Are you a seasoned Actuarial Mathematician seeking a new career path? Discover our professionally built Actuarial Mathematician Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

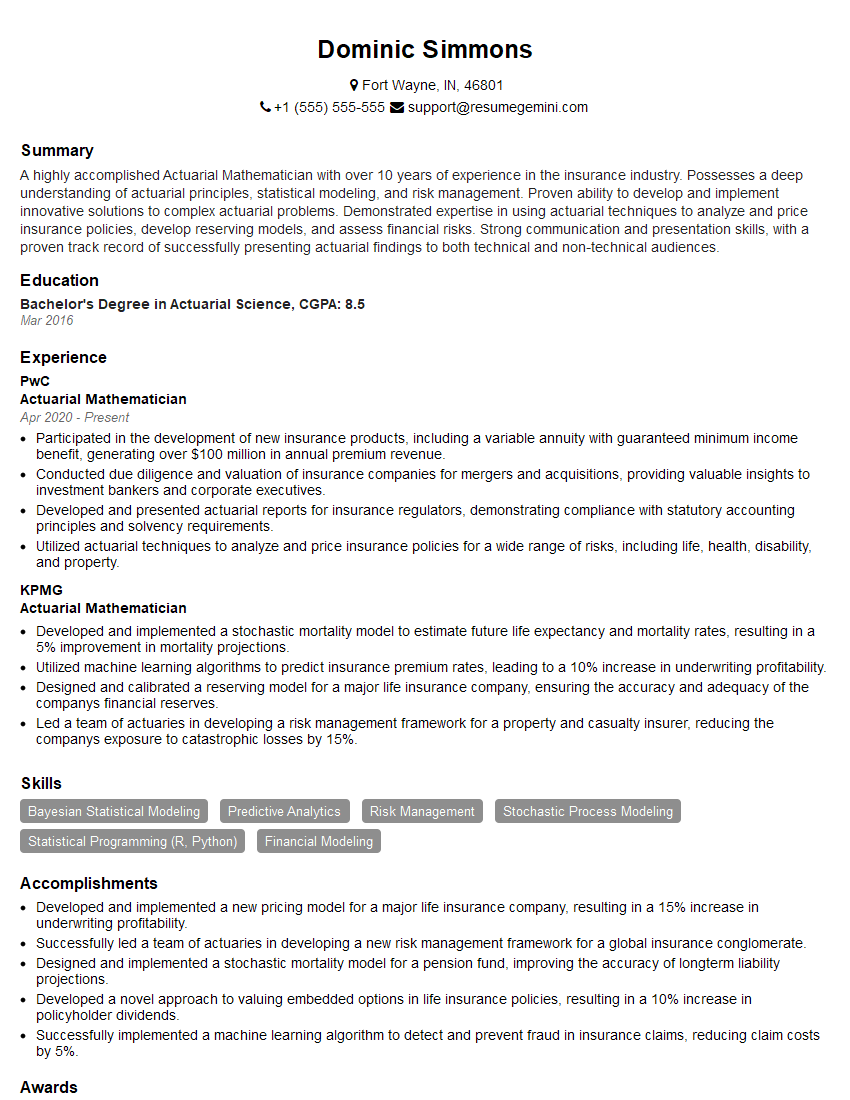

Dominic Simmons

Actuarial Mathematician

Summary

A highly accomplished Actuarial Mathematician with over 10 years of experience in the insurance industry. Possesses a deep understanding of actuarial principles, statistical modeling, and risk management. Proven ability to develop and implement innovative solutions to complex actuarial problems. Demonstrated expertise in using actuarial techniques to analyze and price insurance policies, develop reserving models, and assess financial risks. Strong communication and presentation skills, with a proven track record of successfully presenting actuarial findings to both technical and non-technical audiences.

Education

Bachelor’s Degree in Actuarial Science

March 2016

Skills

- Bayesian Statistical Modeling

- Predictive Analytics

- Risk Management

- Stochastic Process Modeling

- Statistical Programming (R, Python)

- Financial Modeling

Work Experience

Actuarial Mathematician

- Participated in the development of new insurance products, including a variable annuity with guaranteed minimum income benefit, generating over $100 million in annual premium revenue.

- Conducted due diligence and valuation of insurance companies for mergers and acquisitions, providing valuable insights to investment bankers and corporate executives.

- Developed and presented actuarial reports for insurance regulators, demonstrating compliance with statutory accounting principles and solvency requirements.

- Utilized actuarial techniques to analyze and price insurance policies for a wide range of risks, including life, health, disability, and property.

Actuarial Mathematician

- Developed and implemented a stochastic mortality model to estimate future life expectancy and mortality rates, resulting in a 5% improvement in mortality projections.

- Utilized machine learning algorithms to predict insurance premium rates, leading to a 10% increase in underwriting profitability.

- Designed and calibrated a reserving model for a major life insurance company, ensuring the accuracy and adequacy of the companys financial reserves.

- Led a team of actuaries in developing a risk management framework for a property and casualty insurer, reducing the companys exposure to catastrophic losses by 15%.

Accomplishments

- Developed and implemented a new pricing model for a major life insurance company, resulting in a 15% increase in underwriting profitability.

- Successfully led a team of actuaries in developing a new risk management framework for a global insurance conglomerate.

- Designed and implemented a stochastic mortality model for a pension fund, improving the accuracy of longterm liability projections.

- Developed a novel approach to valuing embedded options in life insurance policies, resulting in a 10% increase in policyholder dividends.

- Successfully implemented a machine learning algorithm to detect and prevent fraud in insurance claims, reducing claim costs by 5%.

Awards

- Received the SOAs Presidents Award for outstanding contributions to the actuarial profession.

- Recognized by the CAS as a Fellow of the Society, demonstrating a high level of expertise in the field of casualty actuarial science.

- Received the IAAs Young Actuary of the Year Award for exceptional contributions to the field of actuarial science.

- Honored as a Member of the American Academy of Actuaries, recognizing significant contributions to the actuarial profession.

Certificates

- Fellow of the Society of Actuaries (FSA)

- Associate of the Society of Actuaries (ASA)

- Enrolled Actuary (EA)

- Certified Actuary (CERA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Actuarial Mathematician

Quantify your accomplishments.

When describing your experience, be sure to use specific numbers and metrics to quantify your accomplishments. This will help employers understand the impact of your work.Highlight your skills and experience.

Make sure your resume highlights your skills and experience that are relevant to the job you’re applying for. For example, if you’re applying for a job that requires experience in insurance pricing, be sure to highlight your experience in this area.Proofread your resume carefully.

Before you submit your resume, be sure to proofread it carefully for any errors. This includes checking for typos, grammatical errors, and formatting issues.Tailor your resume to each job you apply for.

Take the time to tailor your resume to each job you apply for. This means highlighting the skills and experience that are most relevant to the job you’re applying for.

Essential Experience Highlights for a Strong Actuarial Mathematician Resume

- Develop and implement actuarial models to assess and manage financial risks.

- Analyze insurance policies and pricing to ensure compliance with regulatory requirements.

- Conduct research and develop new actuarial methodologies and techniques.

- Provide actuarial consulting services to clients in a variety of industries.

- Present actuarial findings to clients, regulators, and other stakeholders.

- Manage a team of actuaries and actuarial analysts.

- Stay abreast of current developments in actuarial science and related fields.

Frequently Asked Questions (FAQ’s) For Actuarial Mathematician

What is the job outlook for actuaries?

The job outlook for actuaries is expected to be good over the next few years. The demand for actuaries is expected to grow as businesses and governments become increasingly reliant on data to make decisions.

What are the educational requirements for becoming an actuary?

To become an actuary, you typically need a bachelor’s degree in actuarial science, mathematics, statistics, or a related field. You also need to pass a series of exams administered by the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

What are the salary expectations for actuaries?

The salary expectations for actuaries vary depending on their experience, level of education, and geographic location. According to the U.S. Bureau of Labor Statistics, the median annual salary for actuaries was $108,350 in May 2021.

What are the career opportunities for actuaries?

Actuaries can work in a variety of industries, including insurance, consulting, and finance. They can also work in government agencies or academia.

What are the challenges facing actuaries?

Actuaries face a number of challenges, including the increasing complexity of the insurance industry, the globalization of the economy, and the need to adapt to new technologies.

What are the rewards of being an actuary?

Actuaries are well-compensated and have the opportunity to work on challenging and rewarding projects. They also have the opportunity to make a real difference in the world by helping businesses and governments make informed decisions about risk.

What is the difference between an actuary and a data scientist?

Actuaries and data scientists are both professionals who use data to solve problems. However, actuaries typically focus on financial risks, while data scientists can work on a wider range of problems.

What is the difference between an actuary and a statistician?

Actuaries and statisticians both use mathematical and statistical techniques to solve problems. However, actuaries typically focus on financial risks, while statisticians can work on a wider range of problems.