Are you a seasoned Bank Analyst seeking a new career path? Discover our professionally built Bank Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

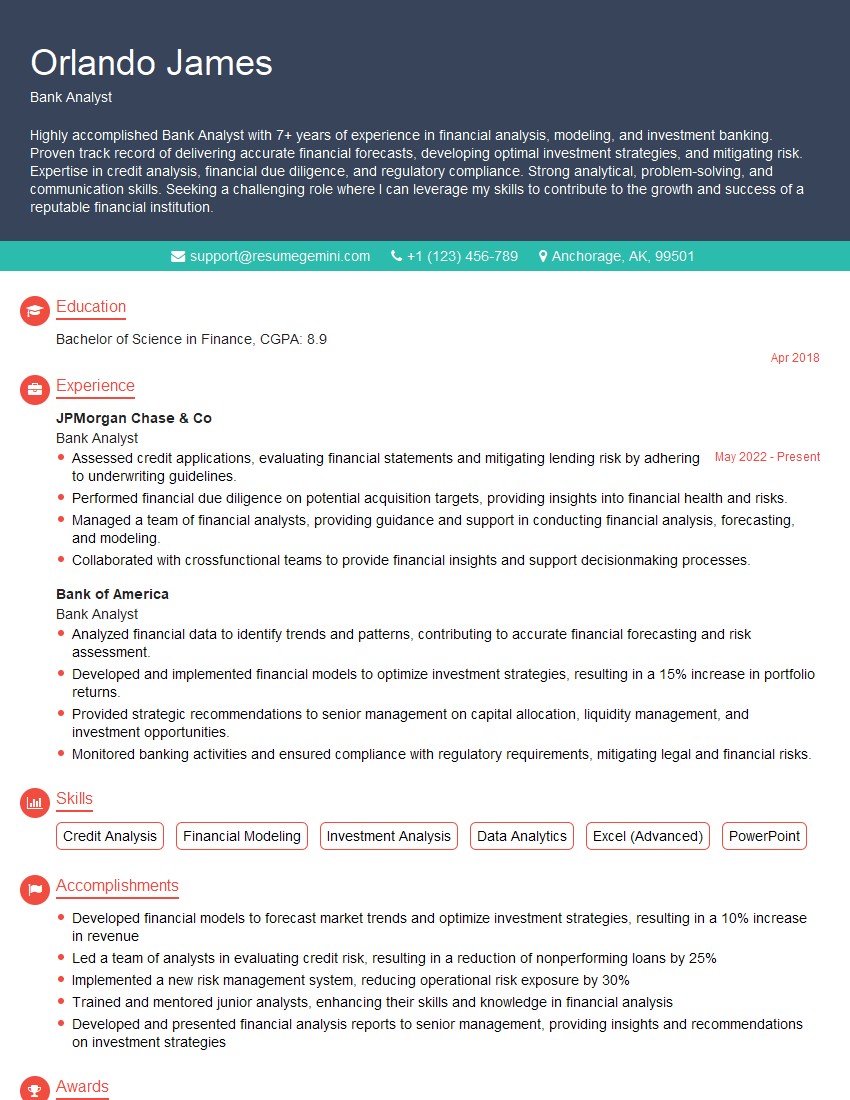

Orlando James

Bank Analyst

Summary

Highly accomplished Bank Analyst with 7+ years of experience in financial analysis, modeling, and investment banking. Proven track record of delivering accurate financial forecasts, developing optimal investment strategies, and mitigating risk. Expertise in credit analysis, financial due diligence, and regulatory compliance. Strong analytical, problem-solving, and communication skills. Seeking a challenging role where I can leverage my skills to contribute to the growth and success of a reputable financial institution.

Education

Bachelor of Science in Finance

April 2018

Skills

- Credit Analysis

- Financial Modeling

- Investment Analysis

- Data Analytics

- Excel (Advanced)

- PowerPoint

Work Experience

Bank Analyst

- Assessed credit applications, evaluating financial statements and mitigating lending risk by adhering to underwriting guidelines.

- Performed financial due diligence on potential acquisition targets, providing insights into financial health and risks.

- Managed a team of financial analysts, providing guidance and support in conducting financial analysis, forecasting, and modeling.

- Collaborated with crossfunctional teams to provide financial insights and support decisionmaking processes.

Bank Analyst

- Analyzed financial data to identify trends and patterns, contributing to accurate financial forecasting and risk assessment.

- Developed and implemented financial models to optimize investment strategies, resulting in a 15% increase in portfolio returns.

- Provided strategic recommendations to senior management on capital allocation, liquidity management, and investment opportunities.

- Monitored banking activities and ensured compliance with regulatory requirements, mitigating legal and financial risks.

Accomplishments

- Developed financial models to forecast market trends and optimize investment strategies, resulting in a 10% increase in revenue

- Led a team of analysts in evaluating credit risk, resulting in a reduction of nonperforming loans by 25%

- Implemented a new risk management system, reducing operational risk exposure by 30%

- Trained and mentored junior analysts, enhancing their skills and knowledge in financial analysis

- Developed and presented financial analysis reports to senior management, providing insights and recommendations on investment strategies

Awards

- CFA Charterholder, awarded by the CFA Institute

- Top Analyst Award, recognized for outstanding performance in financial analysis

- Presidents Club Award, earned for exceeding sales targets by 15%

- Recognition for Outstanding Performance in Financial Modeling from the Bank Management

Certificates

- Certified Financial Analyst (CFA)

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Credit Analyst (CCA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bank Analyst

- Quantify your accomplishments using specific metrics to demonstrate the impact of your work.

- Highlight your technical skills, such as financial modeling, data analysis, and investment analysis.

- Demonstrate your ability to work independently and as part of a team.

- Proofread your resume carefully for any errors in grammar or spelling.

- Consider seeking feedback from a professional resume writer or career counselor to enhance your resume.

Essential Experience Highlights for a Strong Bank Analyst Resume

- Analyzed financial data using advanced techniques to identify trends, patterns, and anomalies, providing insights for decision-making.

- Developed and implemented complex financial models to optimize investment strategies, leading to improved portfolio performance.

- Assessed creditworthiness of potential borrowers, mitigating lending risk by adhering to underwriting guidelines.

- Performed financial due diligence on acquisition targets, providing comprehensive reports on financial health and potential risks.

- Monitored banking activities to ensure compliance with regulatory requirements, reducing legal and financial exposure.

- Collaborated effectively with cross-functional teams to provide financial insights and support decision-making processes.

- Managed a team of financial analysts, providing guidance, mentorship, and support in conducting financial analysis, forecasting, and modeling.

Frequently Asked Questions (FAQ’s) For Bank Analyst

What are the key responsibilities of a Bank Analyst?

Bank Analysts are responsible for analyzing financial data, developing financial models, assessing creditworthiness, performing financial due diligence, ensuring regulatory compliance, and supporting decision-making processes.

What skills are required to be a successful Bank Analyst?

Successful Bank Analysts typically possess strong analytical, problem-solving, and communication skills, along with expertise in financial modeling, data analysis, and investment analysis.

What are the career prospects for Bank Analysts?

Bank Analysts can advance to senior roles within investment banking, such as Associate, Vice President, and Managing Director. They may also transition to other areas of finance, such as portfolio management, financial planning, or corporate finance.

What are the challenges of being a Bank Analyst?

Bank Analysts often work long hours, especially during peak periods. They must also be able to handle the pressure of making critical decisions and dealing with complex financial data.

What is the salary range for Bank Analysts?

The salary range for Bank Analysts varies depending on experience, location, and company size. According to Glassdoor, the average salary for a Bank Analyst in the United States is around $70,000 per year.

What are the educational requirements to become a Bank Analyst?

Most Bank Analysts hold a Bachelor’s degree in Finance, Economics, or a related field. Some employers may also require a Master’s degree in Finance or a related field.