Are you a seasoned Branch Manager seeking a new career path? Discover our professionally built Branch Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

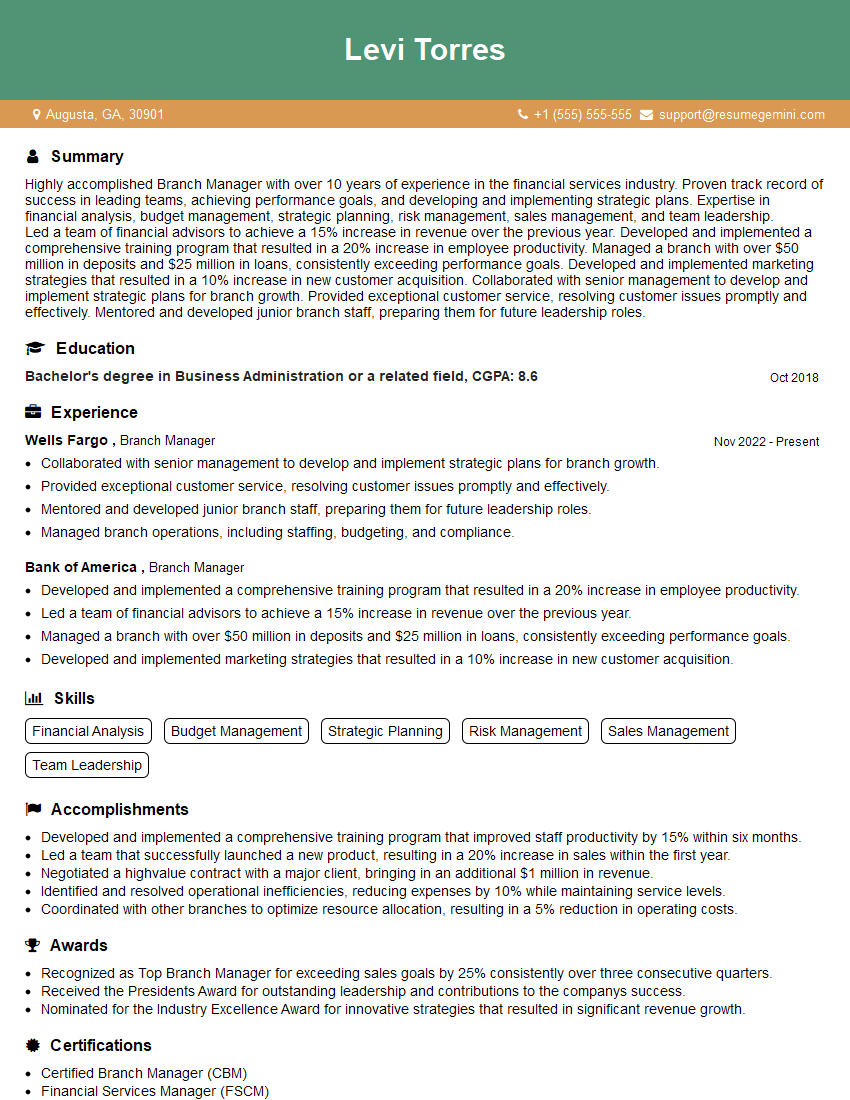

Levi Torres

Branch Manager

Summary

Highly accomplished Branch Manager with over 10 years of experience in the financial services industry. Proven track record of success in leading teams, achieving performance goals, and developing and implementing strategic plans. Expertise in financial analysis, budget management, strategic planning, risk management, sales management, and team leadership.

Led a team of financial advisors to achieve a 15% increase in revenue over the previous year. Developed and implemented a comprehensive training program that resulted in a 20% increase in employee productivity. Managed a branch with over $50 million in deposits and $25 million in loans, consistently exceeding performance goals. Developed and implemented marketing strategies that resulted in a 10% increase in new customer acquisition. Collaborated with senior management to develop and implement strategic plans for branch growth. Provided exceptional customer service, resolving customer issues promptly and effectively. Mentored and developed junior branch staff, preparing them for future leadership roles.

Education

Bachelor’s degree in Business Administration or a related field

October 2018

Skills

- Financial Analysis

- Budget Management

- Strategic Planning

- Risk Management

- Sales Management

- Team Leadership

Work Experience

Branch Manager

- Collaborated with senior management to develop and implement strategic plans for branch growth.

- Provided exceptional customer service, resolving customer issues promptly and effectively.

- Mentored and developed junior branch staff, preparing them for future leadership roles.

- Managed branch operations, including staffing, budgeting, and compliance.

Branch Manager

- Developed and implemented a comprehensive training program that resulted in a 20% increase in employee productivity.

- Led a team of financial advisors to achieve a 15% increase in revenue over the previous year.

- Managed a branch with over $50 million in deposits and $25 million in loans, consistently exceeding performance goals.

- Developed and implemented marketing strategies that resulted in a 10% increase in new customer acquisition.

Accomplishments

- Developed and implemented a comprehensive training program that improved staff productivity by 15% within six months.

- Led a team that successfully launched a new product, resulting in a 20% increase in sales within the first year.

- Negotiated a highvalue contract with a major client, bringing in an additional $1 million in revenue.

- Identified and resolved operational inefficiencies, reducing expenses by 10% while maintaining service levels.

- Coordinated with other branches to optimize resource allocation, resulting in a 5% reduction in operating costs.

Awards

- Recognized as Top Branch Manager for exceeding sales goals by 25% consistently over three consecutive quarters.

- Received the Presidents Award for outstanding leadership and contributions to the companys success.

- Nominated for the Industry Excellence Award for innovative strategies that resulted in significant revenue growth.

Certificates

- Certified Branch Manager (CBM)

- Financial Services Manager (FSCM)

- Chartered Financial Analyst (CFA)

- Certified Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Branch Manager

- Quantify your accomplishments. Use specific numbers and metrics to demonstrate the impact of your work. For example, instead of saying “Increased sales,” say “Increased sales by 15%.”.

- Highlight your leadership skills. Branch managers are responsible for leading and motivating a team. Be sure to highlight your experience in leading teams and achieving results.

- Demonstrate your financial acumen. Branch managers need to have a strong understanding of financial principles. Showcase your knowledge of financial analysis, budgeting, and risk management.

- Be concise and to the point. Resumes should be concise and easy to read. Focus on highlighting your most relevant skills and experience.

- Proofread carefully. Make sure your resume is free of errors. A well-written resume will make you stand out from the competition.

Essential Experience Highlights for a Strong Branch Manager Resume

- Lead and manage a team of financial advisors to achieve performance goals.

- Develop and implement strategic plans for branch growth.

- Manage branch operations, including staffing, budgeting, and compliance.

- Provide exceptional customer service, resolving customer issues promptly and effectively.

- Collaborate with senior management to develop and implement strategic plans.

- Monitor and analyze financial performance, identifying opportunities for growth and improvement.

- Stay abreast of industry trends and best practices, and implement them within the branch.

Frequently Asked Questions (FAQ’s) For Branch Manager

What are the key responsibilities of a Branch Manager?

Branch Managers are responsible for the overall performance of a bank or credit union branch. They lead and manage a team of financial advisors, develop and implement strategic plans, manage branch operations, provide exceptional customer service, and collaborate with senior management. Branch Managers also monitor and analyze financial performance, identify opportunities for growth and improvement, and stay abreast of industry trends and best practices.

What are the qualifications for a Branch Manager?

Branch Managers typically have a Bachelor’s degree in Business Administration or a related field. They also have several years of experience in the financial services industry, including experience in leading teams and managing branch operations. Branch Managers must also be able to demonstrate strong financial acumen, leadership skills, and customer service skills.

What are the career prospects for a Branch Manager?

Branch Managers can advance to positions such as Regional Manager, Market Manager, or District Manager. They may also move into other roles within the financial services industry, such as Wealth Management, Commercial Banking, or Investment Banking.

What are the challenges of being a Branch Manager?

Branch Managers face a number of challenges, including managing a team of financial advisors, achieving performance goals, and staying abreast of industry trends. They must also be able to deal with difficult customers and resolve customer issues promptly and effectively.

What are the rewards of being a Branch Manager?

Branch Managers are rewarded with a competitive salary and benefits package. They also have the opportunity to make a difference in the lives of their customers and employees. Branch Managers who are successful in their careers can enjoy a sense of accomplishment and satisfaction.

What are the skills required to be a successful Branch Manager?

Branch Managers need a strong foundation in financial principles and practices. They also need to be able to lead and motivate a team, manage branch operations, and provide exceptional customer service. Branch Managers must also be able to stay abreast of industry trends and best practices.

What are the different types of Branch Managers?

There are different types of Branch Managers, depending on the size and type of financial institution. Some Branch Managers are responsible for a single branch, while others are responsible for multiple branches. Some Branch Managers are responsible for retail banking, while others are responsible for commercial banking or wealth management.

What are the steps to becoming a Branch Manager?

To become a Branch Manager, you typically need to have a Bachelor’s degree in Business Administration or a related field. You also need to have several years of experience in the financial services industry, including experience in leading teams and managing branch operations. You may also need to obtain a certification, such as the Certified Branch Manager (CBM) certification.