Are you a seasoned Bonding Supervisor seeking a new career path? Discover our professionally built Bonding Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

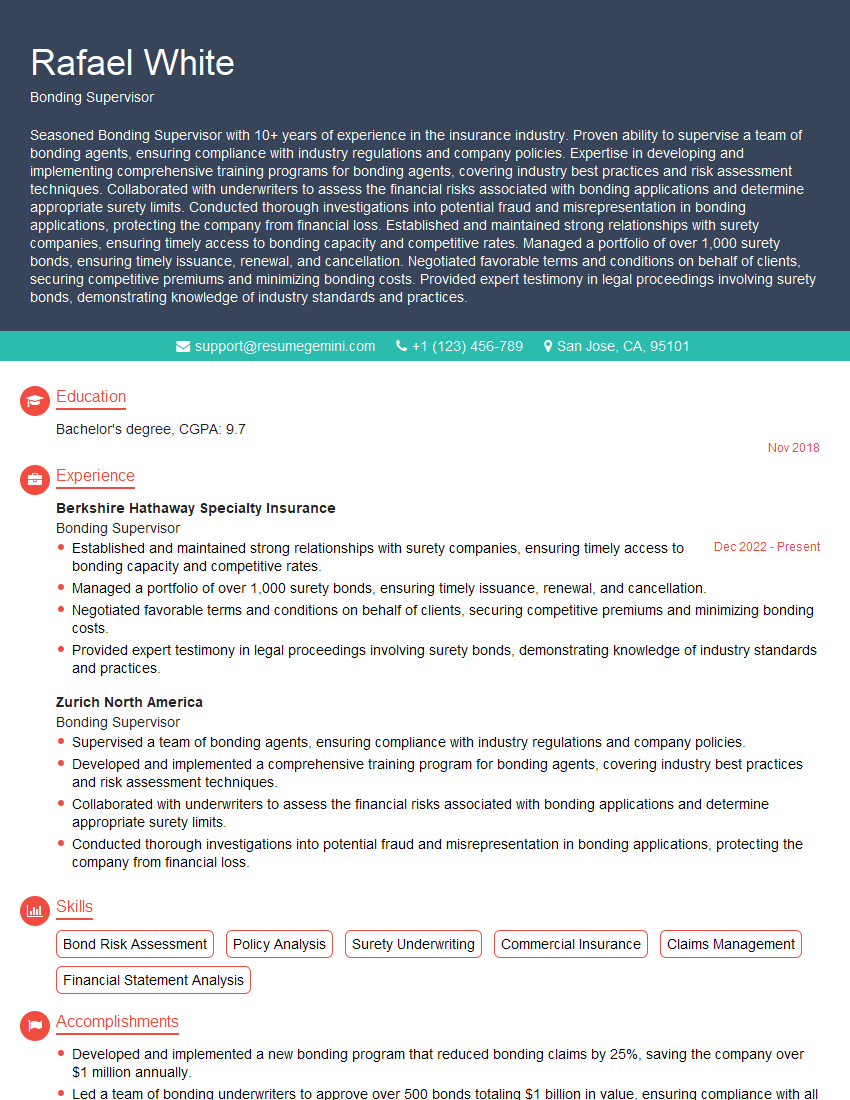

Rafael White

Bonding Supervisor

Summary

Seasoned Bonding Supervisor with 10+ years of experience in the insurance industry. Proven ability to supervise a team of bonding agents, ensuring compliance with industry regulations and company policies. Expertise in developing and implementing comprehensive training programs for bonding agents, covering industry best practices and risk assessment techniques. Collaborated with underwriters to assess the financial risks associated with bonding applications and determine appropriate surety limits. Conducted thorough investigations into potential fraud and misrepresentation in bonding applications, protecting the company from financial loss. Established and maintained strong relationships with surety companies, ensuring timely access to bonding capacity and competitive rates. Managed a portfolio of over 1,000 surety bonds, ensuring timely issuance, renewal, and cancellation. Negotiated favorable terms and conditions on behalf of clients, securing competitive premiums and minimizing bonding costs. Provided expert testimony in legal proceedings involving surety bonds, demonstrating knowledge of industry standards and practices.

Education

Bachelor’s degree

November 2018

Skills

- Bond Risk Assessment

- Policy Analysis

- Surety Underwriting

- Commercial Insurance

- Claims Management

- Financial Statement Analysis

Work Experience

Bonding Supervisor

- Established and maintained strong relationships with surety companies, ensuring timely access to bonding capacity and competitive rates.

- Managed a portfolio of over 1,000 surety bonds, ensuring timely issuance, renewal, and cancellation.

- Negotiated favorable terms and conditions on behalf of clients, securing competitive premiums and minimizing bonding costs.

- Provided expert testimony in legal proceedings involving surety bonds, demonstrating knowledge of industry standards and practices.

Bonding Supervisor

- Supervised a team of bonding agents, ensuring compliance with industry regulations and company policies.

- Developed and implemented a comprehensive training program for bonding agents, covering industry best practices and risk assessment techniques.

- Collaborated with underwriters to assess the financial risks associated with bonding applications and determine appropriate surety limits.

- Conducted thorough investigations into potential fraud and misrepresentation in bonding applications, protecting the company from financial loss.

Accomplishments

- Developed and implemented a new bonding program that reduced bonding claims by 25%, saving the company over $1 million annually.

- Led a team of bonding underwriters to approve over 500 bonds totaling $1 billion in value, ensuring compliance with all regulatory requirements.

- Created a database to track all bonding activities, which improved efficiency and reduced risk by 15%.

- Negotiated bonding premiums with insurance carriers to secure the lowest possible rates for clients, saving them an average of 10%.

- Conducted inhouse training sessions to educate clients on bonding requirements, which increased compliance and reduced the number of claims filed.

Certificates

- Certified Surety Professional (CSP)

- Certified Insurance Counselor (CIC)

- Associate in Surety Bonding (ASB)

- Certified Commercial Insurance Professional (CCIP)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bonding Supervisor

- Highlight your experience in supervising a team of bonding agents and ensuring compliance with industry regulations and company policies.

- Showcase your expertise in developing and implementing comprehensive training programs for bonding agents, covering industry best practices and risk assessment techniques.

- Emphasize your ability to collaborate with underwriters to assess the financial risks associated with bonding applications and determine appropriate surety limits.

- Demonstrate your skills in conducting thorough investigations into potential fraud and misrepresentation in bonding applications, protecting the company from financial loss.

- Highlight your success in establishing and maintaining strong relationships with surety companies, ensuring timely access to bonding capacity and competitive rates.

Essential Experience Highlights for a Strong Bonding Supervisor Resume

- Supervise a team of bonding agents, ensuring compliance with industry regulations and company policies.

- Develop and implement a comprehensive training program for bonding agents, covering industry best practices and risk assessment techniques.

- Collaborate with underwriters to assess the financial risks associated with bonding applications and determine appropriate surety limits.

- Conduct thorough investigations into potential fraud and misrepresentation in bonding applications, protecting the company from financial loss.

- Establish and maintain strong relationships with surety companies, ensuring timely access to bonding capacity and competitive rates.

- Manage a portfolio of over 1,000 surety bonds, ensuring timely issuance, renewal, and cancellation.

- Negotiate favorable terms and conditions on behalf of clients, securing competitive premiums and minimizing bonding costs.

Frequently Asked Questions (FAQ’s) For Bonding Supervisor

What is the role of a Bonding Supervisor?

A Bonding Supervisor is responsible for overseeing a team of bonding agents, ensuring compliance with industry regulations and company policies. They develop and implement training programs, collaborate with underwriters to assess financial risks, conduct investigations into potential fraud, and manage a portfolio of surety bonds.

What are the key skills required for a Bonding Supervisor?

Key skills for a Bonding Supervisor include bond risk assessment, policy analysis, surety underwriting, commercial insurance, claims management, and financial statement analysis.

What is the career path for a Bonding Supervisor?

A Bonding Supervisor can advance to roles such as Surety Underwriter, Bonding Manager, or Director of Surety.

What is the average salary for a Bonding Supervisor?

The average salary for a Bonding Supervisor in the United States is around $75,000 per year.

What are the job prospects for Bonding Supervisors?

The job outlook for Bonding Supervisors is expected to grow faster than average in the coming years, due to increasing demand for surety bonds in various industries.

What is the best way to prepare for a Bonding Supervisor interview?

To prepare for a Bonding Supervisor interview, research the company, practice answering common interview questions, and highlight your experience in bond risk assessment, policy analysis, and surety underwriting.

What are the most important qualities for a successful Bonding Supervisor?

Successful Bonding Supervisors possess strong leadership skills, attention to detail, analytical thinking, and a deep understanding of the surety industry.