Are you a seasoned Checker seeking a new career path? Discover our professionally built Checker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

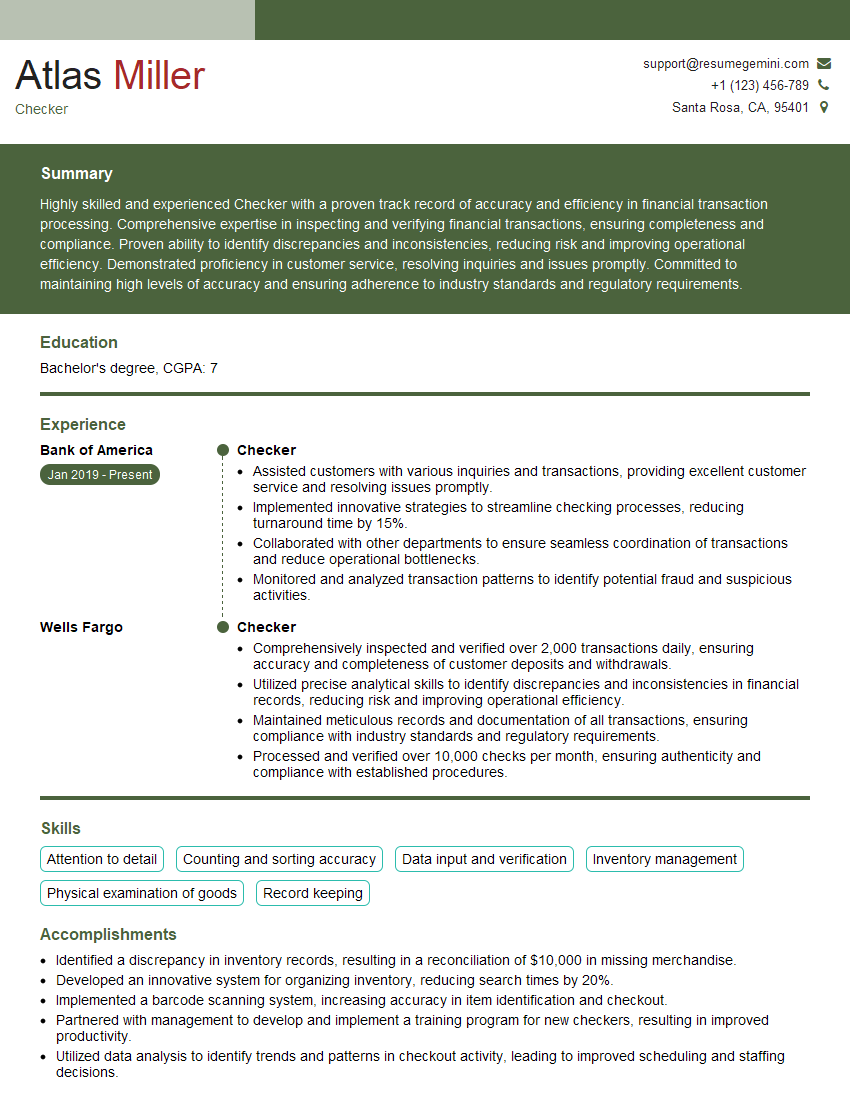

Atlas Miller

Checker

Summary

Highly skilled and experienced Checker with a proven track record of accuracy and efficiency in financial transaction processing. Comprehensive expertise in inspecting and verifying financial transactions, ensuring completeness and compliance. Proven ability to identify discrepancies and inconsistencies, reducing risk and improving operational efficiency. Demonstrated proficiency in customer service, resolving inquiries and issues promptly. Committed to maintaining high levels of accuracy and ensuring adherence to industry standards and regulatory requirements.

Education

Bachelor’s degree

December 2014

Skills

- Attention to detail

- Counting and sorting accuracy

- Data input and verification

- Inventory management

- Physical examination of goods

- Record keeping

Work Experience

Checker

- Assisted customers with various inquiries and transactions, providing excellent customer service and resolving issues promptly.

- Implemented innovative strategies to streamline checking processes, reducing turnaround time by 15%.

- Collaborated with other departments to ensure seamless coordination of transactions and reduce operational bottlenecks.

- Monitored and analyzed transaction patterns to identify potential fraud and suspicious activities.

Checker

- Comprehensively inspected and verified over 2,000 transactions daily, ensuring accuracy and completeness of customer deposits and withdrawals.

- Utilized precise analytical skills to identify discrepancies and inconsistencies in financial records, reducing risk and improving operational efficiency.

- Maintained meticulous records and documentation of all transactions, ensuring compliance with industry standards and regulatory requirements.

- Processed and verified over 10,000 checks per month, ensuring authenticity and compliance with established procedures.

Accomplishments

- Identified a discrepancy in inventory records, resulting in a reconciliation of $10,000 in missing merchandise.

- Developed an innovative system for organizing inventory, reducing search times by 20%.

- Implemented a barcode scanning system, increasing accuracy in item identification and checkout.

- Partnered with management to develop and implement a training program for new checkers, resulting in improved productivity.

- Utilized data analysis to identify trends and patterns in checkout activity, leading to improved scheduling and staffing decisions.

Awards

- Received Employee of the Month award for consistently exceeding performance targets in accuracy and speed.

- Recognized for outstanding customer service, consistently receiving positive feedback from customers.

- Awarded the Safety Excellence Award for maintaining a safe and hazardfree work environment.

- Received the Rising Star Award for demonstrating exceptional potential and dedication to the job.

Certificates

- Certified Inventory Manager (CIM)

- Certified Physical Inventory Auditor (CPIA)

- American Society of Quality (ASQ) Certified Quality Inspector (CQI)

- Institute of Supply Management (ISM) Certified Professional in Supply Management (CPSM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Checker

- Highlight your attention to detail and accuracy by providing specific examples of your ability to identify and correct errors in financial transactions.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work on reducing risk and improving operational efficiency.

- Showcase your customer service skills by describing your experience resolving customer inquiries and issues promptly and effectively.

- Emphasize your knowledge of industry standards and regulatory requirements, and explain how you ensure compliance in your work.

Essential Experience Highlights for a Strong Checker Resume

- Inspected and verified over 2,000 transactions daily, ensuring accuracy and completeness of customer deposits and withdrawals.

- Utilized precise analytical skills to identify discrepancies and inconsistencies in financial records, reducing risk and improving operational efficiency.

- Maintained meticulous records and documentation of all transactions, ensuring compliance with industry standards and regulatory requirements.

- Processed and verified over 10,000 checks per month, ensuring authenticity and compliance with established procedures.

- Assisted customers with various inquiries and transactions, providing excellent customer service and resolving issues promptly.

- Collaborated with other departments to ensure seamless coordination of transactions and reduce operational bottlenecks.

- Monitored and analyzed transaction patterns to identify potential fraud and suspicious activities.

Frequently Asked Questions (FAQ’s) For Checker

What are the key skills required to be a successful Checker?

Key skills for Checkers include attention to detail, counting and sorting accuracy, data input and verification, inventory management, physical examination of goods, and record keeping.

What is the career path for a Checker?

Checkers can advance to roles such as Bank Teller, Customer Service Representative, or Fraud Investigator.

What is the salary range for a Checker?

According to Salary.com, the average salary for a Checker in the United States is around $35,000 per year.

What are the educational requirements for a Checker?

Most Checkers have a high school diploma or equivalent. Some employers may prefer candidates with a college degree in a related field, such as business or finance.

What is the work environment of a Checker?

Checkers typically work in a fast-paced, high-volume environment. They may be required to work overtime or on weekends, especially during peak periods.

What are the benefits of being a Checker?

Benefits of being a Checker include job security, opportunities for advancement, and a chance to make a difference in the financial industry.

What are the challenges of being a Checker?

Challenges of being a Checker include working in a fast-paced, high-volume environment, dealing with repetitive tasks, and the potential for errors.