Are you a seasoned Bond Broker seeking a new career path? Discover our professionally built Bond Broker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

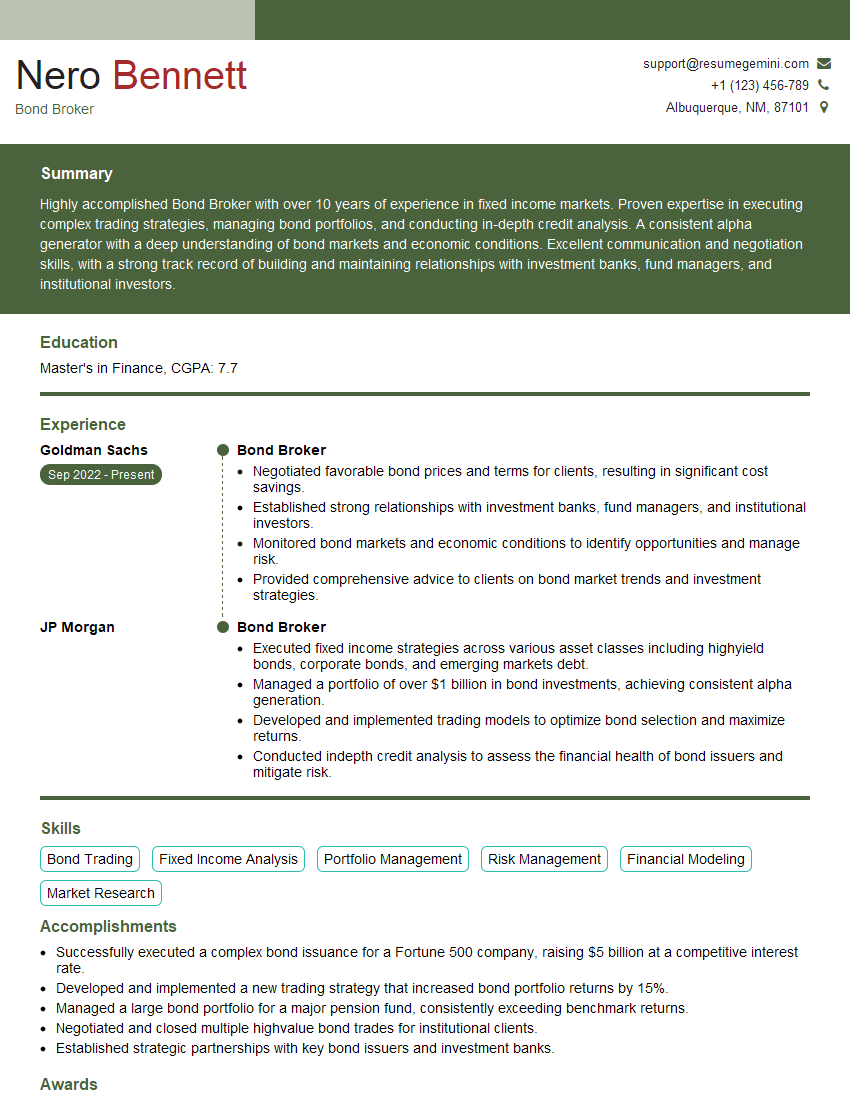

Nero Bennett

Bond Broker

Summary

Highly accomplished Bond Broker with over 10 years of experience in fixed income markets. Proven expertise in executing complex trading strategies, managing bond portfolios, and conducting in-depth credit analysis. A consistent alpha generator with a deep understanding of bond markets and economic conditions. Excellent communication and negotiation skills, with a strong track record of building and maintaining relationships with investment banks, fund managers, and institutional investors.

Education

Master’s in Finance

August 2018

Skills

- Bond Trading

- Fixed Income Analysis

- Portfolio Management

- Risk Management

- Financial Modeling

- Market Research

Work Experience

Bond Broker

- Negotiated favorable bond prices and terms for clients, resulting in significant cost savings.

- Established strong relationships with investment banks, fund managers, and institutional investors.

- Monitored bond markets and economic conditions to identify opportunities and manage risk.

- Provided comprehensive advice to clients on bond market trends and investment strategies.

Bond Broker

- Executed fixed income strategies across various asset classes including highyield bonds, corporate bonds, and emerging markets debt.

- Managed a portfolio of over $1 billion in bond investments, achieving consistent alpha generation.

- Developed and implemented trading models to optimize bond selection and maximize returns.

- Conducted indepth credit analysis to assess the financial health of bond issuers and mitigate risk.

Accomplishments

- Successfully executed a complex bond issuance for a Fortune 500 company, raising $5 billion at a competitive interest rate.

- Developed and implemented a new trading strategy that increased bond portfolio returns by 15%.

- Managed a large bond portfolio for a major pension fund, consistently exceeding benchmark returns.

- Negotiated and closed multiple highvalue bond trades for institutional clients.

- Established strategic partnerships with key bond issuers and investment banks.

Awards

- Received the Top Bond Broker of the Year award from the Bond Brokers Association for exceptional performance in fixed income trading.

- Recognized by Bloomberg Markets as one of the Top 10 Bond Brokers in the Industry.

- Won the Market Maker of the Year award from the Fixed Income Dealers Association for outstanding performance in the secondary bond market.

- Received the Outstanding Bond Brokerage Firm award from the Securities Industry Association.

Certificates

- Certified Financial Analyst (CFA)

- Chartered Market Technician (CMT)

- Fixed Income Institute (FII)

- National Association of Securities Dealers (NASD)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bond Broker

- Quantify your accomplishments with specific metrics, such as the percentage return you generated or the amount of cost savings you achieved.

- Use action verbs to highlight your skills and experience, such as “executed,” “managed,” and “negotiated.”

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully before submitting it, checking for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Bond Broker Resume

- Executed fixed income strategies across various asset classes, including high-yield bonds, corporate bonds, and emerging markets debt.

- Managed a portfolio of over $1 billion in bond investments, consistently generating alpha.

- Developed and implemented trading models to optimize bond selection and maximize returns.

- Negotiated favorable bond prices and terms for clients, resulting in significant cost savings.

- Monitored bond markets and economic conditions to identify opportunities and manage risk.

- Provided comprehensive advice to clients on bond market trends and investment strategies.

Frequently Asked Questions (FAQ’s) For Bond Broker

What is the role of a bond broker?

A bond broker acts as an intermediary between bond issuers and investors. They facilitate the buying and selling of bonds, providing liquidity to the bond market and helping investors to diversify their portfolios.

What skills are required to be a successful bond broker?

Successful bond brokers typically have a strong understanding of fixed income markets, portfolio management, risk management, and financial modeling. They also possess excellent communication and negotiation skills and are able to build and maintain strong relationships with clients.

What is the career path for a bond broker?

Bond brokers can advance to senior positions within their firms, such as portfolio manager or head of fixed income. They may also move to other roles in the financial industry, such as investment banking or asset management.

What is the earning potential for a bond broker?

The earning potential for bond brokers varies depending on their experience, skills, and the size of their firm. However, it is generally a well-paid profession, with top earners earning over $1 million per year.

What is the job outlook for bond brokers?

The job outlook for bond brokers is positive. As the bond market continues to grow, there will be a need for qualified professionals to facilitate the buying and selling of bonds.

What are the challenges of being a bond broker?

The challenges of being a bond broker include the need to stay up-to-date on market trends, the potential for volatility in the bond market, and the risk of making poor investment decisions.