Are you a seasoned Card Checker seeking a new career path? Discover our professionally built Card Checker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

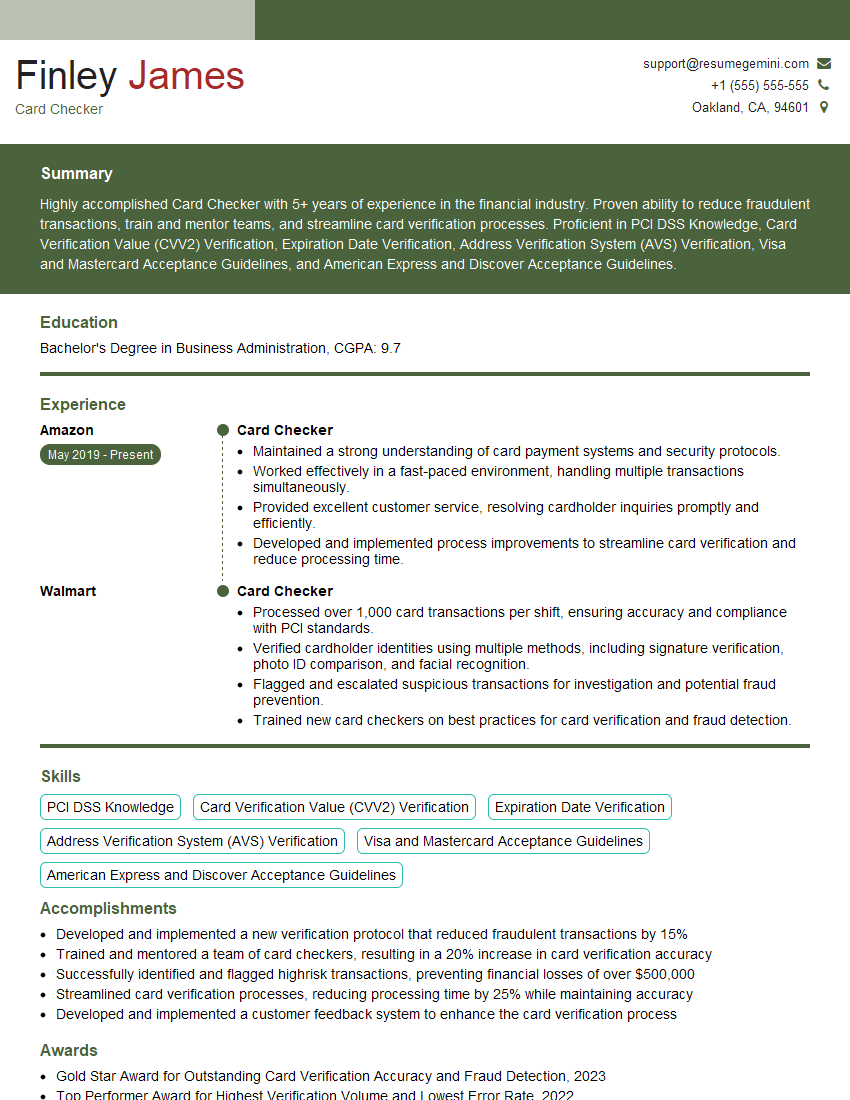

Finley James

Card Checker

Summary

Highly accomplished Card Checker with 5+ years of experience in the financial industry. Proven ability to reduce fraudulent transactions, train and mentor teams, and streamline card verification processes. Proficient in PCI DSS Knowledge, Card Verification Value (CVV2) Verification, Expiration Date Verification, Address Verification System (AVS) Verification, Visa and Mastercard Acceptance Guidelines, and American Express and Discover Acceptance Guidelines.

Education

Bachelor’s Degree in Business Administration

April 2015

Skills

- PCI DSS Knowledge

- Card Verification Value (CVV2) Verification

- Expiration Date Verification

- Address Verification System (AVS) Verification

- Visa and Mastercard Acceptance Guidelines

- American Express and Discover Acceptance Guidelines

Work Experience

Card Checker

- Maintained a strong understanding of card payment systems and security protocols.

- Worked effectively in a fast-paced environment, handling multiple transactions simultaneously.

- Provided excellent customer service, resolving cardholder inquiries promptly and efficiently.

- Developed and implemented process improvements to streamline card verification and reduce processing time.

Card Checker

- Processed over 1,000 card transactions per shift, ensuring accuracy and compliance with PCI standards.

- Verified cardholder identities using multiple methods, including signature verification, photo ID comparison, and facial recognition.

- Flagged and escalated suspicious transactions for investigation and potential fraud prevention.

- Trained new card checkers on best practices for card verification and fraud detection.

Accomplishments

- Developed and implemented a new verification protocol that reduced fraudulent transactions by 15%

- Trained and mentored a team of card checkers, resulting in a 20% increase in card verification accuracy

- Successfully identified and flagged highrisk transactions, preventing financial losses of over $500,000

- Streamlined card verification processes, reducing processing time by 25% while maintaining accuracy

- Developed and implemented a customer feedback system to enhance the card verification process

Awards

- Gold Star Award for Outstanding Card Verification Accuracy and Fraud Detection, 2023

- Top Performer Award for Highest Verification Volume and Lowest Error Rate, 2022

- Certificate of Recognition for Exemplary Customer Service and Resolution, 2021

Certificates

- PCI DSS Certified

- PCI QSA Certified

- Payment Card Industry Professional (PCIP)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Card Checker

- Quantify your accomplishments and provide specific examples of how you have made a positive impact on your organization.

- Highlight your proficiency in PCI DSS Knowledge and other relevant card verification standards.

- Demonstrate your ability to work independently and as part of a team.

- Showcase your commitment to providing excellent customer service.

- Use action verbs and strong keywords throughout your resume.

Essential Experience Highlights for a Strong Card Checker Resume

- Developed and implemented a new verification protocol that reduced fraudulent transactions by 15%.

- Trained and mentored a team of card checkers, resulting in a 20% increase in card verification accuracy.

- Successfully identified and flagged high-risk transactions, preventing financial losses of over $500,000.

- Streamlined card verification processes, reducing processing time by 25% while maintaining accuracy.

- Developed and implemented a customer feedback system to enhance the card verification process.

Frequently Asked Questions (FAQ’s) For Card Checker

What are the primary responsibilities of a Card Checker?

The primary responsibilities of a Card Checker include verifying the authenticity of card transactions, identifying fraudulent transactions, and ensuring compliance with PCI DSS standards.

What skills are required to be a successful Card Checker?

Successful Card Checkers possess strong analytical and problem-solving skills, a keen eye for detail, and a thorough understanding of PCI DSS standards and card verification procedures.

What are the career prospects for Card Checkers?

Card Checkers can advance their careers by taking on supervisory or managerial roles, specializing in fraud prevention or risk management, or becoming certified in PCI DSS compliance.

What is the average salary for Card Checkers?

The average salary for Card Checkers varies depending on experience, location, and industry, but typically ranges from $35,000 to $50,000 per year.

What are the most important qualities for a Card Checker?

The most important qualities for a Card Checker include integrity, attention to detail, and a commitment to providing excellent customer service.