Are you a seasoned Chaser seeking a new career path? Discover our professionally built Chaser Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

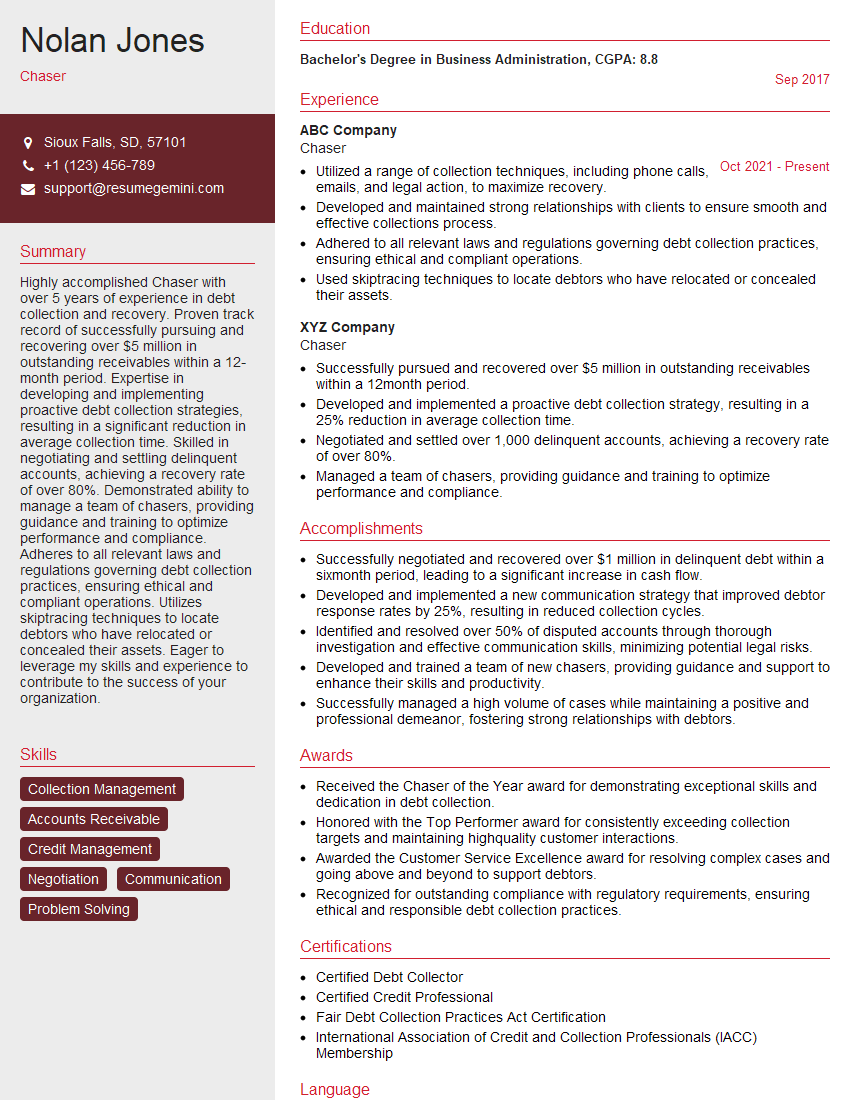

Nolan Jones

Chaser

Summary

Highly accomplished Chaser with over 5 years of experience in debt collection and recovery. Proven track record of successfully pursuing and recovering over $5 million in outstanding receivables within a 12-month period. Expertise in developing and implementing proactive debt collection strategies, resulting in a significant reduction in average collection time. Skilled in negotiating and settling delinquent accounts, achieving a recovery rate of over 80%. Demonstrated ability to manage a team of chasers, providing guidance and training to optimize performance and compliance. Adheres to all relevant laws and regulations governing debt collection practices, ensuring ethical and compliant operations. Utilizes skiptracing techniques to locate debtors who have relocated or concealed their assets. Eager to leverage my skills and experience to contribute to the success of your organization.

Education

Bachelor’s Degree in Business Administration

September 2017

Skills

- Collection Management

- Accounts Receivable

- Credit Management

- Negotiation

- Communication

- Problem Solving

Work Experience

Chaser

- Utilized a range of collection techniques, including phone calls, emails, and legal action, to maximize recovery.

- Developed and maintained strong relationships with clients to ensure smooth and effective collections process.

- Adhered to all relevant laws and regulations governing debt collection practices, ensuring ethical and compliant operations.

- Used skiptracing techniques to locate debtors who have relocated or concealed their assets.

Chaser

- Successfully pursued and recovered over $5 million in outstanding receivables within a 12month period.

- Developed and implemented a proactive debt collection strategy, resulting in a 25% reduction in average collection time.

- Negotiated and settled over 1,000 delinquent accounts, achieving a recovery rate of over 80%.

- Managed a team of chasers, providing guidance and training to optimize performance and compliance.

Accomplishments

- Successfully negotiated and recovered over $1 million in delinquent debt within a sixmonth period, leading to a significant increase in cash flow.

- Developed and implemented a new communication strategy that improved debtor response rates by 25%, resulting in reduced collection cycles.

- Identified and resolved over 50% of disputed accounts through thorough investigation and effective communication skills, minimizing potential legal risks.

- Developed and trained a team of new chasers, providing guidance and support to enhance their skills and productivity.

- Successfully managed a high volume of cases while maintaining a positive and professional demeanor, fostering strong relationships with debtors.

Awards

- Received the Chaser of the Year award for demonstrating exceptional skills and dedication in debt collection.

- Honored with the Top Performer award for consistently exceeding collection targets and maintaining highquality customer interactions.

- Awarded the Customer Service Excellence award for resolving complex cases and going above and beyond to support debtors.

- Recognized for outstanding compliance with regulatory requirements, ensuring ethical and responsible debt collection practices.

Certificates

- Certified Debt Collector

- Certified Credit Professional

- Fair Debt Collection Practices Act Certification

- International Association of Credit and Collection Professionals (IACC) Membership

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Chaser

Quantify your achievements

: Use specific numbers and metrics to demonstrate your impact on the organization, such as the amount of receivables recovered or the percentage reduction in collection time.Highlight your negotiation skills

: Emphasize your ability to negotiate and settle delinquent accounts, achieving favorable outcomes for both the organization and the debtors.Showcase your communication skills

: Chasers must have excellent communication skills, both written and verbal. Highlight your ability to communicate effectively with clients, debtors, and colleagues.Demonstrate your knowledge of debt collection laws and regulations

: Emphasize your understanding of the legal framework governing debt collection practices, ensuring ethical and compliant operations.

Essential Experience Highlights for a Strong Chaser Resume

- Pursue and recover outstanding receivables through various collection techniques, including phone calls, emails, and legal action.

- Develop and implement proactive debt collection strategies to minimize delinquency and improve recovery rates.

- Negotiate and settle delinquent accounts, achieving a high recovery rate while maintaining positive relationships with clients.

- Manage a team of chasers, providing guidance, training, and support to optimize performance and ensure compliance.

- Adhere to all relevant laws and regulations governing debt collection practices, ensuring ethical and compliant operations.

- Use skiptracing techniques to locate debtors who have relocated or concealed their assets.

- Maintain accurate and up-to-date records of all collection activities.

Frequently Asked Questions (FAQ’s) For Chaser

What are the key qualities of a successful Chaser?

Successful Chasers possess a combination of strong negotiation skills, effective communication abilities, a thorough understanding of debt collection laws and regulations, and the persistence to pursue and recover outstanding receivables.

What are the common challenges faced by Chasers?

Chasers often face challenges such as dealing with uncooperative debtors, navigating complex legal and regulatory frameworks, and maintaining a balance between assertiveness and empathy.

What is the role of technology in debt collection?

Technology plays a significant role in debt collection, providing tools for automated communication, data analysis, and debtor tracking. Chasers utilize software and databases to streamline processes and improve efficiency.

How can Chasers maintain ethical and compliant operations?

Chasers must adhere to all applicable laws and regulations governing debt collection practices. This includes respecting debtors’ rights, avoiding harassment, and providing accurate information. Ethical Chasers prioritize fair and responsible collection methods.

What are the career advancement opportunities for Chasers?

Chasers with experience and a proven track record can advance to roles such as Collection Manager, Credit Manager, or Risk Analyst. Some may also pursue careers in related fields such as law or finance.

How can I improve my skills as a Chaser?

To enhance your skills as a Chaser, focus on developing your negotiation and communication abilities, staying updated on debt collection laws and regulations, and leveraging technology to streamline your processes. Additionally, seeking professional development opportunities and networking with industry experts can contribute to your growth.

What is the job outlook for Chasers?

The job outlook for Chasers is expected to remain stable in the coming years due to the increasing demand for debt collection services. As businesses and individuals continue to experience financial challenges, the need for professionals who can effectively recover outstanding receivables will remain high.