Are you a seasoned Bank Cashier seeking a new career path? Discover our professionally built Bank Cashier Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

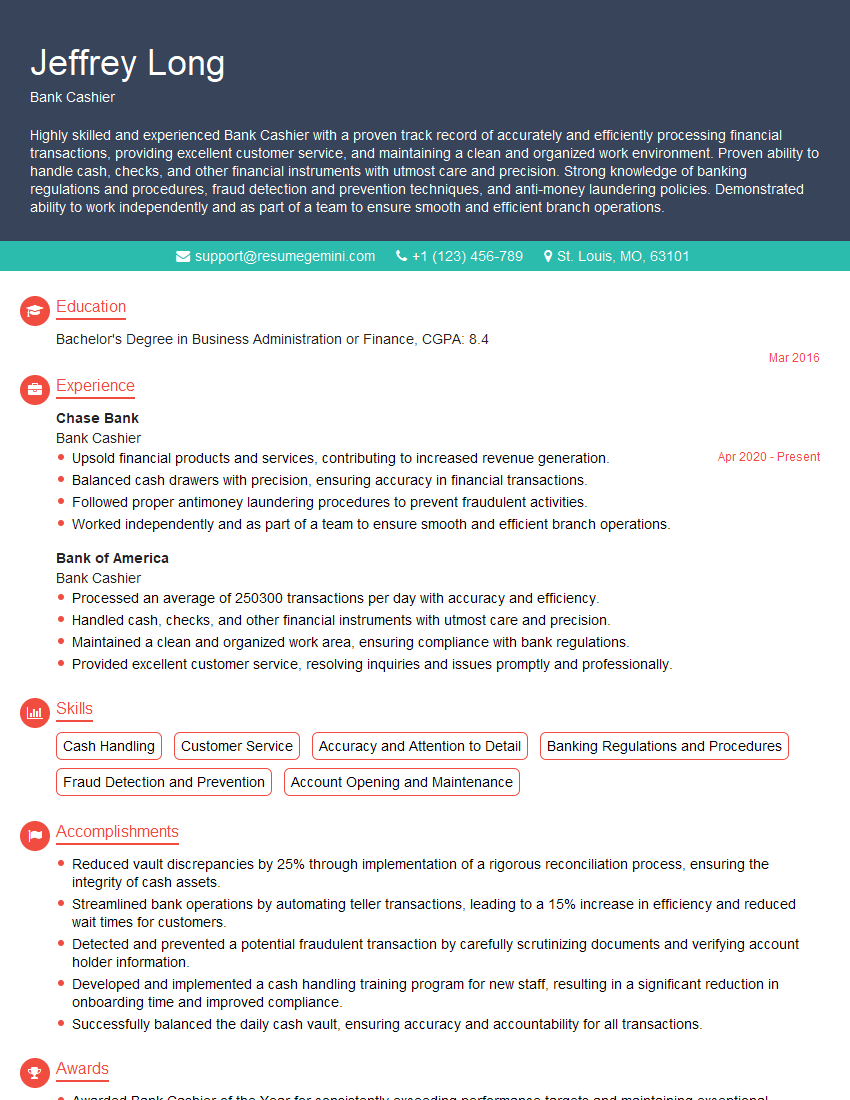

Jeffrey Long

Bank Cashier

Summary

Highly skilled and experienced Bank Cashier with a proven track record of accurately and efficiently processing financial transactions, providing excellent customer service, and maintaining a clean and organized work environment. Proven ability to handle cash, checks, and other financial instruments with utmost care and precision. Strong knowledge of banking regulations and procedures, fraud detection and prevention techniques, and anti-money laundering policies. Demonstrated ability to work independently and as part of a team to ensure smooth and efficient branch operations.

Education

Bachelor’s Degree in Business Administration or Finance

March 2016

Skills

- Cash Handling

- Customer Service

- Accuracy and Attention to Detail

- Banking Regulations and Procedures

- Fraud Detection and Prevention

- Account Opening and Maintenance

Work Experience

Bank Cashier

- Upsold financial products and services, contributing to increased revenue generation.

- Balanced cash drawers with precision, ensuring accuracy in financial transactions.

- Followed proper antimoney laundering procedures to prevent fraudulent activities.

- Worked independently and as part of a team to ensure smooth and efficient branch operations.

Bank Cashier

- Processed an average of 250300 transactions per day with accuracy and efficiency.

- Handled cash, checks, and other financial instruments with utmost care and precision.

- Maintained a clean and organized work area, ensuring compliance with bank regulations.

- Provided excellent customer service, resolving inquiries and issues promptly and professionally.

Accomplishments

- Reduced vault discrepancies by 25% through implementation of a rigorous reconciliation process, ensuring the integrity of cash assets.

- Streamlined bank operations by automating teller transactions, leading to a 15% increase in efficiency and reduced wait times for customers.

- Detected and prevented a potential fraudulent transaction by carefully scrutinizing documents and verifying account holder information.

- Developed and implemented a cash handling training program for new staff, resulting in a significant reduction in onboarding time and improved compliance.

- Successfully balanced the daily cash vault, ensuring accuracy and accountability for all transactions.

Awards

- Awarded Bank Cashier of the Year for consistently exceeding performance targets and maintaining exceptional customer service.

- Received Excellence in Customer Service award for consistently resolving customer inquiries promptly and effectively, enhancing customer satisfaction.

- Recognized by the Chamber of Commerce for outstanding cash management practices, contributing to the banks financial stability.

- Awarded Employee of the Month for exemplary contributions to team success and commitment to providing exceptional customer experiences.

Certificates

- Certified Bank Teller (CBT)

- Registered Bank Cashier (RBC)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Bank Security Officer (CBSO)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bank Cashier

- Highlight your key skills and experience in your resume summary, such as your ability to handle cash, provide excellent customer service, and maintain a clean and organized work environment.

- Provide specific examples of your accomplishments in your resume, such as the number of transactions you processed per day or the amount of revenue you generated through upsales.

- Use strong action verbs in your resume to describe your skills and experience, such as “processed”, “handled”, “maintained”, “provided”, and “upsold”.

- Tailor your resume to each job you apply for by highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Bank Cashier Resume

- Process financial transactions accurately and efficiently, including cash, checks, and other financial instruments.

- Maintain a clean and organized work area, ensuring compliance with bank regulations.

- Provide excellent customer service, resolving inquiries and issues promptly and professionally.

- Upsold financial products and services, contributing to increased revenue generation.

- Balanced cash drawers with precision, ensuring accuracy in financial transactions.

- Followed proper anti-money laundering procedures to prevent fraudulent activities.

- Worked independently and as part of a team to ensure smooth and efficient branch operations.

Frequently Asked Questions (FAQ’s) For Bank Cashier

What are the primary responsibilities of a Bank Cashier?

The primary responsibilities of a Bank Cashier include processing financial transactions, providing customer service, maintaining a clean and organized work environment, upsaling financial products and services, balancing cash drawers, following anti-money laundering procedures, and working independently and as part of a team.

What skills are required to be a successful Bank Cashier?

Successful Bank Cashiers typically possess strong cash handling skills, excellent customer service skills, accuracy and attention to detail, knowledge of banking regulations and procedures, fraud detection and prevention skills, and the ability to work independently and as part of a team.

What is the average salary for a Bank Cashier?

The average salary for a Bank Cashier in the United States is around $30,000 per year, according to Salary.com.

What are the career advancement opportunities for Bank Cashiers?

Bank Cashiers can advance their careers by becoming Bank Tellers, Customer Service Representatives, or Branch Managers.

What is the job outlook for Bank Cashiers?

The job outlook for Bank Cashiers is expected to be good over the next few years, according to the Bureau of Labor Statistics.