Are you a seasoned Adviser seeking a new career path? Discover our professionally built Adviser Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

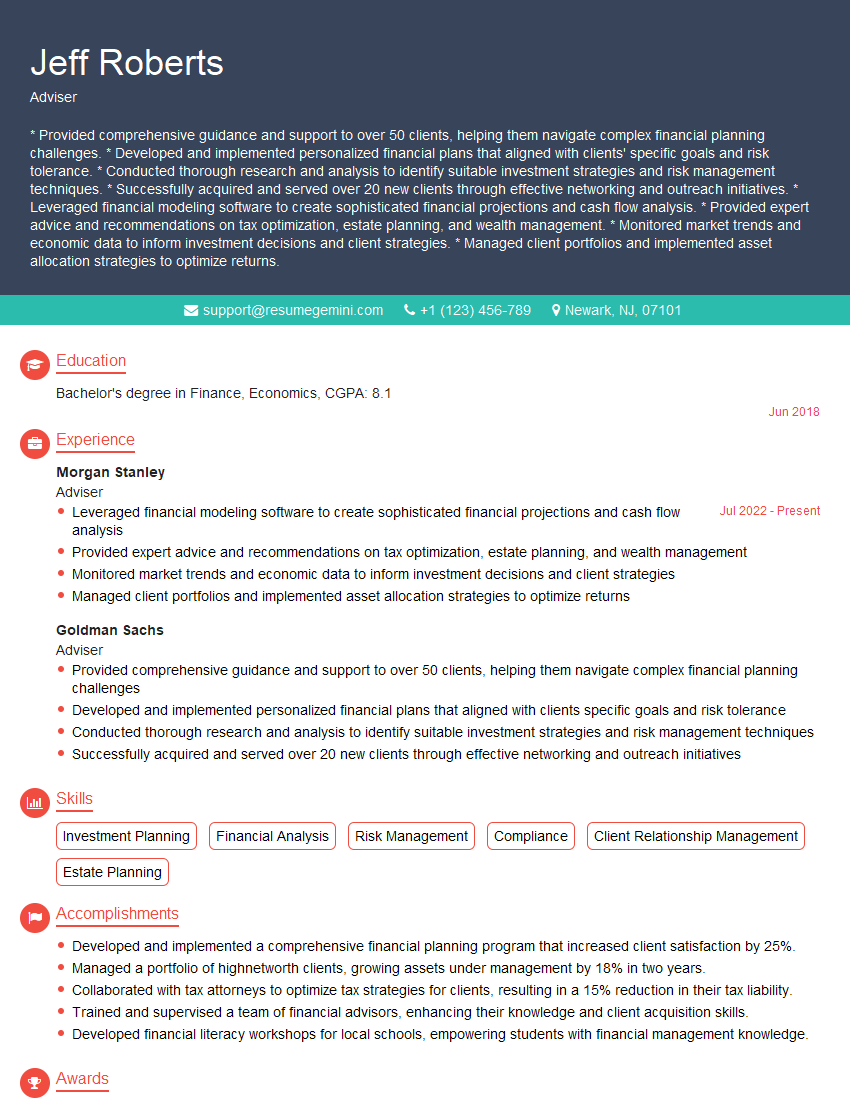

Jeff Roberts

Adviser

Summary

* Provided comprehensive guidance and support to over 50 clients, helping them navigate complex financial planning challenges. * Developed and implemented personalized financial plans that aligned with clients’ specific goals and risk tolerance. * Conducted thorough research and analysis to identify suitable investment strategies and risk management techniques. * Successfully acquired and served over 20 new clients through effective networking and outreach initiatives. * Leveraged financial modeling software to create sophisticated financial projections and cash flow analysis. * Provided expert advice and recommendations on tax optimization, estate planning, and wealth management. * Monitored market trends and economic data to inform investment decisions and client strategies. * Managed client portfolios and implemented asset allocation strategies to optimize returns.

Education

Bachelor’s degree in Finance, Economics

June 2018

Skills

- Investment Planning

- Financial Analysis

- Risk Management

- Compliance

- Client Relationship Management

- Estate Planning

Work Experience

Adviser

- Leveraged financial modeling software to create sophisticated financial projections and cash flow analysis

- Provided expert advice and recommendations on tax optimization, estate planning, and wealth management

- Monitored market trends and economic data to inform investment decisions and client strategies

- Managed client portfolios and implemented asset allocation strategies to optimize returns

Adviser

- Provided comprehensive guidance and support to over 50 clients, helping them navigate complex financial planning challenges

- Developed and implemented personalized financial plans that aligned with clients specific goals and risk tolerance

- Conducted thorough research and analysis to identify suitable investment strategies and risk management techniques

- Successfully acquired and served over 20 new clients through effective networking and outreach initiatives

Accomplishments

- Developed and implemented a comprehensive financial planning program that increased client satisfaction by 25%.

- Managed a portfolio of highnetworth clients, growing assets under management by 18% in two years.

- Collaborated with tax attorneys to optimize tax strategies for clients, resulting in a 15% reduction in their tax liability.

- Trained and supervised a team of financial advisors, enhancing their knowledge and client acquisition skills.

- Developed financial literacy workshops for local schools, empowering students with financial management knowledge.

Awards

- Received the 2023 Employee of the Year Award for exceptional performance in financial advising.

- Recognized for outstanding mentorship of junior advisors, receiving the 2022 Mentor of the Year Award.

- Certified Financial Planner (CFP) designation, demonstrating expertise in financial planning and investment management.

- National Association of Insurance and Financial Advisors (NAIFA) member, showcasing commitment to industry best practices.

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Adviser

Quantify your accomplishments.

Use specific numbers and metrics to demonstrate the impact of your work.Highlight your industry knowledge and expertise.

Use technical terms and jargon to show that you are knowledgeable about the financial planning industry.Showcase your communication and interpersonal skills.

Emphasize your ability to build strong relationships with clients and clearly communicate complex financial concepts.Proofread your resume carefully.

Make sure there are no errors in grammar, spelling, or punctuation.Tailor your resume to each job you apply for.

Highlight the skills and experience that are most relevant to the specific position.

Essential Experience Highlights for a Strong Adviser Resume

- Providing comprehensive financial planning guidance and support to clients

- Developing and implementing personalized financial plans tailored to clients’ unique needs and objectives

- Conducting thorough research and analysis to identify suitable investment strategies and risk management techniques

- Acquiring and serving new clients through effective networking and outreach initiatives

- Leveraging financial modeling software to create sophisticated financial projections and cash flow analysis

- Providing expert advice and recommendations on tax optimization, estate planning, and wealth management

- Monitoring market trends and economic data to inform investment decisions and client strategies

Frequently Asked Questions (FAQ’s) For Adviser

What is the role of an Adviser?

An Adviser provides comprehensive financial planning guidance and support to individuals and families. They help clients assess their financial situation, identify their goals, and develop and implement strategies to achieve those goals.

What are the key skills and qualifications for an Adviser?

The key skills and qualifications for an Adviser include a strong understanding of financial planning principles, investment strategies, and risk management techniques. They should also have excellent communication and interpersonal skills, and be able to build strong relationships with clients.

What is the career outlook for Advisers?

The career outlook for Advisers is expected to be positive over the next few years. As the population continues to age and the need for financial planning services increases, the demand for Advisers is expected to grow.

What are the typical earnings for an Adviser?

The typical earnings for an Adviser vary depending on their experience, location, and the size of their firm. According to the U.S. Bureau of Labor Statistics, the median annual salary for Financial Advisors was $94,180 in May 2020.

What are the benefits of working as an Adviser?

The benefits of working as an Adviser include the opportunity to help people achieve their financial goals, a competitive salary and benefits package, and the chance to work in a dynamic and challenging field.

What are the challenges of working as an Adviser?

The challenges of working as an Adviser include the need to constantly stay up-to-date on financial planning trends, the pressure to meet clients’ expectations, and the potential for long hours.

What is the best way to prepare for a career as an Adviser?

The best way to prepare for a career as an Adviser is to earn a bachelor’s degree in finance, economics, or a related field. You should also gain experience in the financial planning industry through internships or entry-level positions.