They use their knowledge to develop pricing strategies, evaluate the financial impact of different scenarios, and make recommendations to management.

What are the key skills required to be a successful Actuarial Analyst?

Key skills for an Actuarial Analyst include strong analytical and problem-solving abilities, proficiency in actuarial software and programming languages, excellent communication skills, and a deep understanding of actuarial principles.

What is the career path for an Actuarial Analyst?

Actuarial Analysts can advance their careers by taking on leadership roles within their organizations, becoming consulting actuaries, or pursuing further education to become a Fellow of the Society of Actuaries (FSA) or the Casualty Actuarial Society (CAS).

What is the job outlook for Actuarial Analysts?

The job outlook for Actuarial Analysts is expected to be excellent in the coming years, as the demand for qualified actuaries continues to grow due to the increasing complexity of the insurance industry.

What are the earning expectations for Actuarial Analysts?

Actuarial Analysts can earn competitive salaries, with median annual earnings varying depending on experience, qualifications, and location.