Are you a seasoned Check Clerk seeking a new career path? Discover our professionally built Check Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

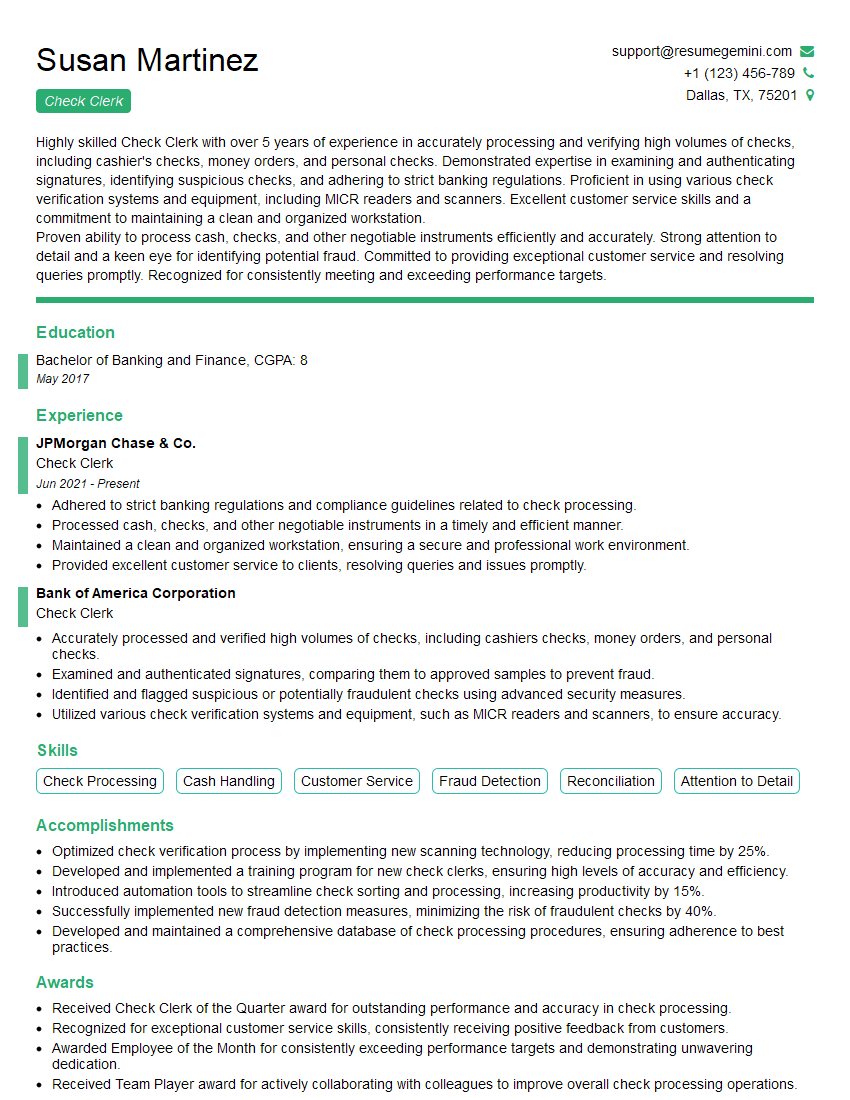

Susan Martinez

Check Clerk

Summary

Highly skilled Check Clerk with over 5 years of experience in accurately processing and verifying high volumes of checks, including cashier’s checks, money orders, and personal checks. Demonstrated expertise in examining and authenticating signatures, identifying suspicious checks, and adhering to strict banking regulations. Proficient in using various check verification systems and equipment, including MICR readers and scanners. Excellent customer service skills and a commitment to maintaining a clean and organized workstation.

Proven ability to process cash, checks, and other negotiable instruments efficiently and accurately. Strong attention to detail and a keen eye for identifying potential fraud. Committed to providing exceptional customer service and resolving queries promptly. Recognized for consistently meeting and exceeding performance targets.

Education

Bachelor of Banking and Finance

May 2017

Skills

- Check Processing

- Cash Handling

- Customer Service

- Fraud Detection

- Reconciliation

- Attention to Detail

Work Experience

Check Clerk

- Adhered to strict banking regulations and compliance guidelines related to check processing.

- Processed cash, checks, and other negotiable instruments in a timely and efficient manner.

- Maintained a clean and organized workstation, ensuring a secure and professional work environment.

- Provided excellent customer service to clients, resolving queries and issues promptly.

Check Clerk

- Accurately processed and verified high volumes of checks, including cashiers checks, money orders, and personal checks.

- Examined and authenticated signatures, comparing them to approved samples to prevent fraud.

- Identified and flagged suspicious or potentially fraudulent checks using advanced security measures.

- Utilized various check verification systems and equipment, such as MICR readers and scanners, to ensure accuracy.

Accomplishments

- Optimized check verification process by implementing new scanning technology, reducing processing time by 25%.

- Developed and implemented a training program for new check clerks, ensuring high levels of accuracy and efficiency.

- Introduced automation tools to streamline check sorting and processing, increasing productivity by 15%.

- Successfully implemented new fraud detection measures, minimizing the risk of fraudulent checks by 40%.

- Developed and maintained a comprehensive database of check processing procedures, ensuring adherence to best practices.

Awards

- Received Check Clerk of the Quarter award for outstanding performance and accuracy in check processing.

- Recognized for exceptional customer service skills, consistently receiving positive feedback from customers.

- Awarded Employee of the Month for consistently exceeding performance targets and demonstrating unwavering dedication.

- Received Team Player award for actively collaborating with colleagues to improve overall check processing operations.

Certificates

- Certified Check Processor (CCP)

- Certified Financial Services Professional (CFSP)

- Anti-Money Laundering (AML) Specialist

- Fraud Prevention Specialist (FPS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Check Clerk

- Highlight your experience in check processing and fraud detection, as these are essential skills for Check Clerks.

- Quantify your accomplishments whenever possible. For example, instead of saying “Processed a high volume of checks,” say “Processed over 10,000 checks per month with 99% accuracy.”

- Use keywords from the job description in your resume. This will help your resume get noticed by potential employers.

- Proofread your resume carefully before submitting it. Make sure there are no errors in grammar or spelling.

- Consider getting your resume reviewed by a career counselor or professional resume writer.

Essential Experience Highlights for a Strong Check Clerk Resume

- Accurately process and verify high volumes of checks, including cashier’s checks, money orders, and personal checks.

- Examine and authenticate signatures, comparing them to approved samples to prevent fraud.

- Identify and flag suspicious or potentially fraudulent checks using advanced security measures.

- Utilize various check verification systems and equipment, such as MICR readers and scanners, to ensure accuracy.

- Maintain a clean and organized workstation, ensuring a secure and professional work environment.

- Provide excellent customer service to clients, resolving queries and issues promptly.

- Adhere to strict banking regulations and compliance guidelines related to check processing.

Frequently Asked Questions (FAQ’s) For Check Clerk

What is the primary responsibility of a Check Clerk?

The primary responsibility of a Check Clerk is to process and verify checks to ensure their validity and prevent fraud.

What skills are required to be a successful Check Clerk?

Successful Check Clerks typically possess strong attention to detail, excellent customer service skills, and experience in check processing and fraud detection.

What is the average salary for a Check Clerk?

The average salary for a Check Clerk can vary depending on experience, location, and employer. According to Salary.com, the average salary for a Check Clerk in the United States is $35,000 per year.

What are the career prospects for Check Clerks?

Check Clerks can advance their careers by gaining experience in other areas of banking or finance. Some Check Clerks may also choose to pursue supervisory or management positions.

How can I prepare for a career as a Check Clerk?

To prepare for a career as a Check Clerk, you can start by completing a high school diploma or equivalent. You can also take courses in banking, finance, and customer service. Additionally, you can volunteer or intern at a bank or credit union to gain experience in check processing.