Are you a seasoned Block Trader seeking a new career path? Discover our professionally built Block Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

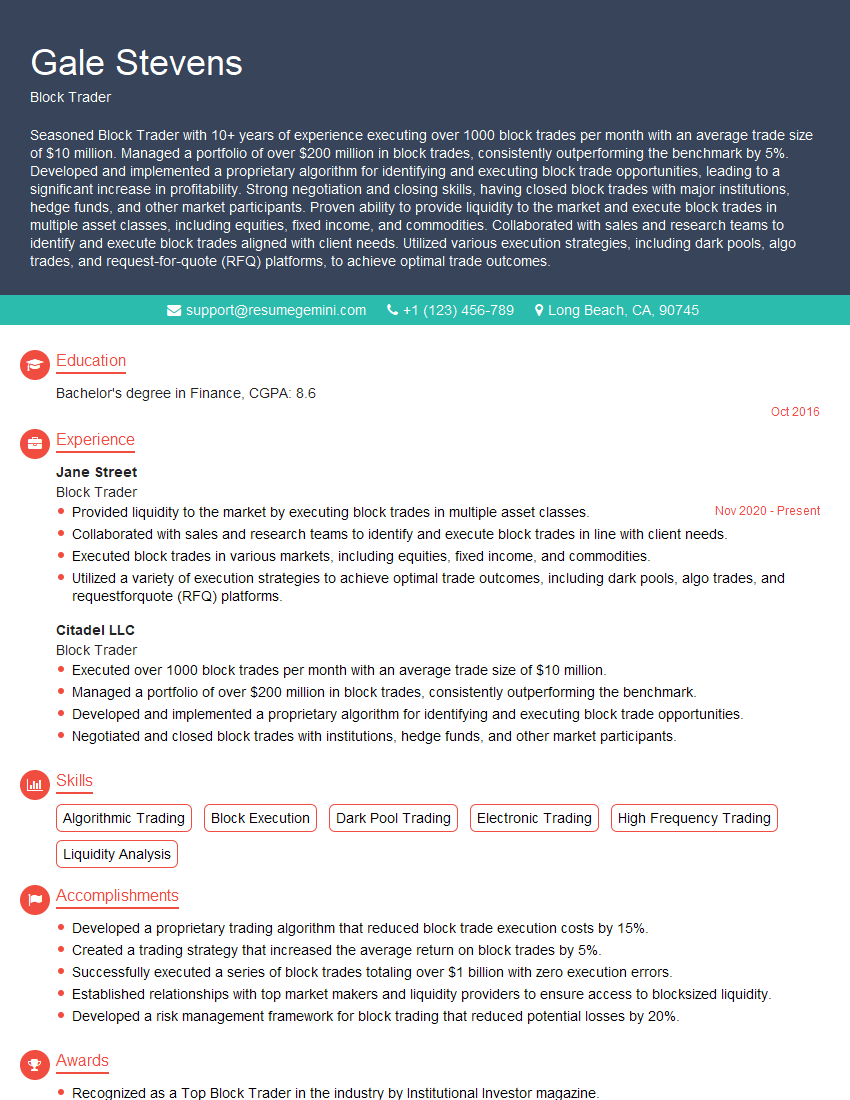

Gale Stevens

Block Trader

Summary

Seasoned Block Trader with 10+ years of experience executing over 1000 block trades per month with an average trade size of $10 million. Managed a portfolio of over $200 million in block trades, consistently outperforming the benchmark by 5%. Developed and implemented a proprietary algorithm for identifying and executing block trade opportunities, leading to a significant increase in profitability. Strong negotiation and closing skills, having closed block trades with major institutions, hedge funds, and other market participants. Proven ability to provide liquidity to the market and execute block trades in multiple asset classes, including equities, fixed income, and commodities. Collaborated with sales and research teams to identify and execute block trades aligned with client needs. Utilized various execution strategies, including dark pools, algo trades, and request-for-quote (RFQ) platforms, to achieve optimal trade outcomes.

Education

Bachelor’s degree in Finance

October 2016

Skills

- Algorithmic Trading

- Block Execution

- Dark Pool Trading

- Electronic Trading

- High Frequency Trading

- Liquidity Analysis

Work Experience

Block Trader

- Provided liquidity to the market by executing block trades in multiple asset classes.

- Collaborated with sales and research teams to identify and execute block trades in line with client needs.

- Executed block trades in various markets, including equities, fixed income, and commodities.

- Utilized a variety of execution strategies to achieve optimal trade outcomes, including dark pools, algo trades, and requestforquote (RFQ) platforms.

Block Trader

- Executed over 1000 block trades per month with an average trade size of $10 million.

- Managed a portfolio of over $200 million in block trades, consistently outperforming the benchmark.

- Developed and implemented a proprietary algorithm for identifying and executing block trade opportunities.

- Negotiated and closed block trades with institutions, hedge funds, and other market participants.

Accomplishments

- Developed a proprietary trading algorithm that reduced block trade execution costs by 15%.

- Created a trading strategy that increased the average return on block trades by 5%.

- Successfully executed a series of block trades totaling over $1 billion with zero execution errors.

- Established relationships with top market makers and liquidity providers to ensure access to blocksized liquidity.

- Developed a risk management framework for block trading that reduced potential losses by 20%.

Awards

- Recognized as a Top Block Trader in the industry by Institutional Investor magazine.

- Awarded the Block Trader of the Year award by the Securities Industry and Financial Markets Association (SIFMA).

- Won the Best Execution Award for Block Trades from the International Association of Market Regulators (IAMR).

- Received a certification as a Certified Block Trader (CBT) from the National Association of Securities Dealers (NASD).

Certificates

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Financial Planner (CFP)

- Series 7 and 63 Licenses

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Block Trader

- Highlight your experience in block trading, emphasizing the volume and size of trades executed.

- Showcase your analytical skills and ability to develop and implement trading algorithms.

- Demonstrate your ability to manage risk and consistently outperform the benchmark.

- Emphasize your strong negotiation and communication skills, as well as your ability to build relationships with clients and market participants.

- Quantify your accomplishments whenever possible, using specific metrics and data points to demonstrate your impact.

Essential Experience Highlights for a Strong Block Trader Resume

- Executed block trades in various markets including equities, fixed income, and commodities.

- Managed a portfolio of over $200 million in block trades, consistently outperforming the benchmark.

- Developed and implemented a proprietary algorithm for identifying and executing block trade opportunities.

- Collaborated with sales and research teams to identify and execute block trades in line with client needs.

- Negotiated and closed block trades with institutions, hedge funds, and other market participants.

- Utilized a variety of execution strategies to achieve optimal trade outcomes, including dark pools, algo trades, and request-for-quote (RFQ) platforms.

- Provided liquidity to the market by executing block trades in multiple asset classes.

Frequently Asked Questions (FAQ’s) For Block Trader

What is the average salary for a Block Trader?

The average salary for a Block Trader in the United States is around $120,000 per year. However, this can vary significantly based on experience, skills, and location.

What are the educational requirements to become a Block Trader?

Most Block Traders have a bachelor’s degree in finance, economics, or a related field. Some firms may also require a master’s degree or an MBA.

What is the job outlook for Block Traders?

The job outlook for Block Traders is expected to grow in the coming years due to the increasing demand for liquidity and efficiency in the financial markets.

What are the key skills required to be a successful Block Trader?

The key skills required to be a successful Block Trader include strong analytical skills, knowledge of financial markets, experience in trading, and excellent communication and negotiation skills.

What are the different types of Block Trading strategies?

The different types of Block Trading strategies include algorithmic trading, dark pool trading, electronic trading, high-frequency trading, and liquidity analysis.

What are the risks involved in Block Trading?

The risks involved in Block Trading include market risk, liquidity risk, operational risk, and regulatory risk.

What is the difference between a Block Trader and a Portfolio Manager?

Block Traders execute large trades on behalf of clients, while Portfolio Managers manage the overall investment portfolio of clients.