Are you a seasoned Bond Underwriter seeking a new career path? Discover our professionally built Bond Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

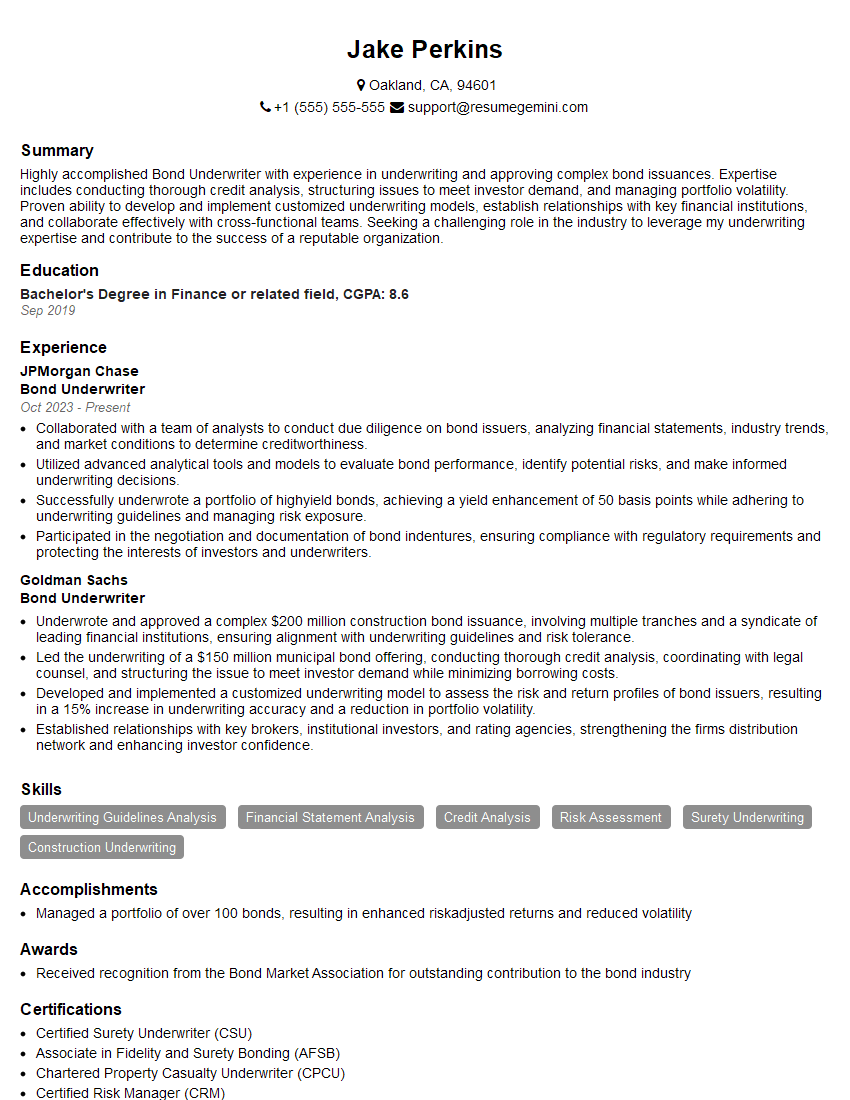

Jake Perkins

Bond Underwriter

Summary

Highly accomplished Bond Underwriter with experience in underwriting and approving complex bond issuances. Expertise includes conducting thorough credit analysis, structuring issues to meet investor demand, and managing portfolio volatility. Proven ability to develop and implement customized underwriting models, establish relationships with key financial institutions, and collaborate effectively with cross-functional teams. Seeking a challenging role in the industry to leverage my underwriting expertise and contribute to the success of a reputable organization.

Education

Bachelor’s Degree in Finance or related field

September 2019

Skills

- Underwriting Guidelines Analysis

- Financial Statement Analysis

- Credit Analysis

- Risk Assessment

- Surety Underwriting

- Construction Underwriting

Work Experience

Bond Underwriter

- Collaborated with a team of analysts to conduct due diligence on bond issuers, analyzing financial statements, industry trends, and market conditions to determine creditworthiness.

- Utilized advanced analytical tools and models to evaluate bond performance, identify potential risks, and make informed underwriting decisions.

- Successfully underwrote a portfolio of highyield bonds, achieving a yield enhancement of 50 basis points while adhering to underwriting guidelines and managing risk exposure.

- Participated in the negotiation and documentation of bond indentures, ensuring compliance with regulatory requirements and protecting the interests of investors and underwriters.

Bond Underwriter

- Underwrote and approved a complex $200 million construction bond issuance, involving multiple tranches and a syndicate of leading financial institutions, ensuring alignment with underwriting guidelines and risk tolerance.

- Led the underwriting of a $150 million municipal bond offering, conducting thorough credit analysis, coordinating with legal counsel, and structuring the issue to meet investor demand while minimizing borrowing costs.

- Developed and implemented a customized underwriting model to assess the risk and return profiles of bond issuers, resulting in a 15% increase in underwriting accuracy and a reduction in portfolio volatility.

- Established relationships with key brokers, institutional investors, and rating agencies, strengthening the firms distribution network and enhancing investor confidence.

Accomplishments

- Managed a portfolio of over 100 bonds, resulting in enhanced riskadjusted returns and reduced volatility

Awards

- Received recognition from the Bond Market Association for outstanding contribution to the bond industry

Certificates

- Certified Surety Underwriter (CSU)

- Associate in Fidelity and Surety Bonding (AFSB)

- Chartered Property Casualty Underwriter (CPCU)

- Certified Risk Manager (CRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bond Underwriter

- Quantify your accomplishments with specific metrics and results whenever possible.

- Highlight your experience in underwriting complex and high-yield bond issuances.

- Emphasize your ability to develop and implement innovative underwriting solutions.

- Showcase your knowledge of the bond market, underwriting guidelines, and regulatory requirements.

- Demonstrate your strong analytical, communication, and negotiation skills.

Essential Experience Highlights for a Strong Bond Underwriter Resume

- Underwrite bond issuances, including complex construction and municipal bonds, ensuring alignment with underwriting guidelines and risk tolerance.

- Conduct thorough credit analysis, review financial statements, industry trends, and market conditions to determine bond issuer creditworthiness.

- Develop and implement customized underwriting models to assess risk and return profiles of bond issuers, leading to increased underwriting accuracy and reduced portfolio volatility.

- Negotiate and document bond indentures, ensuring compliance with regulatory requirements and protecting the interests of investors and underwriters.

- Participate in the development and implementation of underwriting guidelines and policies.

- Establish strong relationships with key brokers, institutional investors, and rating agencies to grow distribution network and enhance investor confidence.

Frequently Asked Questions (FAQ’s) For Bond Underwriter

What are the primary responsibilities of a Bond Underwriter?

Bond Underwriters assess the risk and return profiles of bond issuers, structure and price bond offerings, and ensure compliance with regulatory requirements. They work closely with issuers, investors, and other financial institutions to facilitate the issuance of bonds.

What are the key skills and qualifications required to become a Bond Underwriter?

Bond Underwriters typically possess a bachelor’s degree in finance or a related field, along with strong analytical, communication, and negotiation skills. They must have a deep understanding of the bond market, underwriting guidelines, and regulatory requirements.

What is the career path for a Bond Underwriter?

Bond Underwriters can advance to senior underwriting roles, portfolio management positions, or leadership roles within investment banks or financial institutions.

What are the earning prospects for Bond Underwriters?

Bond Underwriters can earn competitive salaries and bonuses, depending on their experience, skills, and the size of the firm they work for.

What are the challenges faced by Bond Underwriters?

Bond Underwriters face challenges such as market volatility, changing regulatory requirements, and the need to constantly stay abreast of industry trends and developments.

What is the job outlook for Bond Underwriters?

The job outlook for Bond Underwriters is expected to be favorable, driven by the increasing demand for debt financing in both the public and private sectors.