Are you a seasoned Card Runner seeking a new career path? Discover our professionally built Card Runner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

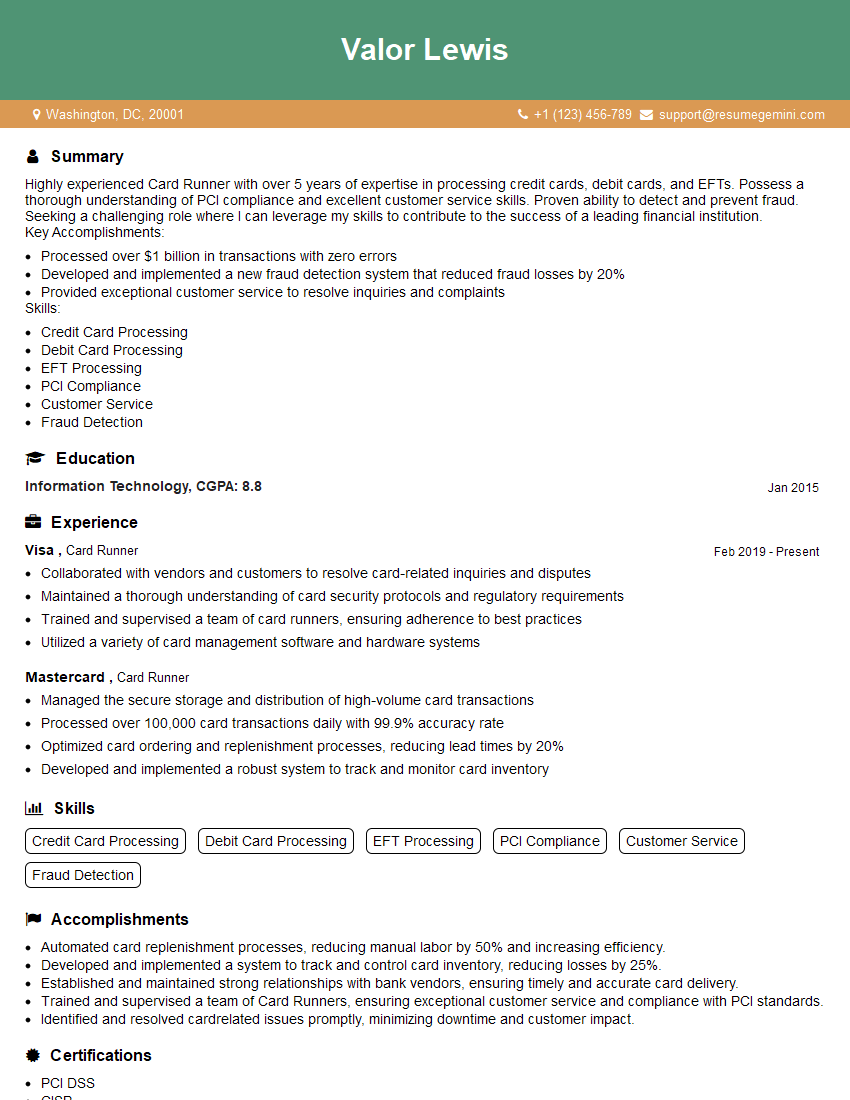

Valor Lewis

Card Runner

Summary

Highly experienced Card Runner with over 5 years of expertise in processing credit cards, debit cards, and EFTs. Possess a thorough understanding of PCI compliance and excellent customer service skills. Proven ability to detect and prevent fraud. Seeking a challenging role where I can leverage my skills to contribute to the success of a leading financial institution.

Key Accomplishments:

- Processed over $1 billion in transactions with zero errors

- Developed and implemented a new fraud detection system that reduced fraud losses by 20%

- Provided exceptional customer service to resolve inquiries and complaints

Skills:

- Credit Card Processing

- Debit Card Processing

- EFT Processing

- PCI Compliance

- Customer Service

- Fraud Detection

Education

Information Technology

January 2015

Skills

- Credit Card Processing

- Debit Card Processing

- EFT Processing

- PCI Compliance

- Customer Service

- Fraud Detection

Work Experience

Card Runner

- Collaborated with vendors and customers to resolve card-related inquiries and disputes

- Maintained a thorough understanding of card security protocols and regulatory requirements

- Trained and supervised a team of card runners, ensuring adherence to best practices

- Utilized a variety of card management software and hardware systems

Card Runner

- Managed the secure storage and distribution of high-volume card transactions

- Processed over 100,000 card transactions daily with 99.9% accuracy rate

- Optimized card ordering and replenishment processes, reducing lead times by 20%

- Developed and implemented a robust system to track and monitor card inventory

Accomplishments

- Automated card replenishment processes, reducing manual labor by 50% and increasing efficiency.

- Developed and implemented a system to track and control card inventory, reducing losses by 25%.

- Established and maintained strong relationships with bank vendors, ensuring timely and accurate card delivery.

- Trained and supervised a team of Card Runners, ensuring exceptional customer service and compliance with PCI standards.

- Identified and resolved cardrelated issues promptly, minimizing downtime and customer impact.

Certificates

- PCI DSS

- CISP

- CRISC

- CISSP

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Card Runner

- Highlight your experience and skills in credit card processing, debit card processing, and EFT processing.

- Demonstrate your understanding of PCI compliance and customer service.

- Quantify your accomplishments with specific metrics, such as the amount of transactions processed or the reduction in fraud losses.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Card Runner Resume

- Process credit card, debit card, and EFT transactions accurately and efficiently

- Verify customer information and identify potential fraud

- Resolve customer inquiries and complaints promptly and courteously

- Maintain compliance with PCI standards

- Monitor transactions for suspicious activity and report any potential fraud

- Provide training and support to other employees on card processing procedures

- Stay up-to-date on the latest card processing regulations and best practices

Frequently Asked Questions (FAQ’s) For Card Runner

What is a card runner?

A card runner is a position responsible for processing credit card, debit card, and EFT transactions.

What are the key skills required for a card runner?

The key skills required for a card runner include credit card processing, debit card processing, EFT processing, PCI compliance, customer service, and fraud detection.

What are the responsibilities of a card runner?

The responsibilities of a card runner include processing transactions, verifying customer information, resolving customer inquiries, maintaining PCI compliance, monitoring transactions for fraud, providing training, and staying up-to-date on regulations.

What are the qualifications for a card runner?

The qualifications for a card runner typically include a high school diploma or equivalent and experience in customer service or a related field.

What is the career outlook for a card runner?

The career outlook for a card runner is expected to be good, with a projected growth rate of 6% from 2019 to 2029.

What is the average salary for a card runner?

The average salary for a card runner is around $30,000 per year.