Are you a seasoned Claim Examiner seeking a new career path? Discover our professionally built Claim Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

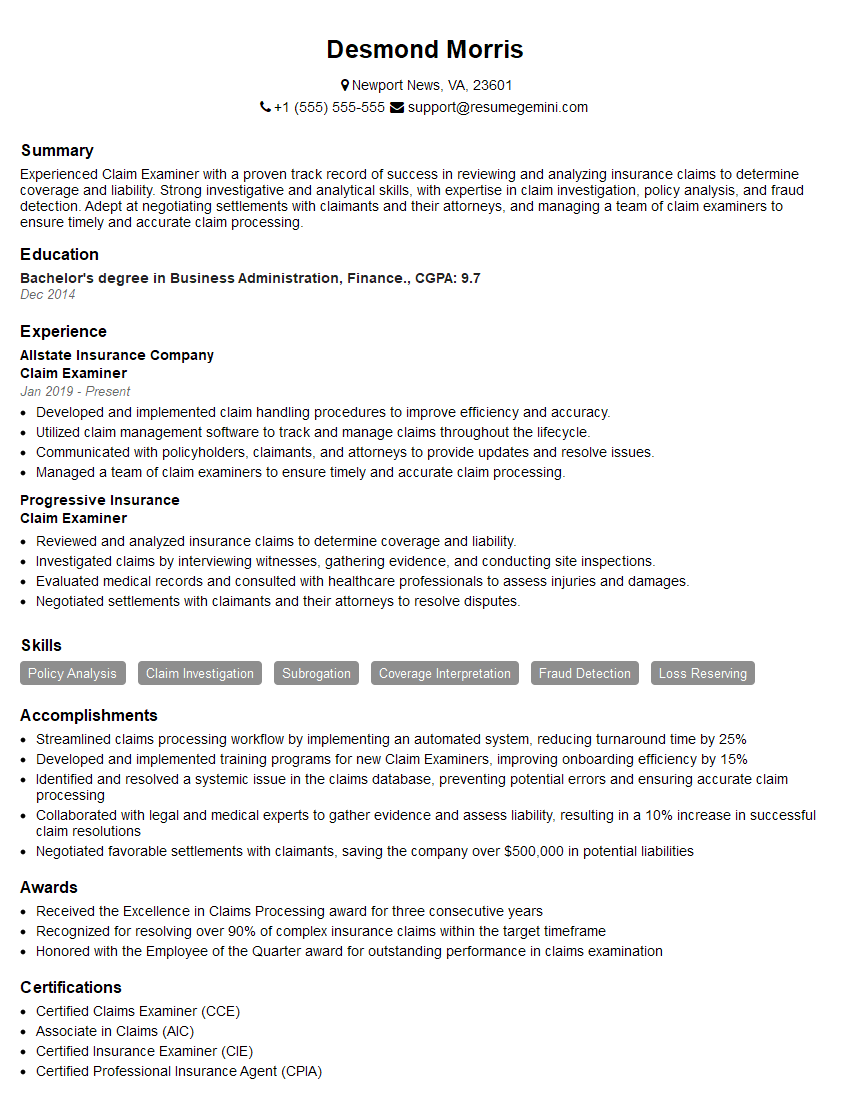

Desmond Morris

Claim Examiner

Summary

Experienced Claim Examiner with a proven track record of success in reviewing and analyzing insurance claims to determine coverage and liability. Strong investigative and analytical skills, with expertise in claim investigation, policy analysis, and fraud detection. Adept at negotiating settlements with claimants and their attorneys, and managing a team of claim examiners to ensure timely and accurate claim processing.

Education

Bachelor’s degree in Business Administration, Finance.

December 2014

Skills

- Policy Analysis

- Claim Investigation

- Subrogation

- Coverage Interpretation

- Fraud Detection

- Loss Reserving

Work Experience

Claim Examiner

- Developed and implemented claim handling procedures to improve efficiency and accuracy.

- Utilized claim management software to track and manage claims throughout the lifecycle.

- Communicated with policyholders, claimants, and attorneys to provide updates and resolve issues.

- Managed a team of claim examiners to ensure timely and accurate claim processing.

Claim Examiner

- Reviewed and analyzed insurance claims to determine coverage and liability.

- Investigated claims by interviewing witnesses, gathering evidence, and conducting site inspections.

- Evaluated medical records and consulted with healthcare professionals to assess injuries and damages.

- Negotiated settlements with claimants and their attorneys to resolve disputes.

Accomplishments

- Streamlined claims processing workflow by implementing an automated system, reducing turnaround time by 25%

- Developed and implemented training programs for new Claim Examiners, improving onboarding efficiency by 15%

- Identified and resolved a systemic issue in the claims database, preventing potential errors and ensuring accurate claim processing

- Collaborated with legal and medical experts to gather evidence and assess liability, resulting in a 10% increase in successful claim resolutions

- Negotiated favorable settlements with claimants, saving the company over $500,000 in potential liabilities

Awards

- Received the Excellence in Claims Processing award for three consecutive years

- Recognized for resolving over 90% of complex insurance claims within the target timeframe

- Honored with the Employee of the Quarter award for outstanding performance in claims examination

Certificates

- Certified Claims Examiner (CCE)

- Associate in Claims (AIC)

- Certified Insurance Examiner (CIE)

- Certified Professional Insurance Agent (CPIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claim Examiner

- Highlight your experience and skills in claim investigation and analysis.

- Showcase your ability to interpret insurance policies and determine coverage.

- Emphasize your negotiation and communication skills.

- Demonstrate your knowledge of claim handling procedures and software.

Essential Experience Highlights for a Strong Claim Examiner Resume

- Reviewed and analyzed insurance claims to determine coverage and liability.

- Investigated claims by interviewing witnesses, gathering evidence, and conducting site inspections.

- Evaluated medical records and consulted with healthcare professionals to assess injuries and damages.

- Negotiated settlements with claimants and their attorneys to resolve disputes.

- Developed and implemented claim handling procedures to improve efficiency and accuracy.

- Utilized claim management software to track and manage claims throughout the lifecycle.

- Communicated with policyholders, claimants, and attorneys to provide updates and resolve issues.

Frequently Asked Questions (FAQ’s) For Claim Examiner

What are the key skills required for a Claim Examiner?

Key skills include policy analysis, claim investigation, subrogation, coverage interpretation, fraud detection, and loss reserving.

What is the job outlook for Claim Examiners?

The job outlook for Claim Examiners is expected to grow faster than average in the coming years due to increasing demand for insurance services.

What is the average salary for a Claim Examiner?

The average salary for a Claim Examiner varies depending on experience and location, but is typically around $60,000 per year.

What are the educational requirements for a Claim Examiner?

Most Claim Examiners have a bachelor’s degree in business administration, finance, or a related field.

What are the career advancement opportunities for a Claim Examiner?

Claim Examiners can advance to positions such as Senior Claim Examiner, Claim Manager, or Claims Director.