Are you a seasoned Actuarial Associate seeking a new career path? Discover our professionally built Actuarial Associate Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

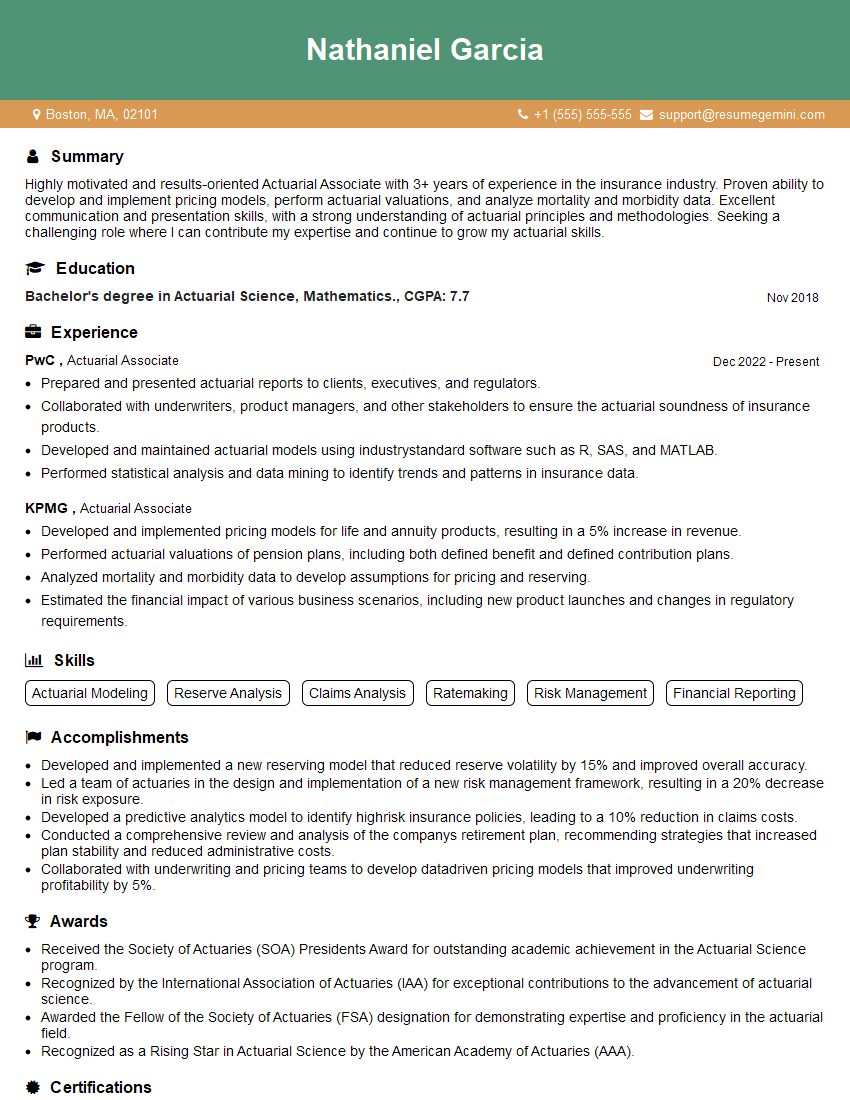

Nathaniel Garcia

Actuarial Associate

Summary

Highly motivated and results-oriented Actuarial Associate with 3+ years of experience in the insurance industry. Proven ability to develop and implement pricing models, perform actuarial valuations, and analyze mortality and morbidity data. Excellent communication and presentation skills, with a strong understanding of actuarial principles and methodologies. Seeking a challenging role where I can contribute my expertise and continue to grow my actuarial skills.

Education

Bachelor’s degree in Actuarial Science, Mathematics.

November 2018

Skills

- Actuarial Modeling

- Reserve Analysis

- Claims Analysis

- Ratemaking

- Risk Management

- Financial Reporting

Work Experience

Actuarial Associate

- Prepared and presented actuarial reports to clients, executives, and regulators.

- Collaborated with underwriters, product managers, and other stakeholders to ensure the actuarial soundness of insurance products.

- Developed and maintained actuarial models using industrystandard software such as R, SAS, and MATLAB.

- Performed statistical analysis and data mining to identify trends and patterns in insurance data.

Actuarial Associate

- Developed and implemented pricing models for life and annuity products, resulting in a 5% increase in revenue.

- Performed actuarial valuations of pension plans, including both defined benefit and defined contribution plans.

- Analyzed mortality and morbidity data to develop assumptions for pricing and reserving.

- Estimated the financial impact of various business scenarios, including new product launches and changes in regulatory requirements.

Accomplishments

- Developed and implemented a new reserving model that reduced reserve volatility by 15% and improved overall accuracy.

- Led a team of actuaries in the design and implementation of a new risk management framework, resulting in a 20% decrease in risk exposure.

- Developed a predictive analytics model to identify highrisk insurance policies, leading to a 10% reduction in claims costs.

- Conducted a comprehensive review and analysis of the companys retirement plan, recommending strategies that increased plan stability and reduced administrative costs.

- Collaborated with underwriting and pricing teams to develop datadriven pricing models that improved underwriting profitability by 5%.

Awards

- Received the Society of Actuaries (SOA) Presidents Award for outstanding academic achievement in the Actuarial Science program.

- Recognized by the International Association of Actuaries (IAA) for exceptional contributions to the advancement of actuarial science.

- Awarded the Fellow of the Society of Actuaries (FSA) designation for demonstrating expertise and proficiency in the actuarial field.

- Recognized as a Rising Star in Actuarial Science by the American Academy of Actuaries (AAA).

Certificates

- Associate of the Society of Actuaries (ASA)

- Fellow of the Society of Actuaries (FSA)

- Casualty Actuarial Society (CAS)

- Certified Associate in Risk Management (CRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Actuarial Associate

- Quantify your accomplishments with specific metrics and data whenever possible.

- Highlight your skills in actuarial modeling, reserve analysis, claims analysis, ratemaking, risk management, and financial reporting.

- Demonstrate your proficiency in using industry-standard software such as R, SAS, and MATLAB.

- Proofread your resume carefully for any errors in grammar or punctuation.

Essential Experience Highlights for a Strong Actuarial Associate Resume

- Developed and implemented pricing models for life and annuity products, resulting in a 5% increase in revenue.

- Performed actuarial valuations of pension plans, including both defined benefit and defined contribution plans.

- Analyzed mortality and morbidity data to develop assumptions for pricing and reserving.

- Estimated the financial impact of various business scenarios, including new product launches and changes in regulatory requirements.

- Prepared and presented actuarial reports to clients, executives, and regulators.

- Collaborated with underwriters, product managers, and other stakeholders to ensure the actuarial soundness of insurance products.

- Developed and maintained actuarial models using industry-standard software such as R, SAS, and MATLAB.

Frequently Asked Questions (FAQ’s) For Actuarial Associate

What is the job outlook for Actuarial Associates?

The job outlook for Actuarial Associates is expected to grow by 20% over the next ten years, faster than the average for all occupations. This growth is due to the increasing demand for actuarial services in the insurance, financial services, and consulting industries.

What are the key skills required for Actuarial Associates?

Key skills for Actuarial Associates include strong analytical and problem-solving skills, as well as proficiency in mathematics, statistics, and computer science. They also need to have excellent communication and presentation skills.

What is the average salary for Actuarial Associates?

The average salary for Actuarial Associates varies depending on experience and location. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for Actuaries was $108,350 in May 2021.

What are the career advancement opportunities for Actuarial Associates?

Actuarial Associates can advance to senior-level positions, such as Actuary or Consulting Actuary. They may also move into management roles, such as Chief Actuary or Actuarial Manager.

What are the educational requirements for Actuarial Associates?

Most Actuarial Associates have a bachelor’s degree in Actuarial Science, Mathematics, or a related field. They also need to pass a series of exams administered by the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

What is the work environment for Actuarial Associates like?

Actuarial Associates typically work in office settings. They may work independently or as part of a team. They may also travel to meet with clients or attend conferences.

What are the benefits of working as an Actuarial Associate?

Benefits of working as an Actuarial Associate include competitive salaries, opportunities for career advancement, and the chance to make a meaningful impact on the insurance and financial services industries.