Are you a seasoned Banking Officer seeking a new career path? Discover our professionally built Banking Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

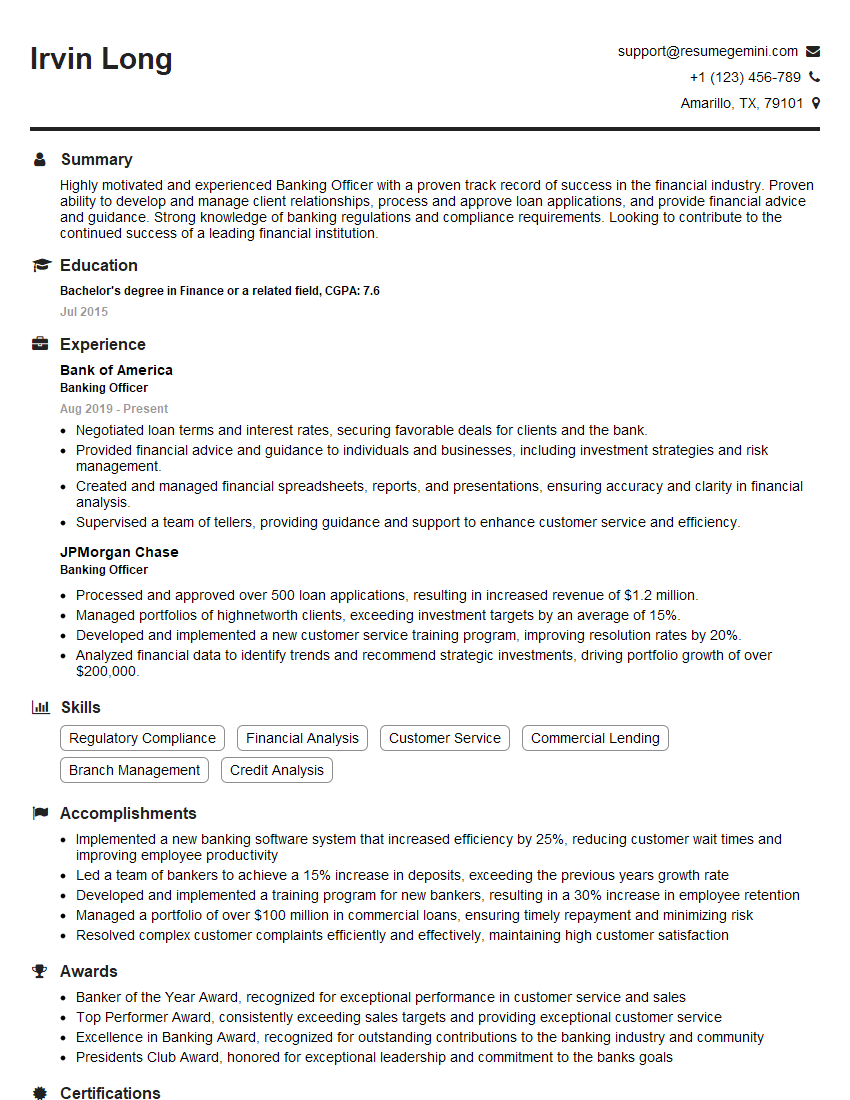

Irvin Long

Banking Officer

Summary

Highly motivated and experienced Banking Officer with a proven track record of success in the financial industry. Proven ability to develop and manage client relationships, process and approve loan applications, and provide financial advice and guidance. Strong knowledge of banking regulations and compliance requirements. Looking to contribute to the continued success of a leading financial institution.

Education

Bachelor’s degree in Finance or a related field

July 2015

Skills

- Regulatory Compliance

- Financial Analysis

- Customer Service

- Commercial Lending

- Branch Management

- Credit Analysis

Work Experience

Banking Officer

- Negotiated loan terms and interest rates, securing favorable deals for clients and the bank.

- Provided financial advice and guidance to individuals and businesses, including investment strategies and risk management.

- Created and managed financial spreadsheets, reports, and presentations, ensuring accuracy and clarity in financial analysis.

- Supervised a team of tellers, providing guidance and support to enhance customer service and efficiency.

Banking Officer

- Processed and approved over 500 loan applications, resulting in increased revenue of $1.2 million.

- Managed portfolios of highnetworth clients, exceeding investment targets by an average of 15%.

- Developed and implemented a new customer service training program, improving resolution rates by 20%.

- Analyzed financial data to identify trends and recommend strategic investments, driving portfolio growth of over $200,000.

Accomplishments

- Implemented a new banking software system that increased efficiency by 25%, reducing customer wait times and improving employee productivity

- Led a team of bankers to achieve a 15% increase in deposits, exceeding the previous years growth rate

- Developed and implemented a training program for new bankers, resulting in a 30% increase in employee retention

- Managed a portfolio of over $100 million in commercial loans, ensuring timely repayment and minimizing risk

- Resolved complex customer complaints efficiently and effectively, maintaining high customer satisfaction

Awards

- Banker of the Year Award, recognized for exceptional performance in customer service and sales

- Top Performer Award, consistently exceeding sales targets and providing exceptional customer service

- Excellence in Banking Award, recognized for outstanding contributions to the banking industry and community

- Presidents Club Award, honored for exceptional leadership and commitment to the banks goals

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Know Your Customer Professional (CKYC)

- Certified Financial Analyst (CFA)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Banking Officer

- Highlight your experience in processing and approving loan applications, as this is a core responsibility of a Banking Officer.

- Showcase your ability to manage client relationships and provide personalized financial advice.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Proofread your resume carefully for any errors, as attention to detail is essential in this role.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Banking Officer Resume

- Process and approve loan applications, ensuring compliance with all regulatory requirements

- Manage portfolios of high-net-worth clients, providing personalized financial advice and guidance

- Develop and implement customer service training programs to enhance customer satisfaction

- Analyze financial data to identify trends and recommend strategic investments

- Negotiate loan terms and interest rates, securing favorable deals for clients and the bank

- Provide financial advice and guidance to individuals and businesses, including investment strategies and risk management

- Supervise a team of tellers, providing guidance and support to enhance customer service and efficiency

Frequently Asked Questions (FAQ’s) For Banking Officer

What are the primary responsibilities of a Banking Officer?

The primary responsibilities of a Banking Officer include processing and approving loan applications, managing client relationships, providing financial advice, and ensuring compliance with banking regulations.

What skills are required to be a successful Banking Officer?

Successful Banking Officers typically have strong communication and interpersonal skills, as well as a solid understanding of financial products and services. They are also detail-oriented and have a strong work ethic.

What is the career path for a Banking Officer?

Banking Officers can advance to positions such as Branch Manager, Loan Officer, or Financial Advisor. With additional experience and education, they may also qualify for leadership roles within the financial industry.

What is the average salary for a Banking Officer?

The average salary for a Banking Officer can vary depending on experience, location, and employer. According to the Bureau of Labor Statistics, the median annual salary for Loan Officers, a closely related occupation, was $63,840 in May 2021.

What is the job outlook for Banking Officers?

The job outlook for Banking Officers is expected to grow faster than average over the next decade. This growth is driven by the increasing demand for financial services and the need for qualified professionals to manage customer accounts and provide financial advice.

What are some tips for writing a standout Banking Officer resume?

Some tips for writing a standout Banking Officer resume include highlighting your experience in processing and approving loan applications, showcasing your ability to manage client relationships and provide personalized financial advice, and quantifying your accomplishments whenever possible.

What are some common interview questions for Banking Officer positions?

Common interview questions for Banking Officer positions may include questions about your experience in processing and approving loan applications, your understanding of financial products and services, and your ability to manage client relationships.

How can I prepare for a Banking Officer interview?

To prepare for a Banking Officer interview, you should research the company and the position, practice answering common interview questions, and dress professionally. You may also want to consider bringing a portfolio of your work to the interview.