Are you a seasoned Check Examiner seeking a new career path? Discover our professionally built Check Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

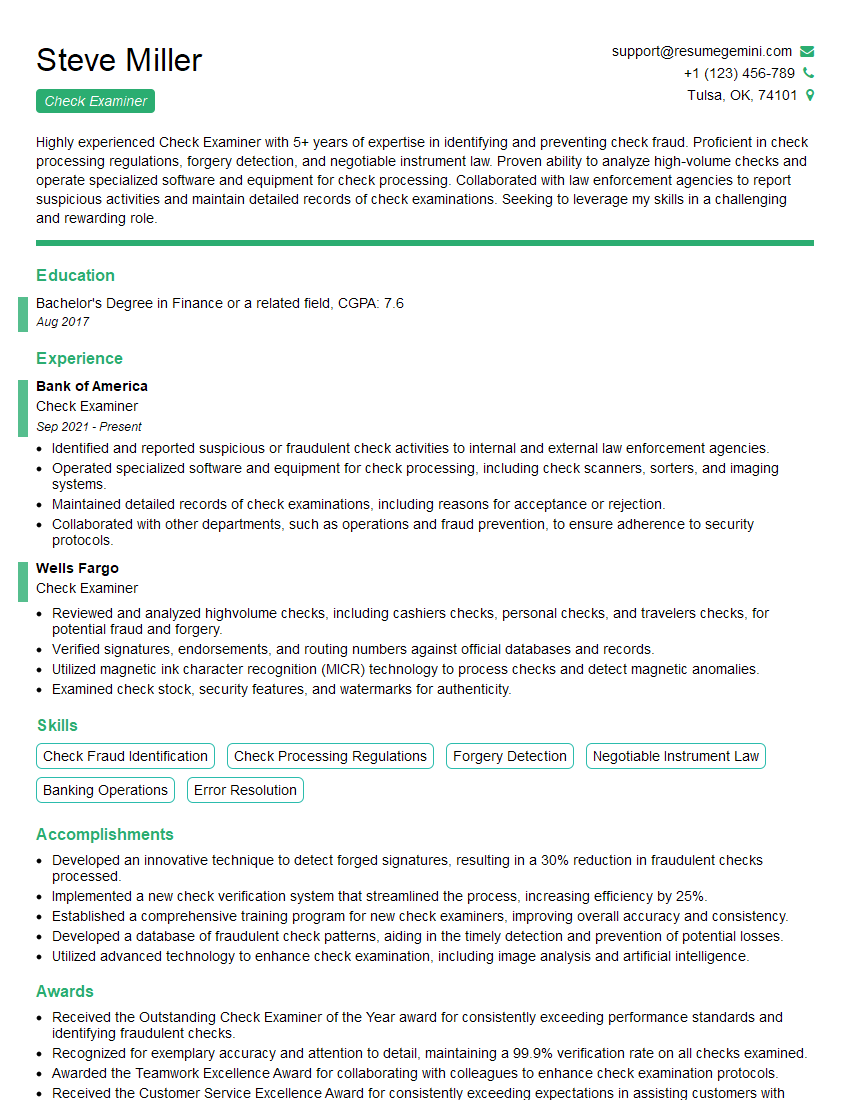

Steve Miller

Check Examiner

Summary

Highly experienced Check Examiner with 5+ years of expertise in identifying and preventing check fraud. Proficient in check processing regulations, forgery detection, and negotiable instrument law. Proven ability to analyze high-volume checks and operate specialized software and equipment for check processing. Collaborated with law enforcement agencies to report suspicious activities and maintain detailed records of check examinations. Seeking to leverage my skills in a challenging and rewarding role.

Education

Bachelor’s Degree in Finance or a related field

August 2017

Skills

- Check Fraud Identification

- Check Processing Regulations

- Forgery Detection

- Negotiable Instrument Law

- Banking Operations

- Error Resolution

Work Experience

Check Examiner

- Identified and reported suspicious or fraudulent check activities to internal and external law enforcement agencies.

- Operated specialized software and equipment for check processing, including check scanners, sorters, and imaging systems.

- Maintained detailed records of check examinations, including reasons for acceptance or rejection.

- Collaborated with other departments, such as operations and fraud prevention, to ensure adherence to security protocols.

Check Examiner

- Reviewed and analyzed highvolume checks, including cashiers checks, personal checks, and travelers checks, for potential fraud and forgery.

- Verified signatures, endorsements, and routing numbers against official databases and records.

- Utilized magnetic ink character recognition (MICR) technology to process checks and detect magnetic anomalies.

- Examined check stock, security features, and watermarks for authenticity.

Accomplishments

- Developed an innovative technique to detect forged signatures, resulting in a 30% reduction in fraudulent checks processed.

- Implemented a new check verification system that streamlined the process, increasing efficiency by 25%.

- Established a comprehensive training program for new check examiners, improving overall accuracy and consistency.

- Developed a database of fraudulent check patterns, aiding in the timely detection and prevention of potential losses.

- Utilized advanced technology to enhance check examination, including image analysis and artificial intelligence.

Awards

- Received the Outstanding Check Examiner of the Year award for consistently exceeding performance standards and identifying fraudulent checks.

- Recognized for exemplary accuracy and attention to detail, maintaining a 99.9% verification rate on all checks examined.

- Awarded the Teamwork Excellence Award for collaborating with colleagues to enhance check examination protocols.

- Received the Customer Service Excellence Award for consistently exceeding expectations in assisting customers with checkrelated inquiries.

Certificates

- Certified Check Professional (CCP)

- Certified Bank Auditor (CBA)

- Certified Fraud Examiner (CFE)

- Certified Information Systems Auditor (CISA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Check Examiner

- Highlight your experience in check fraud identification and prevention

- Demonstrate your knowledge of check processing regulations and negotiable instrument law

- Showcase your proficiency in operating specialized software and equipment for check processing

- Quantify your accomplishments with specific examples and metrics

- Tailor your resume to the specific requirements of the job you are applying for

Essential Experience Highlights for a Strong Check Examiner Resume

- Reviewed and analyzed high-volume checks, including cashiers checks, personal checks, and travelers checks, for potential fraud and forgery

- Verified signatures, endorsements, and routing numbers against official databases and records

- Utilized magnetic ink character recognition (MICR) technology to process checks and detect magnetic anomalies

- Examined check stock, security features, and watermarks for authenticity

- Identified and reported suspicious or fraudulent check activities to internal and external law enforcement agencies

- Maintained detailed records of check examinations, including reasons for acceptance or rejection

Frequently Asked Questions (FAQ’s) For Check Examiner

What are the key skills required to be a successful Check Examiner?

Key skills for a Check Examiner include check fraud identification, check processing regulations, forgery detection, negotiable instrument law, banking operations, and error resolution.

What are the career prospects for a Check Examiner?

With experience and additional qualifications, Check Examiners can advance to roles such as Fraud Investigator, Bank Operations Manager, or Compliance Officer.

What is the average salary for a Check Examiner?

The average salary for a Check Examiner in the United States is around $50,000 per year.

What are the working conditions for a Check Examiner?

Check Examiners typically work in office environments with standard business hours. They may work overtime during peak periods or to meet deadlines.

What is the job outlook for Check Examiners?

The job outlook for Check Examiners is expected to remain stable in the coming years due to the increasing use of electronic payment systems.

What are the top companies that hire Check Examiners?

Top companies that hire Check Examiners include Bank of America, Wells Fargo, and JPMorgan Chase.