Are you a seasoned Chief Accountant seeking a new career path? Discover our professionally built Chief Accountant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

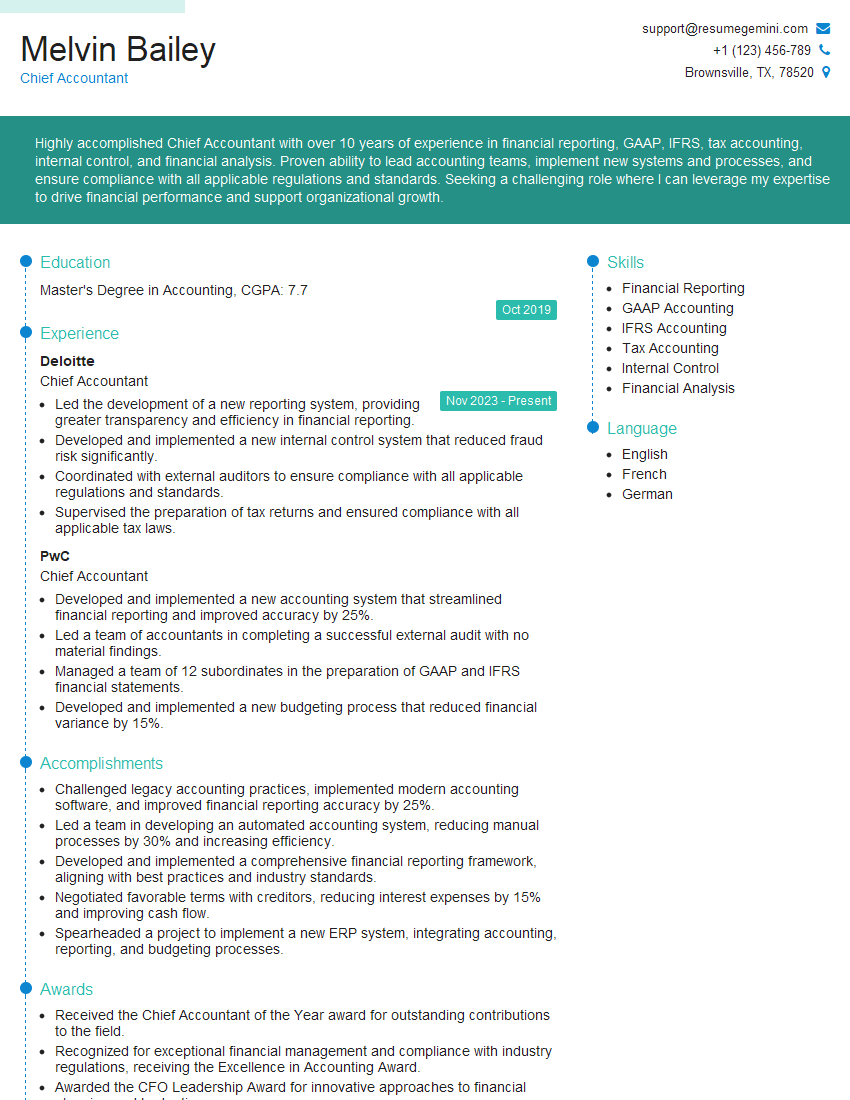

Melvin Bailey

Chief Accountant

Summary

Highly accomplished Chief Accountant with over 10 years of experience in financial reporting, GAAP, IFRS, tax accounting, internal control, and financial analysis. Proven ability to lead accounting teams, implement new systems and processes, and ensure compliance with all applicable regulations and standards. Seeking a challenging role where I can leverage my expertise to drive financial performance and support organizational growth.

Education

Master’s Degree in Accounting

October 2019

Skills

- Financial Reporting

- GAAP Accounting

- IFRS Accounting

- Tax Accounting

- Internal Control

- Financial Analysis

Work Experience

Chief Accountant

- Led the development of a new reporting system, providing greater transparency and efficiency in financial reporting.

- Developed and implemented a new internal control system that reduced fraud risk significantly.

- Coordinated with external auditors to ensure compliance with all applicable regulations and standards.

- Supervised the preparation of tax returns and ensured compliance with all applicable tax laws.

Chief Accountant

- Developed and implemented a new accounting system that streamlined financial reporting and improved accuracy by 25%.

- Led a team of accountants in completing a successful external audit with no material findings.

- Managed a team of 12 subordinates in the preparation of GAAP and IFRS financial statements.

- Developed and implemented a new budgeting process that reduced financial variance by 15%.

Accomplishments

- Challenged legacy accounting practices, implemented modern accounting software, and improved financial reporting accuracy by 25%.

- Led a team in developing an automated accounting system, reducing manual processes by 30% and increasing efficiency.

- Developed and implemented a comprehensive financial reporting framework, aligning with best practices and industry standards.

- Negotiated favorable terms with creditors, reducing interest expenses by 15% and improving cash flow.

- Spearheaded a project to implement a new ERP system, integrating accounting, reporting, and budgeting processes.

Awards

- Received the Chief Accountant of the Year award for outstanding contributions to the field.

- Recognized for exceptional financial management and compliance with industry regulations, receiving the Excellence in Accounting Award.

- Awarded the CFO Leadership Award for innovative approaches to financial planning and budgeting.

- Received the Merit Award for Accounting Innovation for developing a unique solution to improve cash flow management.

Certificates

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Chief Accountant

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your leadership and management skills, especially if you have experience leading a team of accountants.

- Demonstrate your knowledge of GAAP, IFRS, and other accounting standards.

- Showcase your experience in implementing and managing financial systems.

- Emphasize your ability to work independently and as part of a team.

Essential Experience Highlights for a Strong Chief Accountant Resume

- Develop and implement accounting policies and procedures to ensure accurate and timely financial reporting.

- Manage a team of accountants responsible for preparing financial statements, tax returns, and other financial reports.

- Oversee internal control systems to mitigate financial risk and ensure compliance with regulatory requirements.

- Analyze financial data to identify trends, make recommendations, and support decision-making.

- Work closely with external auditors to ensure compliance with GAAP and IFRS.

- Stay abreast of accounting standards and best practices to ensure the organization remains compliant and competitive.

- Contribute to the development and implementation of financial strategies and initiatives.

Frequently Asked Questions (FAQ’s) For Chief Accountant

What are the key skills required to be a successful Chief Accountant?

The key skills required to be a successful Chief Accountant include financial reporting, GAAP accounting, IFRS accounting, tax accounting, internal control, financial analysis, and leadership.

What are the typical responsibilities of a Chief Accountant?

The typical responsibilities of a Chief Accountant include developing and implementing accounting policies and procedures, managing a team of accountants, overseeing internal control systems, analyzing financial data, and working closely with external auditors.

What are the qualifications required to become a Chief Accountant?

The qualifications required to become a Chief Accountant typically include a Master’s Degree in Accounting and several years of experience in financial accounting.

What are the career prospects for Chief Accountants?

Chief Accountants can advance to senior management positions, such as CFO or Controller. They may also choose to specialize in a particular area of accounting, such as tax accounting or forensic accounting.

What are the challenges facing Chief Accountants?

The challenges facing Chief Accountants include the increasing complexity of accounting standards, the need to stay abreast of new technologies, and the pressure to improve financial performance.

What are the top companies that hire Chief Accountants?

Top companies that hire Chief Accountants include Deloitte, PwC, EY, KPMG, and BDO.