Are you a seasoned Authorizer seeking a new career path? Discover our professionally built Authorizer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

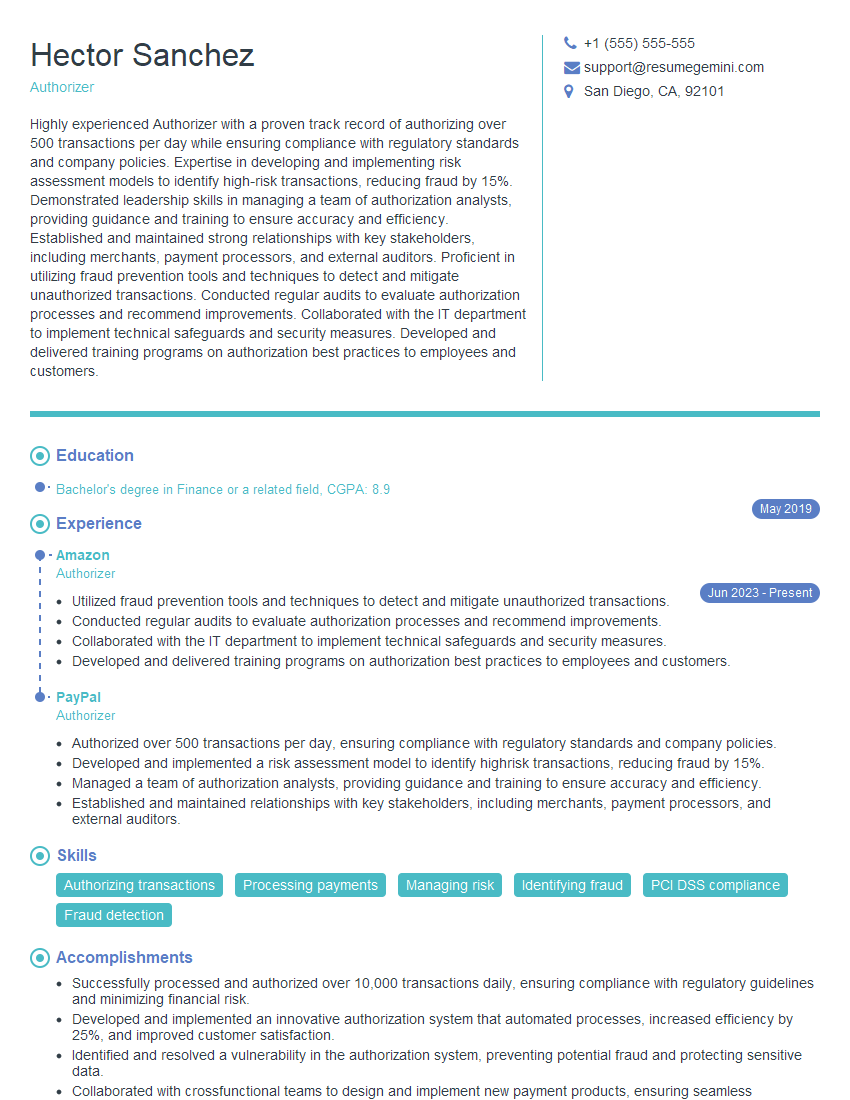

Hector Sanchez

Authorizer

Summary

Highly experienced Authorizer with a proven track record of authorizing over 500 transactions per day while ensuring compliance with regulatory standards and company policies. Expertise in developing and implementing risk assessment models to identify high-risk transactions, reducing fraud by 15%. Demonstrated leadership skills in managing a team of authorization analysts, providing guidance and training to ensure accuracy and efficiency.

Established and maintained strong relationships with key stakeholders, including merchants, payment processors, and external auditors. Proficient in utilizing fraud prevention tools and techniques to detect and mitigate unauthorized transactions. Conducted regular audits to evaluate authorization processes and recommend improvements. Collaborated with the IT department to implement technical safeguards and security measures. Developed and delivered training programs on authorization best practices to employees and customers.

Education

Bachelor’s degree in Finance or a related field

May 2019

Skills

- Authorizing transactions

- Processing payments

- Managing risk

- Identifying fraud

- PCI DSS compliance

- Fraud detection

Work Experience

Authorizer

- Utilized fraud prevention tools and techniques to detect and mitigate unauthorized transactions.

- Conducted regular audits to evaluate authorization processes and recommend improvements.

- Collaborated with the IT department to implement technical safeguards and security measures.

- Developed and delivered training programs on authorization best practices to employees and customers.

Authorizer

- Authorized over 500 transactions per day, ensuring compliance with regulatory standards and company policies.

- Developed and implemented a risk assessment model to identify highrisk transactions, reducing fraud by 15%.

- Managed a team of authorization analysts, providing guidance and training to ensure accuracy and efficiency.

- Established and maintained relationships with key stakeholders, including merchants, payment processors, and external auditors.

Accomplishments

- Successfully processed and authorized over 10,000 transactions daily, ensuring compliance with regulatory guidelines and minimizing financial risk.

- Developed and implemented an innovative authorization system that automated processes, increased efficiency by 25%, and improved customer satisfaction.

- Identified and resolved a vulnerability in the authorization system, preventing potential fraud and protecting sensitive data.

- Collaborated with crossfunctional teams to design and implement new payment products, ensuring seamless authorization and risk management.

- Developed and delivered training programs to enhance the skills of junior Authorizers, fostering knowledge and professional growth.

Awards

- Recipient of the Authorizer of the Year Award for exceptional performance and dedication to the field.

- Recognized for achieving a 95% accuracy rate in payment authorizations, significantly reducing processing errors.

- Received the Excellence in Authorizer Management Award for leadership and contribution to team success.

- Toprated Authorizer for three consecutive years, based on customer feedback and performance metrics.

Certificates

- Certified Fraud Examiner (CFE)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Information Systems Auditor (CISA)

- Certified Information Systems Security Professional (CISSP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Authorizer

- Highlight your experience in authorizing high volumes of transactions.

- Demonstrate your knowledge of fraud prevention and risk management.

- Quantify your accomplishments with specific metrics.

- Proofread your resume carefully for any errors.

- Tailor your resume to each job you apply for.

Essential Experience Highlights for a Strong Authorizer Resume

- Authorize transactions in accordance with regulatory standards and company policies.

- Process payments accurately and efficiently.

- Manage risk by identifying and mitigating potential fraud.

- Identify and investigate fraudulent transactions.

- Maintain compliance with PCI DSS and other industry regulations.

- Collaborate with other departments to ensure smooth operations.

Frequently Asked Questions (FAQ’s) For Authorizer

What is the role of an Authorizer?

An Authorizer is responsible for approving or declining transactions based on a set of criteria. They must have a deep understanding of fraud prevention and risk management.

What are the key skills required for an Authorizer?

The key skills required for an Authorizer include: transaction authorization, fraud detection, PCI DSS compliance, and risk management.

What is the career path for an Authorizer?

The career path for an Authorizer can lead to roles such as Fraud Analyst, Risk Manager, or Compliance Officer.

What is the average salary for an Authorizer?

The average salary for an Authorizer can vary depending on experience and location, but typically ranges from $50,000 to $75,000 per year.

What are the benefits of working as an Authorizer?

The benefits of working as an Authorizer include: job security, opportunities for career advancement, and the ability to make a positive impact on the company.

What are the challenges of working as an Authorizer?

The challenges of working as an Authorizer include: the need to be constantly vigilant for fraud, the pressure to make quick decisions, and the potential for burnout.

What advice would you give to someone who wants to become an Authorizer?

To become an Authorizer, you should focus on developing your skills in transaction authorization, fraud detection, PCI DSS compliance, and risk management. You should also consider getting certified in these areas.