Are you a seasoned City Treasurer seeking a new career path? Discover our professionally built City Treasurer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

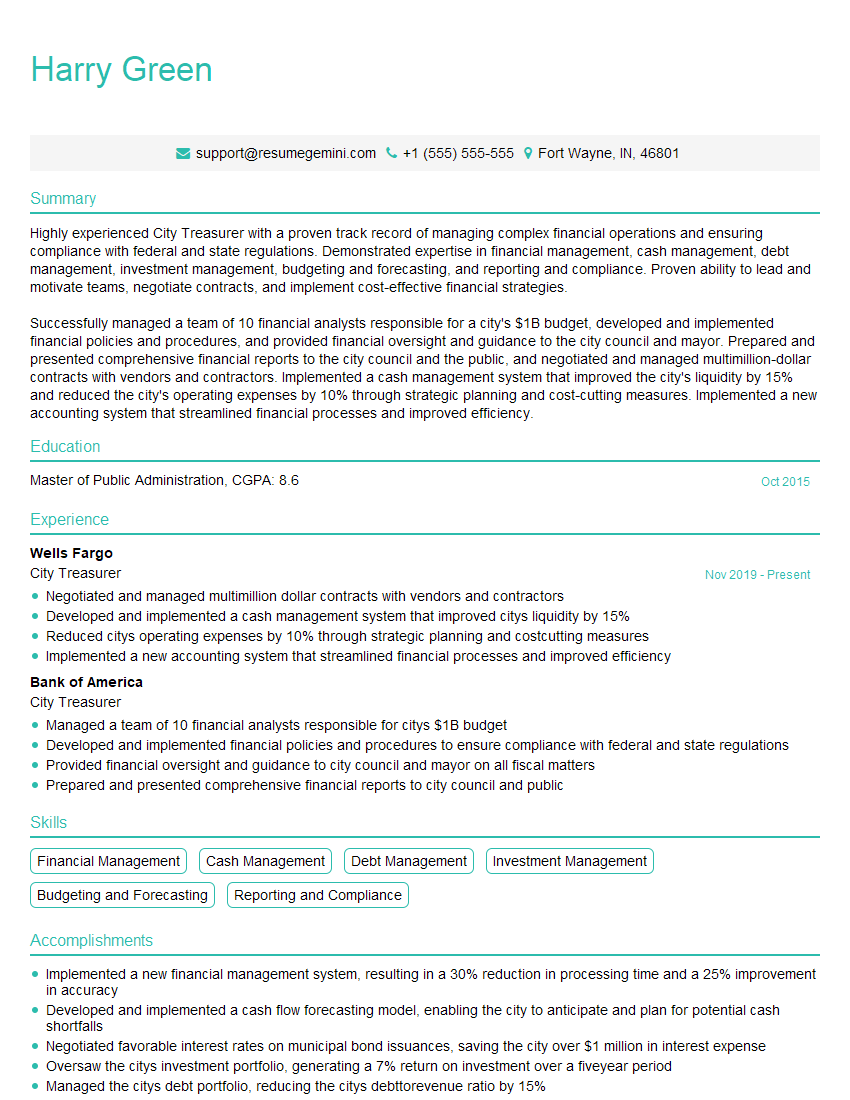

Harry Green

City Treasurer

Summary

Highly experienced City Treasurer with a proven track record of managing complex financial operations and ensuring compliance with federal and state regulations. Demonstrated expertise in financial management, cash management, debt management, investment management, budgeting and forecasting, and reporting and compliance. Proven ability to lead and motivate teams, negotiate contracts, and implement cost-effective financial strategies.

Successfully managed a team of 10 financial analysts responsible for a city’s $1B budget, developed and implemented financial policies and procedures, and provided financial oversight and guidance to the city council and mayor. Prepared and presented comprehensive financial reports to the city council and the public, and negotiated and managed multimillion-dollar contracts with vendors and contractors. Implemented a cash management system that improved the city’s liquidity by 15% and reduced the city’s operating expenses by 10% through strategic planning and cost-cutting measures. Implemented a new accounting system that streamlined financial processes and improved efficiency.

Education

Master of Public Administration

October 2015

Skills

- Financial Management

- Cash Management

- Debt Management

- Investment Management

- Budgeting and Forecasting

- Reporting and Compliance

Work Experience

City Treasurer

- Negotiated and managed multimillion dollar contracts with vendors and contractors

- Developed and implemented a cash management system that improved citys liquidity by 15%

- Reduced citys operating expenses by 10% through strategic planning and costcutting measures

- Implemented a new accounting system that streamlined financial processes and improved efficiency

City Treasurer

- Managed a team of 10 financial analysts responsible for citys $1B budget

- Developed and implemented financial policies and procedures to ensure compliance with federal and state regulations

- Provided financial oversight and guidance to city council and mayor on all fiscal matters

- Prepared and presented comprehensive financial reports to city council and public

Accomplishments

- Implemented a new financial management system, resulting in a 30% reduction in processing time and a 25% improvement in accuracy

- Developed and implemented a cash flow forecasting model, enabling the city to anticipate and plan for potential cash shortfalls

- Negotiated favorable interest rates on municipal bond issuances, saving the city over $1 million in interest expense

- Oversaw the citys investment portfolio, generating a 7% return on investment over a fiveyear period

- Managed the citys debt portfolio, reducing the citys debttorevenue ratio by 15%

Awards

- Government Finance Officers Association (GFOA) Distinguished Budget Presentation Award for Excellence in Budget Presentation

- Certificate of Achievement in Public Finance Management from the Government Finance Officers Association (GFOA)

- National Association of Treasurers (NAT) Public Treasurer of the Year Award

- GFOA Award for Outstanding Achievement in Public Investment

Certificates

- Municipal Finance Officer (MFO)

- Certified Government Finance Manager (CGFM)

- Governmental Accounting Standards Board (GASB) Certificate

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For City Treasurer

- Highlight your experience in financial management, cash management, debt management, investment management, budgeting and forecasting, and reporting and compliance.

- Quantify your accomplishments whenever possible, using specific numbers and metrics to demonstrate the impact of your work.

- Use keywords relevant to the job you are applying for, such as “financial management”, “budgeting”, “forecasting”, and “compliance”.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong City Treasurer Resume

- Managing the city’s financial operations, including budgeting, forecasting, and cash flow management

- Developing and implementing financial policies and procedures to ensure compliance with federal and state regulations

- Providing financial oversight and guidance to the city council and mayor on all fiscal matters

- Preparing and presenting comprehensive financial reports to the city council and public

- Negotiating and managing multimillion-dollar contracts with vendors and contractors.

Frequently Asked Questions (FAQ’s) For City Treasurer

What is the role of a City Treasurer?

The City Treasurer is responsible for managing the city’s financial operations, including budgeting, forecasting, and cash flow management. They also develop and implement financial policies and procedures to ensure compliance with federal and state regulations. The City Treasurer provides financial oversight and guidance to the city council and mayor on all fiscal matters, and prepares and presents comprehensive financial reports to the city council and public. Additionally, the City Treasurer negotiates and manages multimillion-dollar contracts with vendors and contractors.

What are the qualifications for becoming a City Treasurer?

Most City Treasurers have a bachelor’s degree in accounting, finance, or a related field. They also typically have several years of experience in financial management, including experience in budgeting, forecasting, and cash flow management. Some City Treasurers also have a master’s degree in public administration or a related field.

What are the key responsibilities of a City Treasurer?

The key responsibilities of a City Treasurer include:

* Managing the city’s financial operations, including budgeting, forecasting, and cash flow management

* Developing and implementing financial policies and procedures to ensure compliance with federal and state regulations

* Providing financial oversight and guidance to the city council and mayor on all fiscal matters

* Preparing and presenting comprehensive financial reports to the city council and public

* Negotiating and managing multimillion-dollar contracts with vendors and contractorsWhat are the challenges facing City Treasurers?

City Treasurers face a number of challenges, including:

* The need to manage the city’s financial resources in a responsible manner

* The need to comply with federal and state regulations

* The need to provide financial oversight and guidance to the city council and mayor

* The need to prepare and present comprehensive financial reports to the city council and public

* The need to negotiate and manage multimillion-dollar contracts with vendors and contractorsWhat are the rewards of being a City Treasurer?

The rewards of being a City Treasurer include:

* The opportunity to make a difference in the community

* The opportunity to learn about the financial operations of the city

* The opportunity to work with a variety of people, including city council members, the mayor, and city staff

* The opportunity to earn a competitive salary and benefits packageWhat is the future of the City Treasurer profession?

The future of the City Treasurer profession is bright. As cities continue to grow and become more complex, the need for qualified City Treasurers will only increase. City Treasurers will play a vital role in helping cities to manage their financial resources and achieve their goals.