Are you a seasoned Claim Clerk seeking a new career path? Discover our professionally built Claim Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

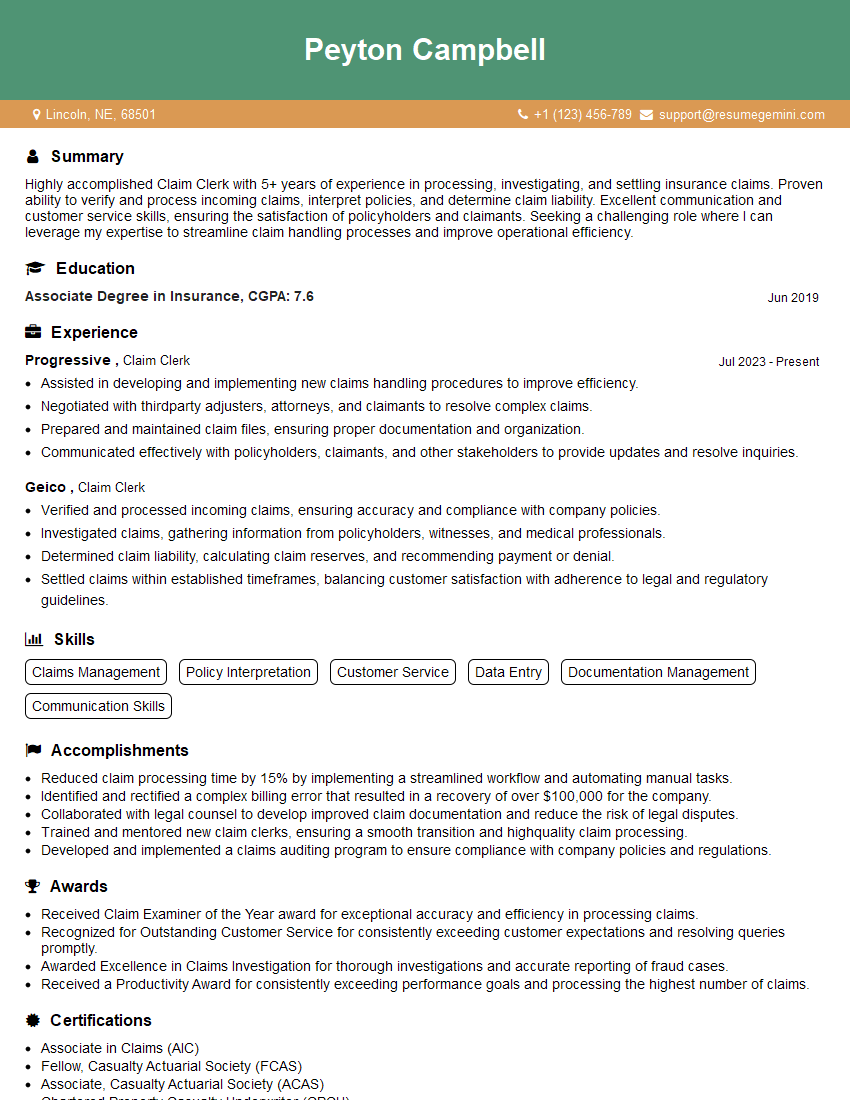

Peyton Campbell

Claim Clerk

Summary

Highly accomplished Claim Clerk with 5+ years of experience in processing, investigating, and settling insurance claims. Proven ability to verify and process incoming claims, interpret policies, and determine claim liability. Excellent communication and customer service skills, ensuring the satisfaction of policyholders and claimants. Seeking a challenging role where I can leverage my expertise to streamline claim handling processes and improve operational efficiency.

Education

Associate Degree in Insurance

June 2019

Skills

- Claims Management

- Policy Interpretation

- Customer Service

- Data Entry

- Documentation Management

- Communication Skills

Work Experience

Claim Clerk

- Assisted in developing and implementing new claims handling procedures to improve efficiency.

- Negotiated with thirdparty adjusters, attorneys, and claimants to resolve complex claims.

- Prepared and maintained claim files, ensuring proper documentation and organization.

- Communicated effectively with policyholders, claimants, and other stakeholders to provide updates and resolve inquiries.

Claim Clerk

- Verified and processed incoming claims, ensuring accuracy and compliance with company policies.

- Investigated claims, gathering information from policyholders, witnesses, and medical professionals.

- Determined claim liability, calculating claim reserves, and recommending payment or denial.

- Settled claims within established timeframes, balancing customer satisfaction with adherence to legal and regulatory guidelines.

Accomplishments

- Reduced claim processing time by 15% by implementing a streamlined workflow and automating manual tasks.

- Identified and rectified a complex billing error that resulted in a recovery of over $100,000 for the company.

- Collaborated with legal counsel to develop improved claim documentation and reduce the risk of legal disputes.

- Trained and mentored new claim clerks, ensuring a smooth transition and highquality claim processing.

- Developed and implemented a claims auditing program to ensure compliance with company policies and regulations.

Awards

- Received Claim Examiner of the Year award for exceptional accuracy and efficiency in processing claims.

- Recognized for Outstanding Customer Service for consistently exceeding customer expectations and resolving queries promptly.

- Awarded Excellence in Claims Investigation for thorough investigations and accurate reporting of fraud cases.

- Received a Productivity Award for consistently exceeding performance goals and processing the highest number of claims.

Certificates

- Associate in Claims (AIC)

- Fellow, Casualty Actuarial Society (FCAS)

- Associate, Casualty Actuarial Society (ACAS)

- Chartered Property Casualty Underwriter (CPCU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claim Clerk

- Highlight your experience in claims processing, investigation, and settlement.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Showcase your customer service skills and ability to build rapport with policyholders and claimants.

- Demonstrate your knowledge of insurance policies and legal regulations.

Essential Experience Highlights for a Strong Claim Clerk Resume

- Verified and processed incoming claims, ensuring accuracy and compliance with company policies.

- Investigated claims, gathering information from policyholders, witnesses, and medical professionals.

- Determined claim liability, calculating claim reserves, and recommending payment or denial.

- Settled claims within established timeframes, balancing customer satisfaction with adherence to legal and regulatory guidelines.

- Prepared and maintained claim files, ensuring proper documentation and organization.

- Communicated effectively with policyholders, claimants, and other stakeholders to provide updates and resolve inquiries.

- Assisted in developing and implementing new claims handling procedures to improve efficiency.

Frequently Asked Questions (FAQ’s) For Claim Clerk

What are the primary responsibilities of a Claim Clerk?

Claim Clerks are responsible for processing, investigating, and settling insurance claims. This includes verifying and processing incoming claims, determining claim liability, and communicating with policyholders and claimants.

What qualifications are required to become a Claim Clerk?

Typically, an Associate Degree in Insurance or a related field is required to become a Claim Clerk. Relevant experience in claims processing or customer service may also be considered.

What are the key skills for success as a Claim Clerk?

Strong communication and customer service skills are crucial, along with attention to detail, problem-solving abilities, and knowledge of insurance policies and procedures.

What is the job outlook for Claim Clerks?

The job outlook for Claim Clerks is expected to grow faster than average in the coming years due to the increasing demand for insurance services.

What is the average salary range for Claim Clerks?

The average salary range for Claim Clerks varies depending on experience, location, and company size, but it typically falls between $35,000 and $60,000 per year.

What are the advancement opportunities for Claim Clerks?

With experience and additional qualifications, Claim Clerks can advance to roles such as Claims Adjuster, Claims Manager, or Insurance Underwriter.