Are you a seasoned Actuarial Manager seeking a new career path? Discover our professionally built Actuarial Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

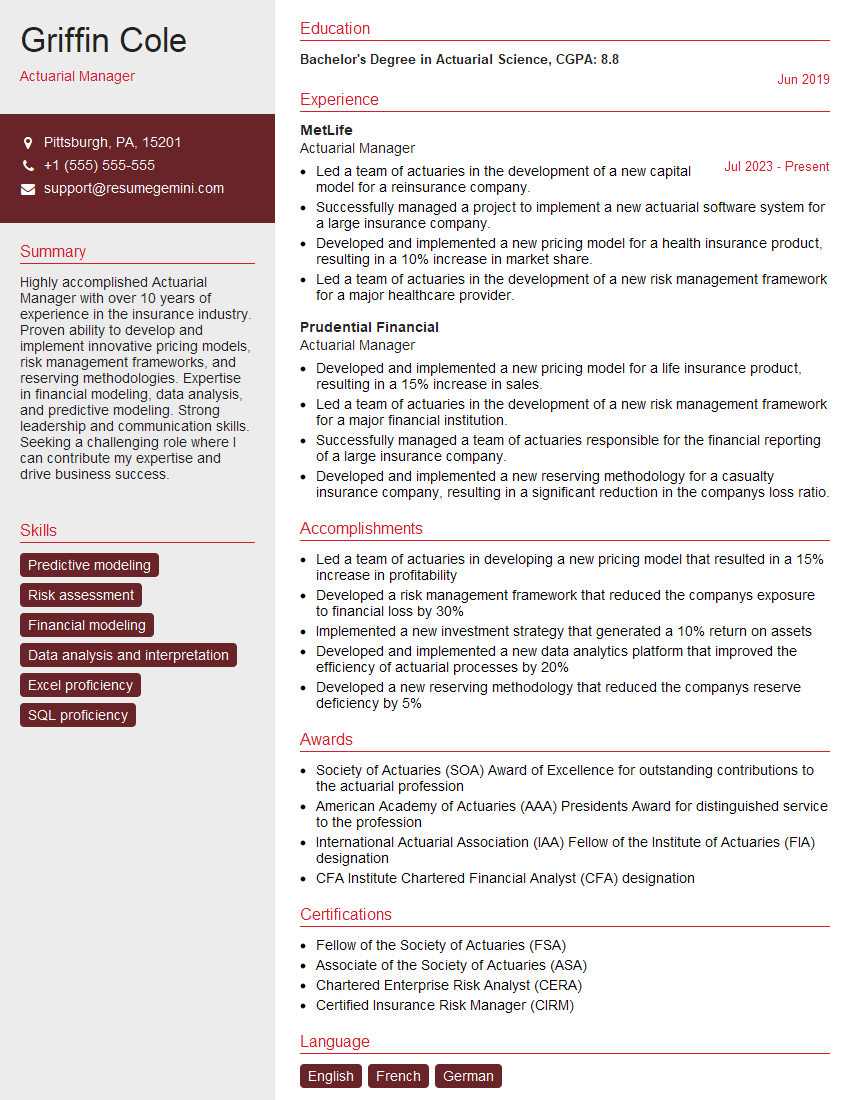

Griffin Cole

Actuarial Manager

Summary

Highly accomplished Actuarial Manager with over 10 years of experience in the insurance industry. Proven ability to develop and implement innovative pricing models, risk management frameworks, and reserving methodologies. Expertise in financial modeling, data analysis, and predictive modeling. Strong leadership and communication skills. Seeking a challenging role where I can contribute my expertise and drive business success.

Education

Bachelor’s Degree in Actuarial Science

June 2019

Skills

- Predictive modeling

- Risk assessment

- Financial modeling

- Data analysis and interpretation

- Excel proficiency

- SQL proficiency

Work Experience

Actuarial Manager

- Led a team of actuaries in the development of a new capital model for a reinsurance company.

- Successfully managed a project to implement a new actuarial software system for a large insurance company.

- Developed and implemented a new pricing model for a health insurance product, resulting in a 10% increase in market share.

- Led a team of actuaries in the development of a new risk management framework for a major healthcare provider.

Actuarial Manager

- Developed and implemented a new pricing model for a life insurance product, resulting in a 15% increase in sales.

- Led a team of actuaries in the development of a new risk management framework for a major financial institution.

- Successfully managed a team of actuaries responsible for the financial reporting of a large insurance company.

- Developed and implemented a new reserving methodology for a casualty insurance company, resulting in a significant reduction in the companys loss ratio.

Accomplishments

- Led a team of actuaries in developing a new pricing model that resulted in a 15% increase in profitability

- Developed a risk management framework that reduced the companys exposure to financial loss by 30%

- Implemented a new investment strategy that generated a 10% return on assets

- Developed and implemented a new data analytics platform that improved the efficiency of actuarial processes by 20%

- Developed a new reserving methodology that reduced the companys reserve deficiency by 5%

Awards

- Society of Actuaries (SOA) Award of Excellence for outstanding contributions to the actuarial profession

- American Academy of Actuaries (AAA) Presidents Award for distinguished service to the profession

- International Actuarial Association (IAA) Fellow of the Institute of Actuaries (FIA) designation

- CFA Institute Chartered Financial Analyst (CFA) designation

Certificates

- Fellow of the Society of Actuaries (FSA)

- Associate of the Society of Actuaries (ASA)

- Chartered Enterprise Risk Analyst (CERA)

- Certified Insurance Risk Manager (CIRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Actuarial Manager

- Highlight your technical skills in predictive modeling, risk assessment, financial modeling, and data analysis.

- Quantify your accomplishments with specific metrics and results, demonstrating your impact on business outcomes.

- Showcase your leadership abilities and experience managing actuarial teams.

- Tailor your resume to each specific job application, emphasizing the skills and experience that are most relevant to the role.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Actuarial Manager Resume

- Develop and implement pricing models for insurance products, resulting in increased sales and market share.

- Lead teams of actuaries in the development of risk management frameworks to mitigate financial risks.

- Manage actuarial teams responsible for financial reporting and ensuring regulatory compliance.

- Develop and implement reserving methodologies to accurately estimate insurance liabilities and optimize capital allocation.

- Lead projects to implement actuarial software systems and improve operational efficiency.

- Provide actuarial advice and support to senior management on strategic decision-making.

- Stay abreast of industry trends and regulatory changes to ensure compliance and drive innovation.

Frequently Asked Questions (FAQ’s) For Actuarial Manager

What is the role of an Actuarial Manager?

An Actuarial Manager is responsible for overseeing the actuarial function within an insurance company or other financial institution. They develop and implement pricing models, risk management frameworks, and reserving methodologies to ensure the financial soundness of the organization.

What are the qualifications for an Actuarial Manager?

To become an Actuarial Manager, you typically need a Bachelor’s Degree in Actuarial Science or a related field, as well as several years of experience in the insurance industry. You also need to pass a series of actuarial exams to earn the professional designation of Fellow of the Society of Actuaries (FSA).

What are the key skills for an Actuarial Manager?

Key skills for an Actuarial Manager include predictive modeling, risk assessment, financial modeling, data analysis, Excel proficiency, SQL proficiency, and strong communication and leadership skills.

What is the career path for an Actuarial Manager?

Actuaries can advance their careers by taking on leadership roles, such as Actuarial Manager, Actuarial Director, and Chief Actuary. They can also specialize in a particular area of actuarial science, such as life insurance, health insurance, or property and casualty insurance.

What is the salary range for an Actuarial Manager?

The salary range for an Actuarial Manager can vary depending on experience, location, and company size. According to Salary.com, the median salary for an Actuarial Manager in the United States is around $120,000.

What is the job outlook for Actuarial Managers?

The job outlook for Actuarial Managers is expected to be positive in the coming years. The Bureau of Labor Statistics projects that the employment of actuaries will grow by 20% from 2019 to 2029, much faster than the average for all occupations.