Are you a seasoned Certified Public Accountant (CPA) seeking a new career path? Discover our professionally built Certified Public Accountant (CPA) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

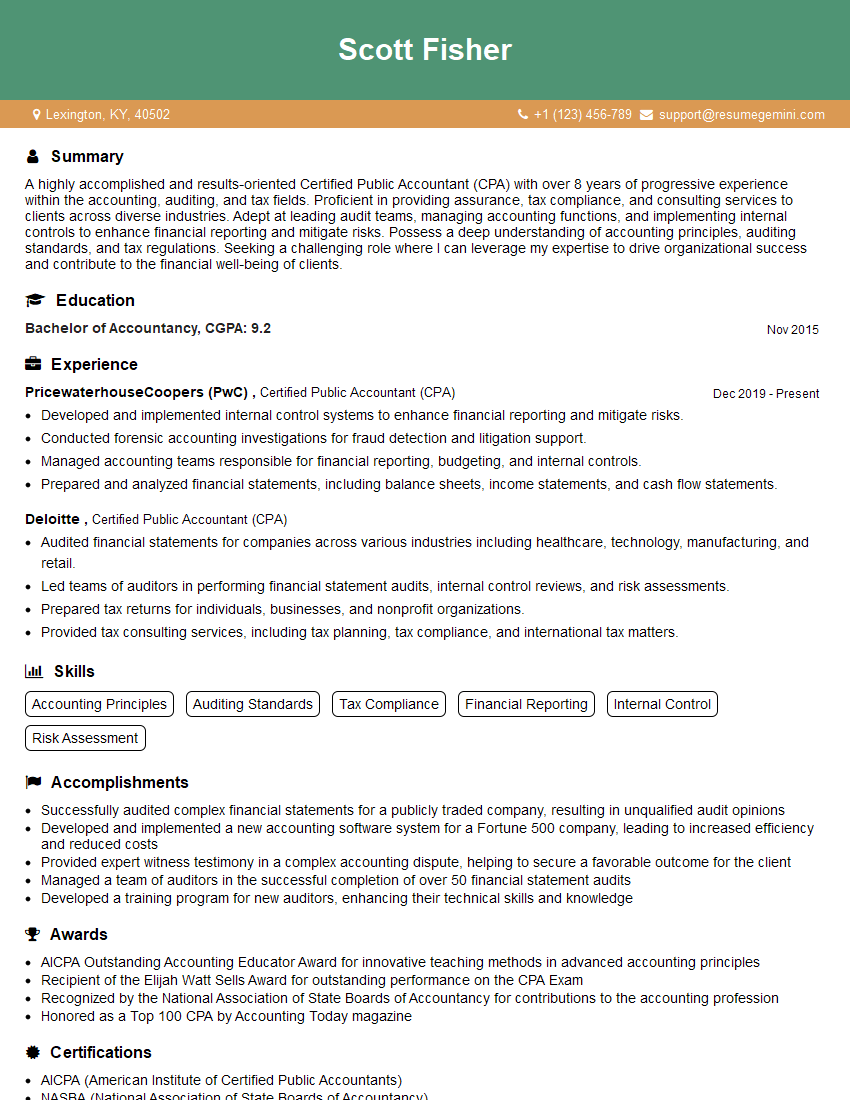

Scott Fisher

Certified Public Accountant (CPA)

Summary

A highly accomplished and results-oriented Certified Public Accountant (CPA) with over 8 years of progressive experience within the accounting, auditing, and tax fields. Proficient in providing assurance, tax compliance, and consulting services to clients across diverse industries. Adept at leading audit teams, managing accounting functions, and implementing internal controls to enhance financial reporting and mitigate risks. Possess a deep understanding of accounting principles, auditing standards, and tax regulations. Seeking a challenging role where I can leverage my expertise to drive organizational success and contribute to the financial well-being of clients.

Education

Bachelor of Accountancy

November 2015

Skills

- Accounting Principles

- Auditing Standards

- Tax Compliance

- Financial Reporting

- Internal Control

- Risk Assessment

Work Experience

Certified Public Accountant (CPA)

- Developed and implemented internal control systems to enhance financial reporting and mitigate risks.

- Conducted forensic accounting investigations for fraud detection and litigation support.

- Managed accounting teams responsible for financial reporting, budgeting, and internal controls.

- Prepared and analyzed financial statements, including balance sheets, income statements, and cash flow statements.

Certified Public Accountant (CPA)

- Audited financial statements for companies across various industries including healthcare, technology, manufacturing, and retail.

- Led teams of auditors in performing financial statement audits, internal control reviews, and risk assessments.

- Prepared tax returns for individuals, businesses, and nonprofit organizations.

- Provided tax consulting services, including tax planning, tax compliance, and international tax matters.

Accomplishments

- Successfully audited complex financial statements for a publicly traded company, resulting in unqualified audit opinions

- Developed and implemented a new accounting software system for a Fortune 500 company, leading to increased efficiency and reduced costs

- Provided expert witness testimony in a complex accounting dispute, helping to secure a favorable outcome for the client

- Managed a team of auditors in the successful completion of over 50 financial statement audits

- Developed a training program for new auditors, enhancing their technical skills and knowledge

Awards

- AICPA Outstanding Accounting Educator Award for innovative teaching methods in advanced accounting principles

- Recipient of the Elijah Watt Sells Award for outstanding performance on the CPA Exam

- Recognized by the National Association of State Boards of Accountancy for contributions to the accounting profession

- Honored as a Top 100 CPA by Accounting Today magazine

Certificates

- AICPA (American Institute of Certified Public Accountants)

- NASBA (National Association of State Boards of Accountancy)

- CFE (Certified Fraud Examiner)

- CIA (Certified Internal Auditor)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Certified Public Accountant (CPA)

- Highlight your CPA certification: As a CPA, emphasize your professional certification prominently in your resume to demonstrate your credibility and expertise.

- Showcase your industry knowledge: Specify the industries you have experience working in, as recruiters often seek candidates with industry-specific knowledge.

- Quantify your accomplishments: Use numbers and metrics to quantify your achievements, such as the number of audits conducted, tax savings generated, or internal control improvements implemented.

- Tailor your resume to the job description: Carefully review the job description and tailor your resume to match the specific requirements and keywords mentioned.

Essential Experience Highlights for a Strong Certified Public Accountant (CPA) Resume

- Audited financial statements for companies across various industries, ensuring compliance with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

- Led teams of auditors in conducting financial statement audits, internal control reviews, and risk assessments, identifying potential risks and recommending improvements.

- Prepared tax returns for individuals, businesses, and nonprofit organizations, ensuring accuracy and compliance with complex tax regulations.

- Delivered tax consulting services, including tax planning, tax compliance, and international tax matters, helping clients minimize tax liabilities and optimize tax strategies.

- Developed and implemented internal control systems to enhance financial reporting reliability, safeguard assets, and prevent fraud.

- Conducted forensic accounting investigations, uncovering financial discrepancies, and providing expert testimony in legal proceedings.

- Managed accounting teams responsible for financial reporting, budgeting, and internal controls, ensuring the accuracy and integrity of financial information.

Frequently Asked Questions (FAQ’s) For Certified Public Accountant (CPA)

What is a Certified Public Accountant (CPA)?

A Certified Public Accountant (CPA) is a licensed and regulated accounting professional who has met specific educational, experience, and examination requirements. CPAs are authorized to perform a wide range of accounting, auditing, and tax services, including financial statement audits, tax preparation, and consulting.

What are the qualifications to become a CPA?

To become a CPA, individuals typically need a bachelor’s degree in accounting or a related field, must pass the Uniform CPA Examination, and meet specific work experience requirements. Each state has its own licensing requirements, which may vary slightly.

What are the benefits of becoming a CPA?

Becoming a CPA offers numerous benefits, including increased job opportunities, higher earning potential, enhanced credibility and professional recognition, and greater career advancement prospects.

What is the job outlook for CPAs?

The job outlook for CPAs is expected to remain strong in the coming years due to the increasing demand for accounting, auditing, and tax services. CPAs with specialized skills and experience, such as forensic accounting or international tax, are in particularly high demand.

What are the key skills and qualities of a successful CPA?

Successful CPAs typically possess a strong understanding of accounting principles and auditing standards, excellent analytical and problem-solving skills, attention to detail, and effective communication and interpersonal abilities.

What are the different types of services that CPAs provide?

CPAs provide a wide range of services, including financial statement audits, tax preparation and planning, internal control reviews, forensic accounting, and consulting services.

Is it necessary to have a CPA license to work as an accountant?

While it is not always necessary to have a CPA license to work as an accountant, having a CPA license can provide significant advantages in terms of career opportunities, earning potential, and professional recognition.

What is the CPA Exam like?

The CPA Exam is a rigorous four-part exam that covers auditing and attestation, financial accounting and reporting, regulation, and business environment and concepts. Each part of the exam is three hours long and is computer-based.