Are you a seasoned Bank Teller seeking a new career path? Discover our professionally built Bank Teller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

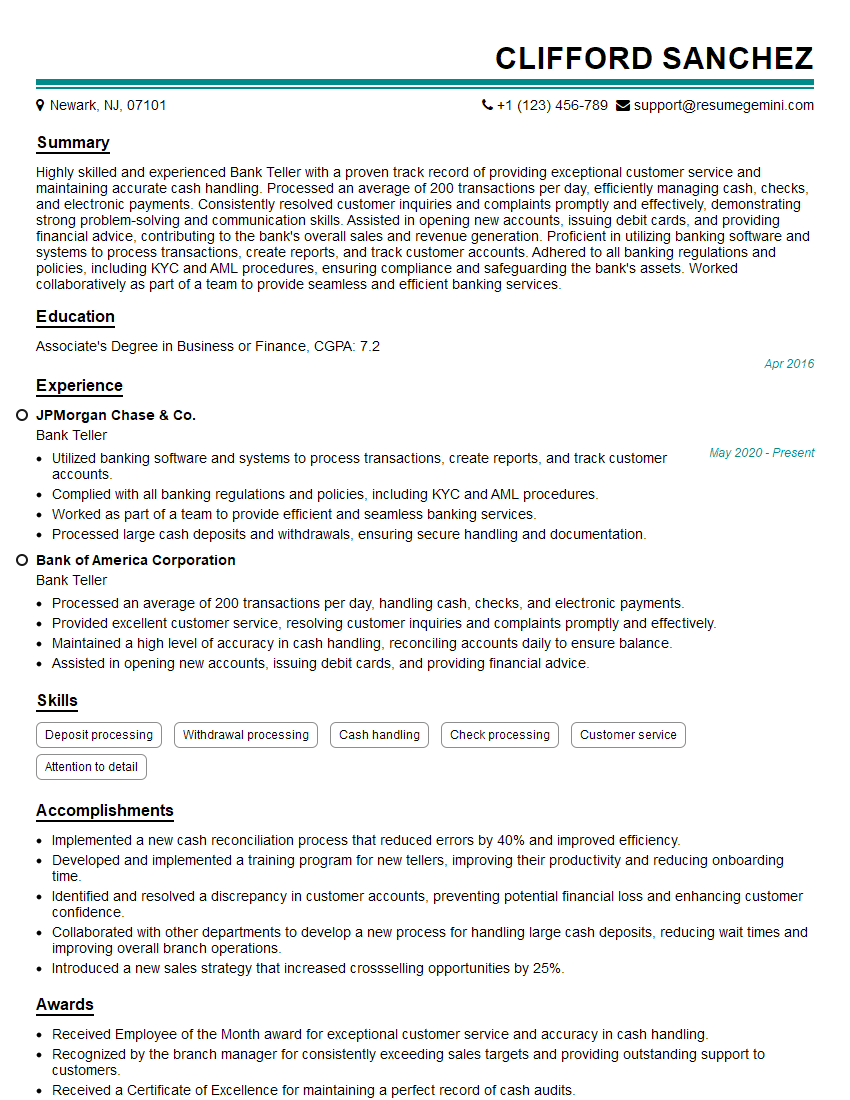

Clifford Sanchez

Bank Teller

Summary

Highly skilled and experienced Bank Teller with a proven track record of providing exceptional customer service and maintaining accurate cash handling. Processed an average of 200 transactions per day, efficiently managing cash, checks, and electronic payments. Consistently resolved customer inquiries and complaints promptly and effectively, demonstrating strong problem-solving and communication skills. Assisted in opening new accounts, issuing debit cards, and providing financial advice, contributing to the bank’s overall sales and revenue generation. Proficient in utilizing banking software and systems to process transactions, create reports, and track customer accounts. Adhered to all banking regulations and policies, including KYC and AML procedures, ensuring compliance and safeguarding the bank’s assets. Worked collaboratively as part of a team to provide seamless and efficient banking services.

Education

Associate’s Degree in Business or Finance

April 2016

Skills

- Deposit processing

- Withdrawal processing

- Cash handling

- Check processing

- Customer service

- Attention to detail

Work Experience

Bank Teller

- Utilized banking software and systems to process transactions, create reports, and track customer accounts.

- Complied with all banking regulations and policies, including KYC and AML procedures.

- Worked as part of a team to provide efficient and seamless banking services.

- Processed large cash deposits and withdrawals, ensuring secure handling and documentation.

Bank Teller

- Processed an average of 200 transactions per day, handling cash, checks, and electronic payments.

- Provided excellent customer service, resolving customer inquiries and complaints promptly and effectively.

- Maintained a high level of accuracy in cash handling, reconciling accounts daily to ensure balance.

- Assisted in opening new accounts, issuing debit cards, and providing financial advice.

Accomplishments

- Implemented a new cash reconciliation process that reduced errors by 40% and improved efficiency.

- Developed and implemented a training program for new tellers, improving their productivity and reducing onboarding time.

- Identified and resolved a discrepancy in customer accounts, preventing potential financial loss and enhancing customer confidence.

- Collaborated with other departments to develop a new process for handling large cash deposits, reducing wait times and improving overall branch operations.

- Introduced a new sales strategy that increased crossselling opportunities by 25%.

Awards

- Received Employee of the Month award for exceptional customer service and accuracy in cash handling.

- Recognized by the branch manager for consistently exceeding sales targets and providing outstanding support to customers.

- Received a Certificate of Excellence for maintaining a perfect record of cash audits.

- Honored with a Customer Service Star award for consistently receiving positive feedback from customers.

Certificates

- Certified Bank Teller (CBT)

- Bank Secrecy Act Compliance Specialist (BSACS)

- National Automated Clearing House Association (NACHA) Certified Payments Professional (NPP)

- Certified Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bank Teller

- Highlight your customer service skills: Bank tellers are the face of the bank, so it’s essential to showcase your ability to provide excellent customer service.

- Quantify your experience: Use numbers to demonstrate your accomplishments, such as the number of transactions you processed or the amount of money you handled.

- Emphasize your attention to detail: Bank tellers must be able to handle money accurately and pay attention to detail.

- Be professional and courteous: Your resume should be well-written and free of errors.

- Tailor your resume to each job you apply for: Make sure to highlight the skills and experience that are most relevant to the position you’re applying for.

Essential Experience Highlights for a Strong Bank Teller Resume

- Processed an average of 200 transactions per day, handling cash, checks, and electronic payments.

- Provided excellent customer service, resolving customer inquiries and complaints promptly and effectively.

- Maintained a high level of accuracy in cash handling, reconciling accounts daily to ensure balance.

- Assisted in opening new accounts, issuing debit cards, and providing financial advice.

- Utilized banking software and systems to process transactions, create reports, and track customer accounts.

- Complied with all banking regulations and policies, including KYC and AML procedures.

- Worked as part of a team to provide efficient and seamless banking services.

Frequently Asked Questions (FAQ’s) For Bank Teller

What are the key responsibilities of a Bank Teller?

The key responsibilities of a Bank Teller typically include processing cash and non-cash transactions, providing customer service, maintaining accurate records, assisting with account opening and closing, and following bank policies and procedures.

What skills are required to be a successful Bank Teller?

To be a successful Bank Teller, you typically need strong customer service skills, attention to detail, accuracy, and the ability to work quickly and efficiently.

What is the career path for a Bank Teller?

Bank Tellers can advance their careers by developing additional skills and experience. Common career paths for Bank Tellers include moving into roles such as Customer Service Representative, Teller Supervisor, or Branch Manager.

What is the average salary for a Bank Teller?

The average salary for a Bank Teller in the United States is around $15-$20 per hour or $30,000-$40,000 per year.

What are the benefits of working as a Bank Teller?

Some of the benefits of working as a Bank Teller include competitive salaries, flexible work hours, opportunities for career advancement, and the chance to make a difference in the community.

What are the challenges of working as a Bank Teller?

Some of the challenges of working as a Bank Teller include dealing with difficult customers, working long hours, and being responsible for large sums of money.

What are the qualifications for becoming a Bank Teller?

The minimum qualifications for becoming a Bank Teller typically include a high school diploma or equivalent, as well as strong customer service skills and attention to detail.