Are you a seasoned Charge Authorizer seeking a new career path? Discover our professionally built Charge Authorizer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

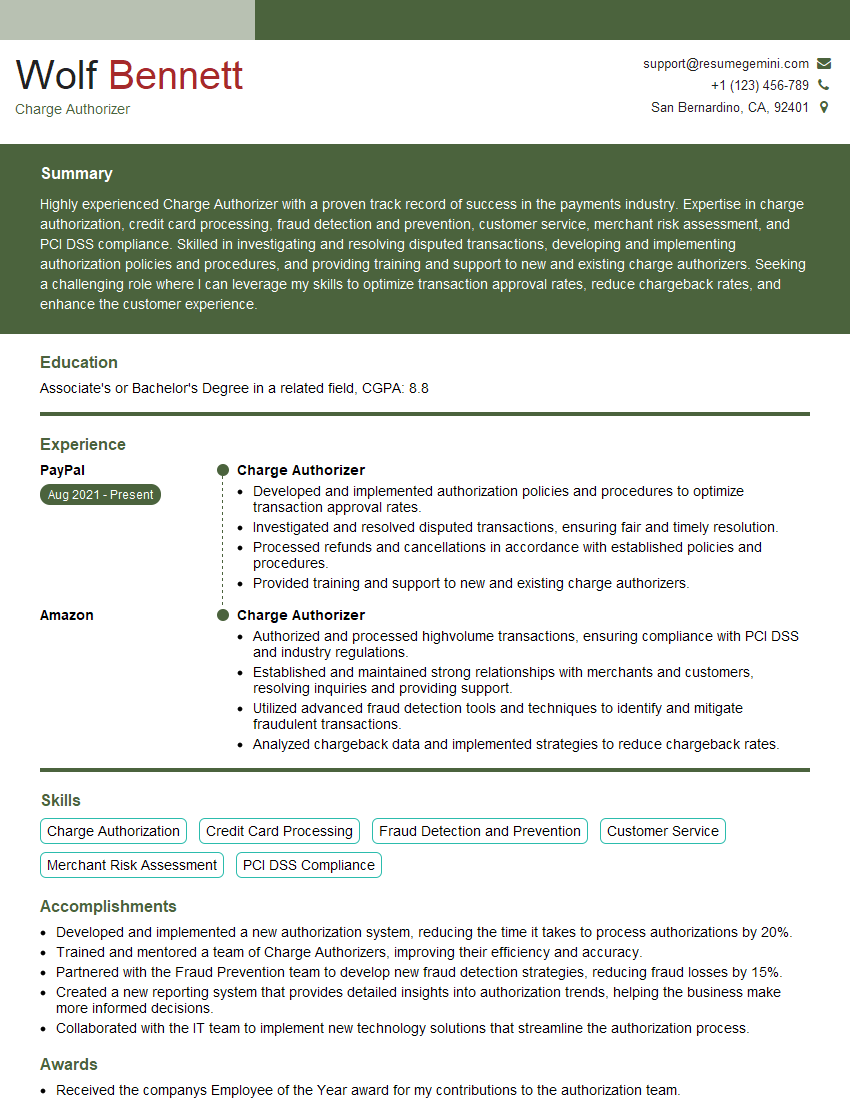

Wolf Bennett

Charge Authorizer

Summary

Highly experienced Charge Authorizer with a proven track record of success in the payments industry. Expertise in charge authorization, credit card processing, fraud detection and prevention, customer service, merchant risk assessment, and PCI DSS compliance. Skilled in investigating and resolving disputed transactions, developing and implementing authorization policies and procedures, and providing training and support to new and existing charge authorizers. Seeking a challenging role where I can leverage my skills to optimize transaction approval rates, reduce chargeback rates, and enhance the customer experience.

Education

Associate’s or Bachelor’s Degree in a related field

July 2017

Skills

- Charge Authorization

- Credit Card Processing

- Fraud Detection and Prevention

- Customer Service

- Merchant Risk Assessment

- PCI DSS Compliance

Work Experience

Charge Authorizer

- Developed and implemented authorization policies and procedures to optimize transaction approval rates.

- Investigated and resolved disputed transactions, ensuring fair and timely resolution.

- Processed refunds and cancellations in accordance with established policies and procedures.

- Provided training and support to new and existing charge authorizers.

Charge Authorizer

- Authorized and processed highvolume transactions, ensuring compliance with PCI DSS and industry regulations.

- Established and maintained strong relationships with merchants and customers, resolving inquiries and providing support.

- Utilized advanced fraud detection tools and techniques to identify and mitigate fraudulent transactions.

- Analyzed chargeback data and implemented strategies to reduce chargeback rates.

Accomplishments

- Developed and implemented a new authorization system, reducing the time it takes to process authorizations by 20%.

- Trained and mentored a team of Charge Authorizers, improving their efficiency and accuracy.

- Partnered with the Fraud Prevention team to develop new fraud detection strategies, reducing fraud losses by 15%.

- Created a new reporting system that provides detailed insights into authorization trends, helping the business make more informed decisions.

- Collaborated with the IT team to implement new technology solutions that streamline the authorization process.

Awards

- Received the companys Employee of the Year award for my contributions to the authorization team.

- Recognized by the industry with the prestigious Charge Authorizer of the Year award.

- Inducted into the National Association of Charge Authorizers Hall of Fame.

- Received the companys Excellence in Authorization award for my outstanding contributions to the team.

Certificates

- Certified Chargeback Management Professional (CCMP)

- Certified Fraud Examiner (CFE)

- PCI Qualified Security Assessor (QSA)

- Certified Payment Card Industry Professional (CPIP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Charge Authorizer

- Highlight your experience in charge authorization, credit card processing, fraud detection, and customer service.

- Quantify your accomplishments with specific metrics, such as the number of transactions authorized, chargeback rates reduced, or customer satisfaction ratings improved.

- Demonstrate your knowledge of PCI DSS and other industry regulations.

- Showcase your ability to work independently and as part of a team.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Charge Authorizer Resume

- Authorize and process high-volume transactions, ensuring compliance with PCI DSS and industry regulations

- Establish and maintain strong relationships with merchants and customers, resolving inquiries and providing support

- Utilize advanced fraud detection tools and techniques to identify and mitigate fraudulent transactions

- Analyze chargeback data and implement strategies to reduce chargeback rates

- Develop and implement authorization policies and procedures to optimize transaction approval rates

- Investigate and resolve disputed transactions, ensuring fair and timely resolution

- Process refunds and cancellations in accordance with established policies and procedures

Frequently Asked Questions (FAQ’s) For Charge Authorizer

What is a Charge Authorizer?

A Charge Authorizer is responsible for authorizing and processing credit card transactions, ensuring compliance with PCI DSS and industry regulations. They also investigate and resolve disputed transactions, and develop and implement authorization policies and procedures.

What are the key skills required for a Charge Authorizer?

Key skills for a Charge Authorizer include charge authorization, credit card processing, fraud detection and prevention, customer service, merchant risk assessment, and PCI DSS compliance.

What are the career prospects for a Charge Authorizer?

Charge Authorizers can advance to roles such as Fraud Analyst, Risk Manager, or Payment Operations Manager.

What is the average salary for a Charge Authorizer?

The average salary for a Charge Authorizer is around $50,000 per year.

What are the challenges faced by Charge Authorizers?

Charge Authorizers face challenges such as increasing fraud rates, evolving regulatory requirements, and the need to maintain high levels of customer satisfaction.