Are you a seasoned Bank Clerk seeking a new career path? Discover our professionally built Bank Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

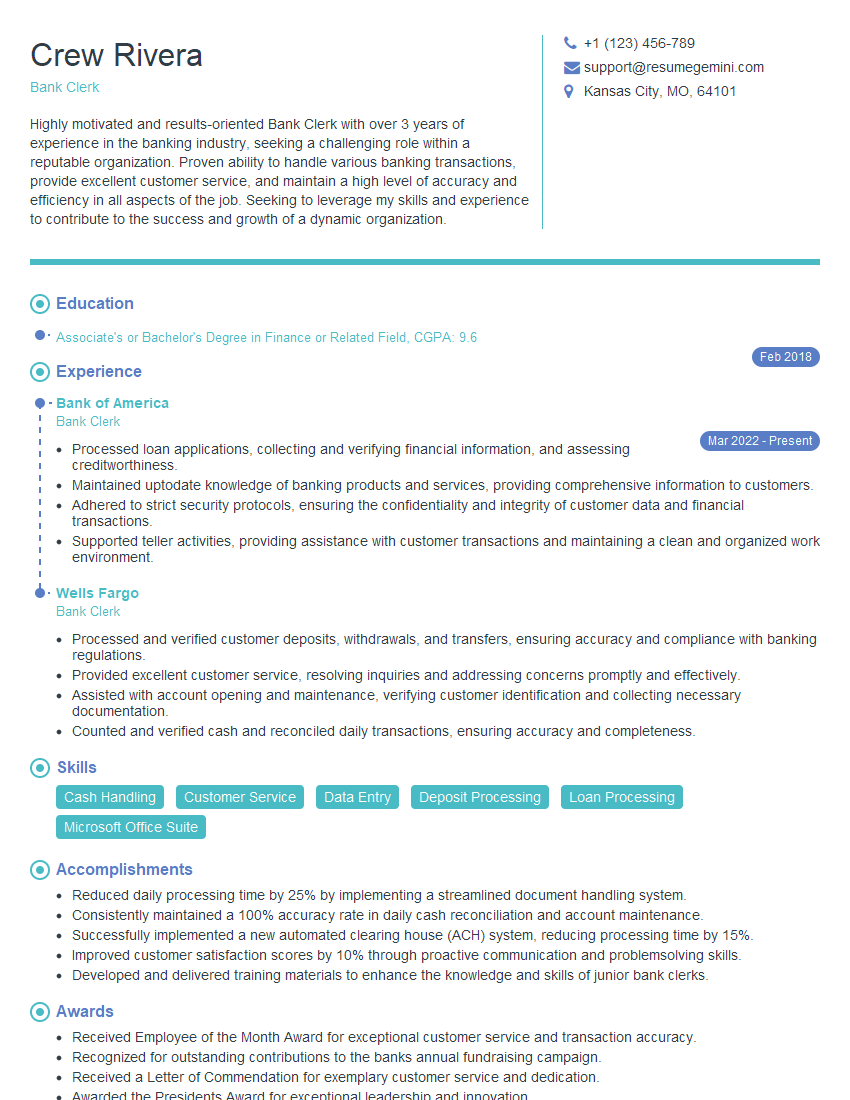

Crew Rivera

Bank Clerk

Summary

Highly motivated and results-oriented Bank Clerk with over 3 years of experience in the banking industry, seeking a challenging role within a reputable organization. Proven ability to handle various banking transactions, provide excellent customer service, and maintain a high level of accuracy and efficiency in all aspects of the job. Seeking to leverage my skills and experience to contribute to the success and growth of a dynamic organization.

Education

Associate’s or Bachelor’s Degree in Finance or Related Field

February 2018

Skills

- Cash Handling

- Customer Service

- Data Entry

- Deposit Processing

- Loan Processing

- Microsoft Office Suite

Work Experience

Bank Clerk

- Processed loan applications, collecting and verifying financial information, and assessing creditworthiness.

- Maintained uptodate knowledge of banking products and services, providing comprehensive information to customers.

- Adhered to strict security protocols, ensuring the confidentiality and integrity of customer data and financial transactions.

- Supported teller activities, providing assistance with customer transactions and maintaining a clean and organized work environment.

Bank Clerk

- Processed and verified customer deposits, withdrawals, and transfers, ensuring accuracy and compliance with banking regulations.

- Provided excellent customer service, resolving inquiries and addressing concerns promptly and effectively.

- Assisted with account opening and maintenance, verifying customer identification and collecting necessary documentation.

- Counted and verified cash and reconciled daily transactions, ensuring accuracy and completeness.

Accomplishments

- Reduced daily processing time by 25% by implementing a streamlined document handling system.

- Consistently maintained a 100% accuracy rate in daily cash reconciliation and account maintenance.

- Successfully implemented a new automated clearing house (ACH) system, reducing processing time by 15%.

- Improved customer satisfaction scores by 10% through proactive communication and problemsolving skills.

- Developed and delivered training materials to enhance the knowledge and skills of junior bank clerks.

Awards

- Received Employee of the Month Award for exceptional customer service and transaction accuracy.

- Recognized for outstanding contributions to the banks annual fundraising campaign.

- Received a Letter of Commendation for exemplary customer service and dedication.

- Awarded the Presidents Award for exceptional leadership and innovation.

Certificates

- Bank Secrecy Act Certification

- Certified Bank Operations Specialist

- Certified Financial Crime Specialist

- Financial Industry Regulatory Authority (FINRA) Series 6

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bank Clerk

- Highlight your customer service and communication skills, as these are essential for success in this role.

- Quantify your accomplishments whenever possible, using specific numbers and metrics to demonstrate your impact.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully before submitting it, ensuring that there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Bank Clerk Resume

- Process and verify customer deposits, withdrawals, and transfers, ensuring accuracy and compliance with banking regulations.

- Provide excellent customer service, resolving inquiries and addressing concerns promptly and effectively.

- Assist with account opening and maintenance, verifying customer identification and collecting necessary documentation.

- Count and verify cash and reconcile daily transactions, ensuring accuracy and completeness.

- Process loan applications, collecting and verifying financial information, and assessing creditworthiness.

Frequently Asked Questions (FAQ’s) For Bank Clerk

What are the primary responsibilities of a Bank Clerk?

The primary responsibilities of a Bank Clerk include processing customer deposits, withdrawals, and transfers; providing excellent customer service; assisting with account opening and maintenance; counting and verifying cash; processing loan applications; and maintaining up-to-date knowledge of banking products and services.

What skills are required to be a successful Bank Clerk?

Bank Clerks typically require strong customer service skills, including the ability to communicate effectively, resolve inquiries, and maintain a positive attitude. They should also have a strong attention to detail and accuracy, as well as the ability to follow instructions and procedures. Additionally, they typically require basic computer skills and knowledge of banking products and services.

What is the career path for Bank Clerks?

Bank Clerks may advance to roles such as Teller Supervisor, Customer Service Representative, or Loan Officer. With additional education and experience, they may also move into management positions within the banking industry.

Is a college degree required to become a Bank Clerk?

While some Bank Clerk positions may require a high school diploma or equivalent, many employers prefer candidates with an Associate’s or Bachelor’s Degree in Finance or a related field. A college degree can provide a strong foundation in banking principles and practices and enhance your career prospects.

What is the average salary for a Bank Clerk?

The average salary for Bank Clerks in the United States is around $35,000 per year. However, salaries may vary depending on experience, location, and employer.