Are you a seasoned Claim Agent seeking a new career path? Discover our professionally built Claim Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

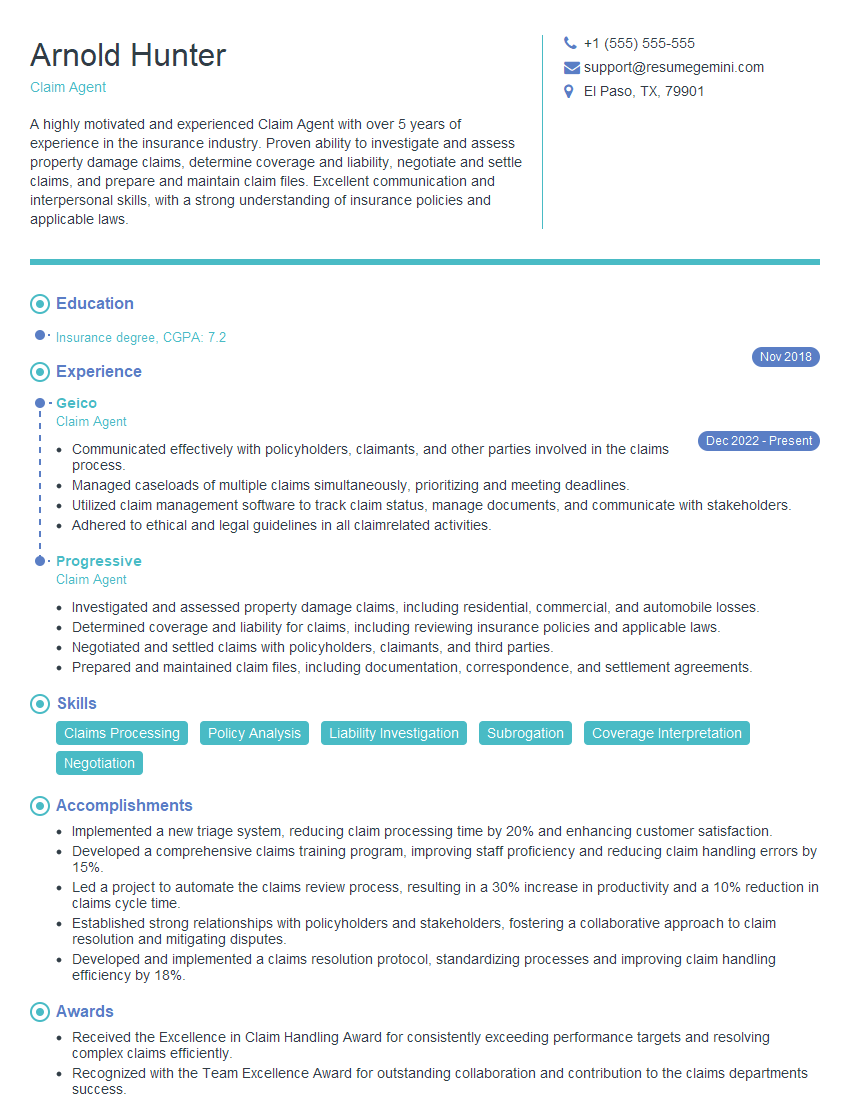

Arnold Hunter

Claim Agent

Summary

A highly motivated and experienced Claim Agent with over 5 years of experience in the insurance industry. Proven ability to investigate and assess property damage claims, determine coverage and liability, negotiate and settle claims, and prepare and maintain claim files. Excellent communication and interpersonal skills, with a strong understanding of insurance policies and applicable laws.

Education

Insurance degree

November 2018

Skills

- Claims Processing

- Policy Analysis

- Liability Investigation

- Subrogation

- Coverage Interpretation

- Negotiation

Work Experience

Claim Agent

- Communicated effectively with policyholders, claimants, and other parties involved in the claims process.

- Managed caseloads of multiple claims simultaneously, prioritizing and meeting deadlines.

- Utilized claim management software to track claim status, manage documents, and communicate with stakeholders.

- Adhered to ethical and legal guidelines in all claimrelated activities.

Claim Agent

- Investigated and assessed property damage claims, including residential, commercial, and automobile losses.

- Determined coverage and liability for claims, including reviewing insurance policies and applicable laws.

- Negotiated and settled claims with policyholders, claimants, and third parties.

- Prepared and maintained claim files, including documentation, correspondence, and settlement agreements.

Accomplishments

- Implemented a new triage system, reducing claim processing time by 20% and enhancing customer satisfaction.

- Developed a comprehensive claims training program, improving staff proficiency and reducing claim handling errors by 15%.

- Led a project to automate the claims review process, resulting in a 30% increase in productivity and a 10% reduction in claims cycle time.

- Established strong relationships with policyholders and stakeholders, fostering a collaborative approach to claim resolution and mitigating disputes.

- Developed and implemented a claims resolution protocol, standardizing processes and improving claim handling efficiency by 18%.

Awards

- Received the Excellence in Claim Handling Award for consistently exceeding performance targets and resolving complex claims efficiently.

- Recognized with the Team Excellence Award for outstanding collaboration and contribution to the claims departments success.

- Recipient of the Presidents Award for exceptional dedication and resolving a highprofile claim with significant financial implications.

- Honored with the Industry Leadership Award for innovative contributions to claim handling practices and thought leadership.

Certificates

- Associate in Claims (AIC)

- Fellow in Claims (FIC)

- Certified Claims Professional (CCP)

- Certified Liability Claims Adjuster (CLCA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claim Agent

- Highlight your experience and skills in investigating and assessing property damage claims.

- Demonstrate your knowledge of insurance policies and applicable laws.

- Showcase your negotiation and settlement skills.

- Emphasize your ability to manage a high volume of claims and meet deadlines.

- Use strong action verbs and specific examples to quantify your accomplishments.

Essential Experience Highlights for a Strong Claim Agent Resume

- Investigated and assessed property damage claims, including residential, commercial, and automobile losses.

- Determined coverage and liability for claims, including reviewing insurance policies and applicable laws.

- Negotiated and settled claims with policyholders, claimants, and third parties.

- Prepared and maintained claim files, including documentation, correspondence, and settlement agreements.

- Communicated effectively with policyholders, claimants, and other parties involved in the claims process.

- Managed caseloads of multiple claims simultaneously, prioritizing and meeting deadlines.

- Utilized claim management software to track claim status, manage documents, and communicate with stakeholders.

- Adhered to ethical and legal guidelines in all claimrelated activities.

Frequently Asked Questions (FAQ’s) For Claim Agent

What is the role of a Claim Agent?

A Claim Agent is responsible for investigating and assessing property damage claims, determining coverage and liability, negotiating and settling claims, and preparing and maintaining claim files.

What are the key skills required to be a successful Claim Agent?

Key skills include claims processing, policy analysis, liability investigation, subrogation, coverage interpretation, and negotiation.

What is the career path for a Claim Agent?

Claim Agents can advance to positions such as Claims Adjuster, Claims Manager, or Insurance Underwriter.

What is the average salary for a Claim Agent?

The average salary for a Claim Agent in the United States is around $65,000 per year.

What are the benefits of working as a Claim Agent?

Benefits of working as a Claim Agent include job security, opportunities for advancement, and the chance to help people in need.

What are the challenges of working as a Claim Agent?

Challenges of working as a Claim Agent include dealing with difficult customers, managing a high volume of claims, and working under tight deadlines.

What is the job outlook for Claim Agents?

The job outlook for Claim Agents is expected to be positive in the coming years, as the demand for insurance services continues to grow.