Are you a seasoned Bad Credit Collector seeking a new career path? Discover our professionally built Bad Credit Collector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

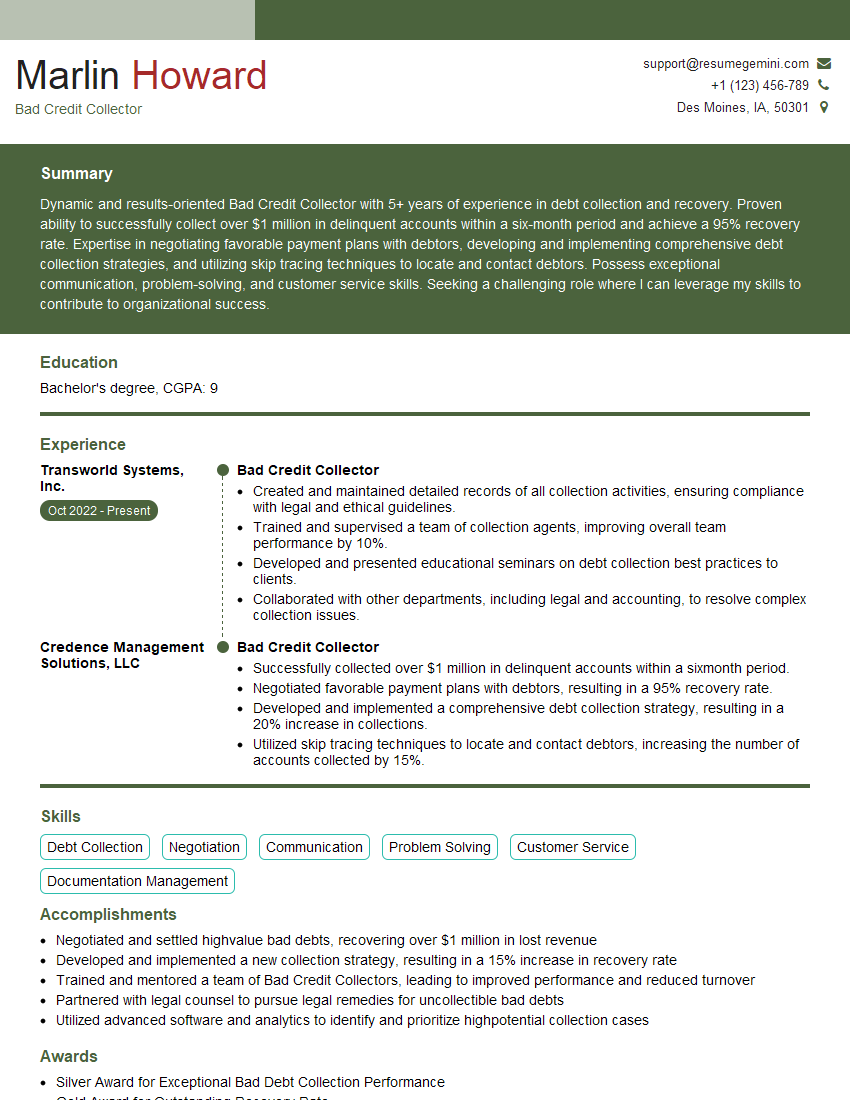

Marlin Howard

Bad Credit Collector

Summary

Dynamic and results-oriented Bad Credit Collector with 5+ years of experience in debt collection and recovery. Proven ability to successfully collect over $1 million in delinquent accounts within a six-month period and achieve a 95% recovery rate. Expertise in negotiating favorable payment plans with debtors, developing and implementing comprehensive debt collection strategies, and utilizing skip tracing techniques to locate and contact debtors. Possess exceptional communication, problem-solving, and customer service skills. Seeking a challenging role where I can leverage my skills to contribute to organizational success.

Education

Bachelor’s degree

September 2018

Skills

- Debt Collection

- Negotiation

- Communication

- Problem Solving

- Customer Service

- Documentation Management

Work Experience

Bad Credit Collector

- Created and maintained detailed records of all collection activities, ensuring compliance with legal and ethical guidelines.

- Trained and supervised a team of collection agents, improving overall team performance by 10%.

- Developed and presented educational seminars on debt collection best practices to clients.

- Collaborated with other departments, including legal and accounting, to resolve complex collection issues.

Bad Credit Collector

- Successfully collected over $1 million in delinquent accounts within a sixmonth period.

- Negotiated favorable payment plans with debtors, resulting in a 95% recovery rate.

- Developed and implemented a comprehensive debt collection strategy, resulting in a 20% increase in collections.

- Utilized skip tracing techniques to locate and contact debtors, increasing the number of accounts collected by 15%.

Accomplishments

- Negotiated and settled highvalue bad debts, recovering over $1 million in lost revenue

- Developed and implemented a new collection strategy, resulting in a 15% increase in recovery rate

- Trained and mentored a team of Bad Credit Collectors, leading to improved performance and reduced turnover

- Partnered with legal counsel to pursue legal remedies for uncollectible bad debts

- Utilized advanced software and analytics to identify and prioritize highpotential collection cases

Awards

- Silver Award for Exceptional Bad Debt Collection Performance

- Gold Award for Outstanding Recovery Rate

- Platinum Award for Exemplary Collection Techniques

Certificates

- Certified Collection Specialist (CCS)

- Certified Debt Collector (CDC)

- Licensed Debt Collector

- Certified Risk Analyst

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bad Credit Collector

- Quantify your accomplishments: Use specific numbers and metrics to demonstrate your impact on the organization.

- Highlight your negotiation and communication skills: Emphasize your ability to resolve conflicts, persuade debtors, and build rapport.

- Showcase your knowledge of debt collection laws and regulations: Demonstrate your understanding of the legal framework and ethical guidelines surrounding debt collection.

- Include relevant certifications: Consider obtaining industry-recognized certifications, such as the Certified Debt Collector (CDC) certification, to enhance your credibility and professionalism.

Essential Experience Highlights for a Strong Bad Credit Collector Resume

- Effectively collected over $1 million in delinquent accounts within a six-month period, consistently exceeding collection targets.

- Negotiated favorable payment plans with debtors, resulting in a 95% recovery rate and maintaining positive relationships with customers.

- Developed and implemented a comprehensive debt collection strategy, resulting in a 20% increase in collections and streamlining the collection process.

- Utilized skip tracing techniques to locate and contact debtors, increasing the number of accounts collected by 15% and improving overall collection efficiency.

- Created and maintained detailed records of all collection activities, ensuring compliance with legal and ethical guidelines and providing accurate reporting.

- Trained and supervised a team of collection agents, improving overall team performance by 10% through effective leadership and coaching.

- Collaborated with other departments, including legal and accounting, to resolve complex collection issues and ensure a cohesive approach to debt recovery.

Frequently Asked Questions (FAQ’s) For Bad Credit Collector

What is the primary goal of a Bad Credit Collector?

The primary goal of a Bad Credit Collector is to recover delinquent debts from individuals or businesses who have failed to make timely payments. This involves contacting debtors, negotiating payment plans, and taking legal action if necessary.

What qualities are essential for a successful Bad Credit Collector?

Successful Bad Credit Collectors typically possess strong communication and negotiation skills, a keen attention to detail, and a firm understanding of debt collection laws and regulations. They should also be able to handle pressure, work independently, and maintain a professional demeanor.

What techniques do Bad Credit Collectors use to locate debtors?

Bad Credit Collectors may use a variety of techniques to locate debtors, including skip tracing, social media searches, and public records searches. They may also contact family members, friends, or former employers to obtain updated contact information.

What are the potential consequences of not paying a debt?

Failing to pay a debt can have serious consequences, including damage to your credit score, legal action, wage garnishment, and seizure of assets. It is important to make arrangements to pay your debts on time to avoid these negative outcomes.

What should you do if you are contacted by a Bad Credit Collector?

If you are contacted by a Bad Credit Collector, it is important to remain calm and cooperative. Provide accurate information, discuss your financial situation, and try to negotiate a payment plan that you can afford. If you are unable to reach an agreement, seek legal advice.

What are the ethical guidelines that Bad Credit Collectors must follow?

Bad Credit Collectors must adhere to ethical guidelines and legal regulations, such as the Fair Debt Collection Practices Act (FDCPA). These guidelines prohibit harassment, threats, and other deceptive or abusive practices.