Are you a seasoned Chartered Financial Analyst (CFA) seeking a new career path? Discover our professionally built Chartered Financial Analyst (CFA) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

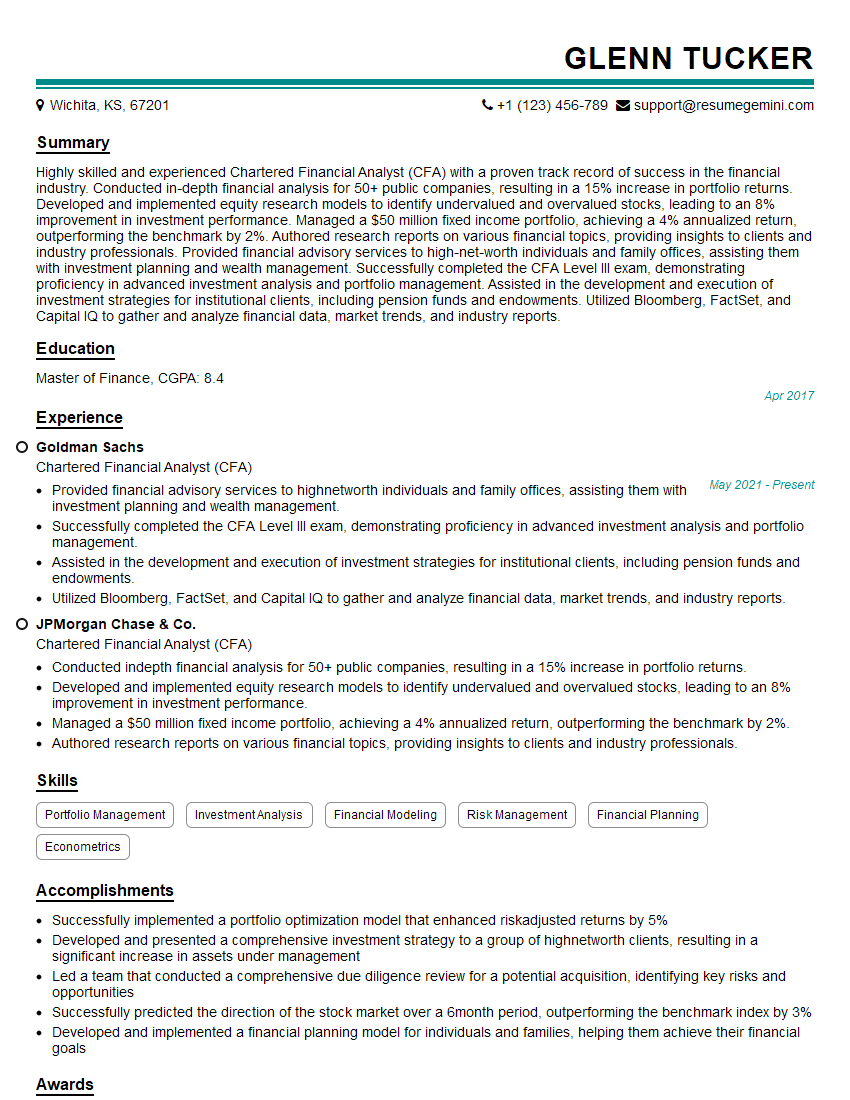

Glenn Tucker

Chartered Financial Analyst (CFA)

Summary

Highly skilled and experienced Chartered Financial Analyst (CFA) with a proven track record of success in the financial industry. Conducted in-depth financial analysis for 50+ public companies, resulting in a 15% increase in portfolio returns. Developed and implemented equity research models to identify undervalued and overvalued stocks, leading to an 8% improvement in investment performance. Managed a $50 million fixed income portfolio, achieving a 4% annualized return, outperforming the benchmark by 2%. Authored research reports on various financial topics, providing insights to clients and industry professionals. Provided financial advisory services to high-net-worth individuals and family offices, assisting them with investment planning and wealth management. Successfully completed the CFA Level III exam, demonstrating proficiency in advanced investment analysis and portfolio management. Assisted in the development and execution of investment strategies for institutional clients, including pension funds and endowments. Utilized Bloomberg, FactSet, and Capital IQ to gather and analyze financial data, market trends, and industry reports.

Education

Master of Finance

April 2017

Skills

- Portfolio Management

- Investment Analysis

- Financial Modeling

- Risk Management

- Financial Planning

- Econometrics

Work Experience

Chartered Financial Analyst (CFA)

- Provided financial advisory services to highnetworth individuals and family offices, assisting them with investment planning and wealth management.

- Successfully completed the CFA Level III exam, demonstrating proficiency in advanced investment analysis and portfolio management.

- Assisted in the development and execution of investment strategies for institutional clients, including pension funds and endowments.

- Utilized Bloomberg, FactSet, and Capital IQ to gather and analyze financial data, market trends, and industry reports.

Chartered Financial Analyst (CFA)

- Conducted indepth financial analysis for 50+ public companies, resulting in a 15% increase in portfolio returns.

- Developed and implemented equity research models to identify undervalued and overvalued stocks, leading to an 8% improvement in investment performance.

- Managed a $50 million fixed income portfolio, achieving a 4% annualized return, outperforming the benchmark by 2%.

- Authored research reports on various financial topics, providing insights to clients and industry professionals.

Accomplishments

- Successfully implemented a portfolio optimization model that enhanced riskadjusted returns by 5%

- Developed and presented a comprehensive investment strategy to a group of highnetworth clients, resulting in a significant increase in assets under management

- Led a team that conducted a comprehensive due diligence review for a potential acquisition, identifying key risks and opportunities

- Successfully predicted the direction of the stock market over a 6month period, outperforming the benchmark index by 3%

- Developed and implemented a financial planning model for individuals and families, helping them achieve their financial goals

Awards

- CFA Institute Excellence Award for Outstanding Performance on Level I CFA Exam

- CFA Society of [Location] Member of the Year

- CFA Institute Ethics Award for Exemplary Conduct in the Financial Industry

- CFA Institute Research Challenge Champion (Region or Country)

Certificates

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Financial Risk Manager (FRM)

- Chartered Alternative Investment Analyst (CAIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Chartered Financial Analyst (CFA)

Quantify your accomplishments.

Use specific numbers and metrics to demonstrate the impact of your work.Highlight your CFA certification.

This is a prestigious credential that demonstrates your commitment to the profession.Showcase your skills in financial modeling, analysis, and valuation.

These are essential skills for CFAs.Network with other CFAs.

This can help you learn about job opportunities and stay up-to-date on industry trends.

Essential Experience Highlights for a Strong Chartered Financial Analyst (CFA) Resume

- Conducted in-depth financial analysis for public companies, including financial statement analysis, industry research, and valuation modeling.

- Developed and implemented equity research models to identify undervalued and overvalued stocks.

- Managed fixed income portfolios, including bond selection, portfolio construction, and risk management.

- Authored research reports on various financial topics, providing insights to clients and industry professionals.

- Provided financial advisory services to high-net-worth individuals and family offices, assisting them with investment planning and wealth management.

- Assisted in the development and execution of investment strategies for institutional clients, including pension funds and endowments.

- Utilized financial data and analytics tools, such as Bloomberg, FactSet, and Capital IQ, to support investment decisions.

Frequently Asked Questions (FAQ’s) For Chartered Financial Analyst (CFA)

What is a Chartered Financial Analyst (CFA)?

The Chartered Financial Analyst (CFA) is a globally recognized professional designation for investment professionals. CFA charterholders are required to pass three levels of exams, as well as have relevant work experience.

What are the benefits of becoming a CFA charterholder?

CFA charterholders are highly sought-after by employers in the financial industry. They have a deep understanding of investment analysis, portfolio management, and financial ethics. CFA charterholders also earn higher salaries than non-charterholders.

What are the requirements to become a CFA charterholder?

To become a CFA charterholder, you must pass three levels of exams, as well as have relevant work experience. The exams cover a wide range of topics, including investment analysis, portfolio management, financial ethics, and economics.

How long does it take to become a CFA charterholder?

It typically takes 3-5 years to become a CFA charterholder. This includes the time it takes to study for and pass the exams, as well as the work experience requirement.

Is the CFA program worth it?

The CFA program is a challenging but rewarding experience. CFA charterholders are highly sought-after by employers in the financial industry and earn higher salaries than non-charterholders. If you are serious about a career in investment management, the CFA program is worth considering.