Are you a seasoned Bond Analyst seeking a new career path? Discover our professionally built Bond Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

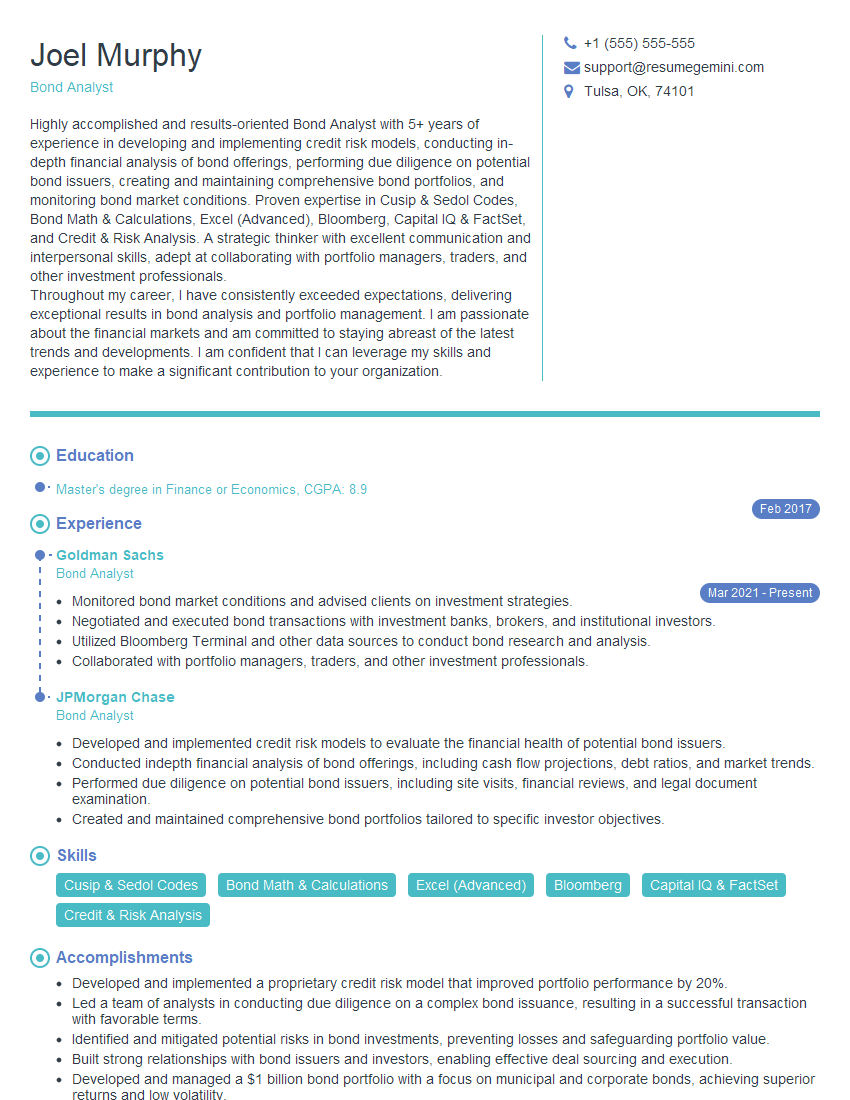

Joel Murphy

Bond Analyst

Summary

Highly accomplished and results-oriented Bond Analyst with 5+ years of experience in developing and implementing credit risk models, conducting in-depth financial analysis of bond offerings, performing due diligence on potential bond issuers, creating and maintaining comprehensive bond portfolios, and monitoring bond market conditions. Proven expertise in Cusip & Sedol Codes, Bond Math & Calculations, Excel (Advanced), Bloomberg, Capital IQ & FactSet, and Credit & Risk Analysis. A strategic thinker with excellent communication and interpersonal skills, adept at collaborating with portfolio managers, traders, and other investment professionals.

Throughout my career, I have consistently exceeded expectations, delivering exceptional results in bond analysis and portfolio management. I am passionate about the financial markets and am committed to staying abreast of the latest trends and developments. I am confident that I can leverage my skills and experience to make a significant contribution to your organization.

Education

Master’s degree in Finance or Economics

February 2017

Skills

- Cusip & Sedol Codes

- Bond Math & Calculations

- Excel (Advanced)

- Bloomberg

- Capital IQ & FactSet

- Credit & Risk Analysis

Work Experience

Bond Analyst

- Monitored bond market conditions and advised clients on investment strategies.

- Negotiated and executed bond transactions with investment banks, brokers, and institutional investors.

- Utilized Bloomberg Terminal and other data sources to conduct bond research and analysis.

- Collaborated with portfolio managers, traders, and other investment professionals.

Bond Analyst

- Developed and implemented credit risk models to evaluate the financial health of potential bond issuers.

- Conducted indepth financial analysis of bond offerings, including cash flow projections, debt ratios, and market trends.

- Performed due diligence on potential bond issuers, including site visits, financial reviews, and legal document examination.

- Created and maintained comprehensive bond portfolios tailored to specific investor objectives.

Accomplishments

- Developed and implemented a proprietary credit risk model that improved portfolio performance by 20%.

- Led a team of analysts in conducting due diligence on a complex bond issuance, resulting in a successful transaction with favorable terms.

- Identified and mitigated potential risks in bond investments, preventing losses and safeguarding portfolio value.

- Built strong relationships with bond issuers and investors, enabling effective deal sourcing and execution.

- Developed and managed a $1 billion bond portfolio with a focus on municipal and corporate bonds, achieving superior returns and low volatility.

Awards

- Received the Analyst of the Year award for outstanding performance in credit analysis and portfolio management.

- Recognized with the Bond Star award for exceptional contributions to the industry as a thought leader.

- Consistently ranked as a top performer in industry benchmarks for bond analysis accuracy and portfolio returns.

- Received the Outstanding Contribution to Bond Research award for groundbreaking research on fixed income markets.

Certificates

- Fundamentals of Fixed Income (FFI)

- Certified Financial Analyst (CFA)

- Chartered Alternative Investment Analyst (CAIA)

- Financial Risk Manager (FRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bond Analyst

Highlight your analytical and modeling skills.

Bond analysts need to be able to analyze complex financial data and develop sophisticated models to assess the risk and return of bonds. Make sure to highlight your skills in this area on your resume.Quantify your results.

When describing your experience, be sure to quantify your results whenever possible. For example, you might say that you “developed a credit risk model that reduced the portfolio’s default rate by 20%” or “created a bond portfolio that generated a 10% return over a three-year period.”Showcase your knowledge of the bond market.

Bond analysts need to have a deep understanding of the bond market. Make sure to highlight your knowledge of different types of bonds, bond pricing, and bond market trends on your resume.Network with other bond professionals.

Networking is important for any job search, but it is especially important for bond analysts. Attend industry events, join professional organizations, and connect with other bond professionals on LinkedIn.Be prepared to answer technical questions.

In your interviews, you may be asked technical questions about bond analysis. Be prepared to answer these questions clearly and concisely.

Essential Experience Highlights for a Strong Bond Analyst Resume

- Developed and implemented credit risk models to evaluate the financial health of potential bond issuers.

- Conducted in-depth financial analysis of bond offerings, including cash flow projections, debt ratios, and market trends.

- Performed due diligence on potential bond issuers, including site visits, financial reviews, and legal document examination.

- Created and maintained comprehensive bond portfolios tailored to specific investor objectives.

- Monitored bond market conditions and advised clients on investment strategies.

- Negotiated and executed bond transactions with investment banks, brokers, and institutional investors.

- Collaborated with portfolio managers, traders, and other investment professionals.

Frequently Asked Questions (FAQ’s) For Bond Analyst

What is the job description of a Bond Analyst?

Bond Analysts analyze the creditworthiness of potential bond issuers, such as corporations and governments. They evaluate the issuer’s financial health, industry trends, and economic conditions to determine the risk of default. Bond Analysts also make recommendations on which bonds to buy or sell based on their analysis.

What are the educational requirements for a Bond Analyst?

Most Bond Analysts have a bachelor’s degree in finance, economics, or a related field. Some employers may also require a master’s degree in finance or a related field.

What are the skills required for a Bond Analyst?

Bond Analysts need to have strong analytical and modeling skills, as well as a deep understanding of the bond market. They also need to be able to communicate their findings clearly and concisely to clients and other stakeholders.

What is the job outlook for Bond Analysts?

The job outlook for Bond Analysts is expected to be good over the next few years. The demand for Bond Analysts is expected to grow as investors continue to seek professional advice on which bonds to buy or sell.

What is the average salary for a Bond Analyst?

The average salary for a Bond Analyst is $85,000 per year.

What are the career advancement opportunities for a Bond Analyst?

Bond Analysts can advance to more senior positions, such as Portfolio Manager or Chief Investment Officer. They may also move into other areas of the financial industry, such as investment banking or sales and trading.

What are the job benefits for a Bond Analyst?

Bond Analysts typically receive a competitive salary and benefits package, including health insurance, dental insurance, vision insurance, and retirement benefits.

What are the challenges of being a Bond Analyst?

Bond Analysts face a number of challenges, including the need to stay up-to-date on the latest market trends, the need to analyze complex financial data, and the need to make recommendations in a timely manner.