Are you a seasoned Claim Approver seeking a new career path? Discover our professionally built Claim Approver Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

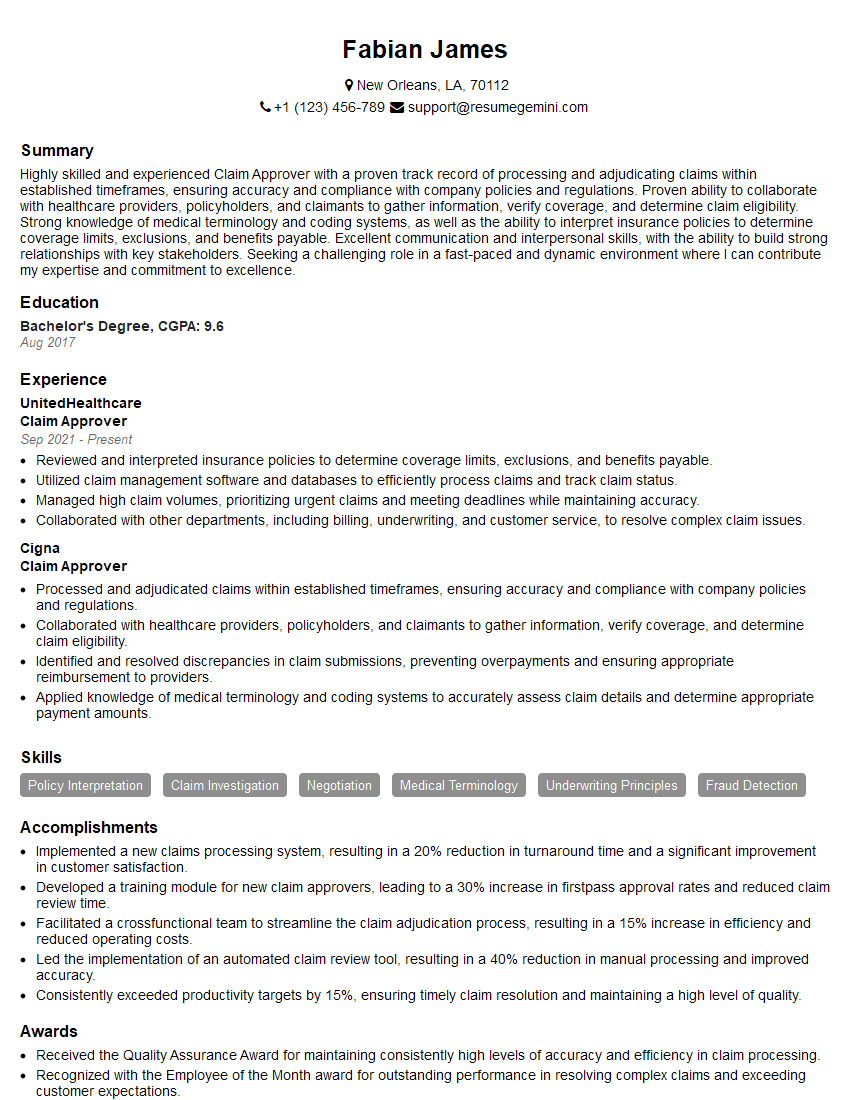

Fabian James

Claim Approver

Summary

Highly skilled and experienced Claim Approver with a proven track record of processing and adjudicating claims within established timeframes, ensuring accuracy and compliance with company policies and regulations. Proven ability to collaborate with healthcare providers, policyholders, and claimants to gather information, verify coverage, and determine claim eligibility. Strong knowledge of medical terminology and coding systems, as well as the ability to interpret insurance policies to determine coverage limits, exclusions, and benefits payable. Excellent communication and interpersonal skills, with the ability to build strong relationships with key stakeholders. Seeking a challenging role in a fast-paced and dynamic environment where I can contribute my expertise and commitment to excellence.

Education

Bachelor’s Degree

August 2017

Skills

- Policy Interpretation

- Claim Investigation

- Negotiation

- Medical Terminology

- Underwriting Principles

- Fraud Detection

Work Experience

Claim Approver

- Reviewed and interpreted insurance policies to determine coverage limits, exclusions, and benefits payable.

- Utilized claim management software and databases to efficiently process claims and track claim status.

- Managed high claim volumes, prioritizing urgent claims and meeting deadlines while maintaining accuracy.

- Collaborated with other departments, including billing, underwriting, and customer service, to resolve complex claim issues.

Claim Approver

- Processed and adjudicated claims within established timeframes, ensuring accuracy and compliance with company policies and regulations.

- Collaborated with healthcare providers, policyholders, and claimants to gather information, verify coverage, and determine claim eligibility.

- Identified and resolved discrepancies in claim submissions, preventing overpayments and ensuring appropriate reimbursement to providers.

- Applied knowledge of medical terminology and coding systems to accurately assess claim details and determine appropriate payment amounts.

Accomplishments

- Implemented a new claims processing system, resulting in a 20% reduction in turnaround time and a significant improvement in customer satisfaction.

- Developed a training module for new claim approvers, leading to a 30% increase in firstpass approval rates and reduced claim review time.

- Facilitated a crossfunctional team to streamline the claim adjudication process, resulting in a 15% increase in efficiency and reduced operating costs.

- Led the implementation of an automated claim review tool, resulting in a 40% reduction in manual processing and improved accuracy.

- Consistently exceeded productivity targets by 15%, ensuring timely claim resolution and maintaining a high level of quality.

Awards

- Received the Quality Assurance Award for maintaining consistently high levels of accuracy and efficiency in claim processing.

- Recognized with the Employee of the Month award for outstanding performance in resolving complex claims and exceeding customer expectations.

- Awarded the Claims Excellence Award for exceptional contributions to the team, exceeding productivity targets and consistently maintaining a positive attitude.

Certificates

- Associate in Claims (AIC)

- Fellowship in Claims (FCAS)

- Certified Insurance Claims Professional (CIC)

- Certified Property and Casualty Underwriter (CPCU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claim Approver

- Highlight your experience in processing and adjudicating claims within established timeframes, ensuring accuracy and compliance with company policies and regulations.

- Demonstrate your ability to collaborate with healthcare providers, policyholders, and claimants to gather information, verify coverage, and determine claim eligibility.

- Showcase your knowledge of medical terminology and coding systems, as well as your ability to interpret insurance policies to determine coverage limits, exclusions, and benefits payable.

- Emphasize your communication and interpersonal skills, and your ability to build strong relationships with key stakeholders.

Essential Experience Highlights for a Strong Claim Approver Resume

- Processed and adjudicated claims within established timeframes, ensuring accuracy and compliance with company policies and regulations.

- Collaborated with healthcare providers, policyholders, and claimants to gather information, verify coverage, and determine claim eligibility.

- Identified and resolved discrepancies in claim submissions, preventing overpayments and ensuring appropriate reimbursement to providers.

- Applied knowledge of medical terminology and coding systems to accurately assess claim details and determine appropriate payment amounts.

- Reviewed and interpreted insurance policies to determine coverage limits, exclusions, and benefits payable.

- Utilized claim management software and databases to efficiently process claims and track claim status.

- Managed high claim volumes, prioritizing urgent claims and meeting deadlines while maintaining accuracy.

Frequently Asked Questions (FAQ’s) For Claim Approver

What are the key skills required to be a successful Claim Approver?

Key skills required for a successful Claim Approver include: policy interpretation, claim investigation, negotiation, medical terminology, underwriting principles, and fraud detection.

What are the typical responsibilities of a Claim Approver?

Typical responsibilities of a Claim Approver include: processing and adjudicating claims, collaborating with healthcare providers, policyholders, and claimants, identifying and resolving discrepancies in claim submissions, applying knowledge of medical terminology and coding systems to accurately assess claim details and determine appropriate payment amounts, reviewing and interpreting insurance policies to determine coverage limits, exclusions, and benefits payable, utilizing claim management software and databases to efficiently process claims and track claim status, and managing high claim volumes, prioritizing urgent claims and meeting deadlines while maintaining accuracy.

What are the qualifications required to become a Claim Approver?

Qualifications required to become a Claim Approver typically include a Bachelor’s Degree in a related field, such as healthcare administration, insurance, or finance.

What is the career path for a Claim Approver?

The career path for a Claim Approver can include promotions to positions such as Claims Manager, Claims Director, or Vice President of Claims.

What is the job outlook for Claim Approvers?

The job outlook for Claim Approvers is expected to grow faster than average in the coming years due to the increasing demand for healthcare services.

What are the top companies that hire Claim Approvers?

Top companies that hire Claim Approvers include: UnitedHealthcare, Cigna, Aetna, Humana, and Blue Cross Blue Shield.