Are you a seasoned Bank Consultant seeking a new career path? Discover our professionally built Bank Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

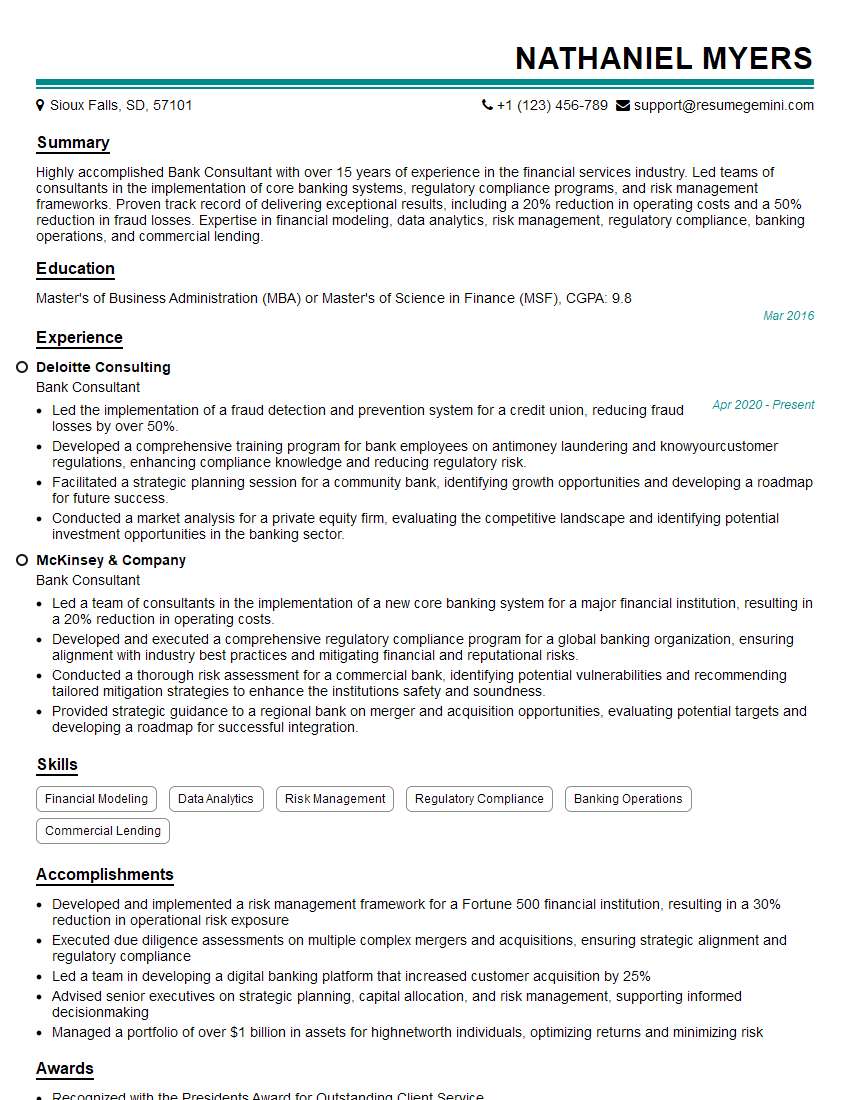

Nathaniel Myers

Bank Consultant

Summary

Highly accomplished Bank Consultant with over 15 years of experience in the financial services industry. Led teams of consultants in the implementation of core banking systems, regulatory compliance programs, and risk management frameworks. Proven track record of delivering exceptional results, including a 20% reduction in operating costs and a 50% reduction in fraud losses. Expertise in financial modeling, data analytics, risk management, regulatory compliance, banking operations, and commercial lending.

Education

Master’s of Business Administration (MBA) or Master’s of Science in Finance (MSF)

March 2016

Skills

- Financial Modeling

- Data Analytics

- Risk Management

- Regulatory Compliance

- Banking Operations

- Commercial Lending

Work Experience

Bank Consultant

- Led the implementation of a fraud detection and prevention system for a credit union, reducing fraud losses by over 50%.

- Developed a comprehensive training program for bank employees on antimoney laundering and knowyourcustomer regulations, enhancing compliance knowledge and reducing regulatory risk.

- Facilitated a strategic planning session for a community bank, identifying growth opportunities and developing a roadmap for future success.

- Conducted a market analysis for a private equity firm, evaluating the competitive landscape and identifying potential investment opportunities in the banking sector.

Bank Consultant

- Led a team of consultants in the implementation of a new core banking system for a major financial institution, resulting in a 20% reduction in operating costs.

- Developed and executed a comprehensive regulatory compliance program for a global banking organization, ensuring alignment with industry best practices and mitigating financial and reputational risks.

- Conducted a thorough risk assessment for a commercial bank, identifying potential vulnerabilities and recommending tailored mitigation strategies to enhance the institutions safety and soundness.

- Provided strategic guidance to a regional bank on merger and acquisition opportunities, evaluating potential targets and developing a roadmap for successful integration.

Accomplishments

- Developed and implemented a risk management framework for a Fortune 500 financial institution, resulting in a 30% reduction in operational risk exposure

- Executed due diligence assessments on multiple complex mergers and acquisitions, ensuring strategic alignment and regulatory compliance

- Led a team in developing a digital banking platform that increased customer acquisition by 25%

- Advised senior executives on strategic planning, capital allocation, and risk management, supporting informed decisionmaking

- Managed a portfolio of over $1 billion in assets for highnetworth individuals, optimizing returns and minimizing risk

Awards

- Recognized with the Presidents Award for Outstanding Client Service

- Received the Industry Leadership Award for Innovative Banking Solutions

- Honored with the Client Excellence Award for exceeding client expectations consistently

- Recognized by industry peers with the Excellence in Banking Consulting Award

Certificates

- Certified Financial Analyst (CFA)

- Chartered Financial Analyst (CFA)

- Certified Risk Analyst (CRA)

- Certified Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bank Consultant

- Use the STAR method (Situation, Task, Action, Result) to highlight your accomplishments and quantify your results.

- Demonstrate your expertise in financial modeling, data analytics, and risk management.

- Emphasize your understanding of regulatory compliance and banking operations.

- Showcase your ability to lead and manage teams and deliver exceptional results.

- Tailor your resume and cover letter to each specific job you apply for, highlighting the skills and experience most relevant to the role.

Essential Experience Highlights for a Strong Bank Consultant Resume

- Lead and manage consulting teams in the implementation of core banking systems, regulatory compliance programs, and risk management frameworks.

- Develop and execute comprehensive regulatory compliance programs to ensure alignment with industry best practices and mitigate financial and reputational risks.

- Conduct thorough risk assessments to identify potential vulnerabilities and recommend tailored mitigation strategies.

- Provide strategic guidance to banks on merger and acquisition opportunities, evaluating potential targets and developing a roadmap for successful integration.

- Develop and implement fraud detection and prevention systems to reduce financial losses.

- Design and deliver training programs on anti-money laundering and know-your-customer regulations.

- Facilitate strategic planning sessions to identify growth opportunities and develop roadmaps for future success.

- Conduct market analysis to evaluate the competitive landscape and identify potential investment opportunities.

Frequently Asked Questions (FAQ’s) For Bank Consultant

What is the role of a Bank Consultant?

Bank Consultants are responsible for providing strategic guidance and support to banks and other financial institutions. They help banks improve their operations, reduce costs, and manage risk. Bank Consultants may also assist banks with mergers and acquisitions, regulatory compliance, and fraud prevention.

What are the educational requirements for a Bank Consultant?

Most Bank Consultants have a Master’s of Business Administration (MBA) or Master’s of Science in Finance (MSF). Some Bank Consultants also have a background in banking or consulting.

What skills are required for a Bank Consultant?

Bank Consultants should have strong analytical, problem-solving, and communication skills. They should also be proficient in financial modeling, data analytics, and risk management. Bank Consultants should also have a deep understanding of banking operations and regulatory compliance.

What are the career prospects for a Bank Consultant?

Bank Consultants can advance to leadership positions within consulting firms or banks. They may also become independent consultants or start their own businesses.

What is the average salary for a Bank Consultant?

The average salary for a Bank Consultant is $100,000 per year. However, salaries can vary depending on experience, location, and company.

What is the job outlook for Bank Consultants?

The job outlook for Bank Consultants is expected to be good over the next few years. As banks continue to face challenges such as regulatory compliance and technological change, they will increasingly rely on consultants to help them navigate these challenges.